Trendaavat aiheet

#

Bonk Eco continues to show strength amid $USELESS rally

#

Pump.fun to raise $1B token sale, traders speculating on airdrop

#

Boop.Fun leading the way with a new launchpad on Solana.

21M Bitcoins, When Mined, What Happens Next?

As we all know, Bitcoin’s design caps the total supply at 21M coins. So, Again, After The Last Bitcoin Block, Can the System Still Hold? Read up, bros 👇

Bitcoin halves the new-coin subsidy roughly every four years. Once the final subsidy is paid, likely around the year 2140, the only revenue left for miners will be transaction fees. The concern is clear. If fees remain too low, miners may shut down their machines, reducing the hash rate and the cost required to attack the network. What can the system do about this?

---

1. Where Miner Income Stands Today

Since the April 2024 halving, the block subsidy fell to 3.125 BTC. Fees briefly spiked during the Ordinals and Runes craze in early 2024 and covered more than the subsidy for a few days. Right now, fees are back to about 7% of miner revenue, the lowest share since the last bear market bottom. Energy alone for an average block still costs $90K at $0.05kw/h. So the fee component would have to rise 4X to keep the lights on at current prices.

---

2. The Runway To 2140

The subsidy does not disappear overnight. Even after the next halving in 2028, about 90% of miner revenue is still projected to come from new coins. The security budget therefore declines slowly, giving almost a century to find stable fee sources. That runway matters. It allows both protocol innovation and organic economic growth to close the gap.

---

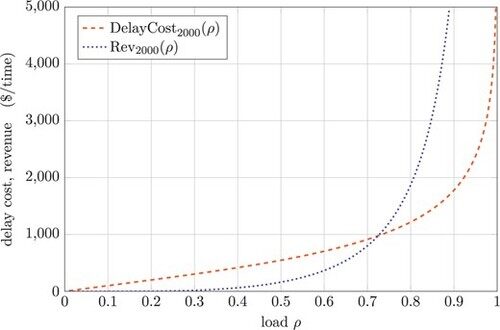

3. Security Budget And Attack Cost

The security budget is the total value miners earn per block. A fall in that budget is not automatically catastrophic because the difficulty adjustment reduces the hash rate until the marginal miner is again profitable. The risk is that the dollar cost to cause a majority attack could fall faster than the network’s economic throughput, inviting well-funded adversaries.

---

4. How A Sustainable Fee Market Could Emerge

A. Fee pressure from finite block space: Even without new features, Bitcoin’s base layer can settle only a few hundred thousand transactions per day. If global demand for final settlement rises while block space stays scarce, users will bid up fees and miners will capture that scarcity premium. A functioning fee market already exists but remains thin because global demand is still modest.

B. Event-driven surges signal latent demand: The Ordinals inscription boom showed that novel uses of the block space can push fee revenue above the subsidy, at least temporarily. Although the surge faded, it illustrated the willingness of users to pay when they perceive unique value in Bitcoin’s immutability.

C. Layer two settlement: Lightning, Fedimint, ₿apps, rollups proposed with opcodes such as OP_CAT or BitVM, and drivechains are all designed to batch many off-chain transfers into a single on-chain settlement transaction. If these ecosystems grow, a rising fraction of global value could settle back to the base layer and pay higher aggregate fees, even while individual retail transfers remain cheap.

D. High-value transaction categories still untapped: Large corporate treasuries, sovereign wealth funds, tokenized real assets, and advanced covenant-based applications could each inject blocks with transactions whose absolute fee in dollars is far higher than today’s median. Studies show that specialized activity clusters drive heavy tails in the fee distribution.

---

5. Protocol Level Responses

→ Incremental soft forks: Features that raise the economic density of each byte, such as covenants, enhanced scripting, or native rollup factors, can lift the upper bound on fee revenue without changing the supply schedule.

→ Tail emission proposals: Communities advocate adding a 0.1% annual inflation subsidy to guarantee a minimum security budget. This breaks the fixed supply credo and requires social consensus.

→ Reclaiming dormant coins: Others suggest recycling inactive coins, but that challenges the standing norms about property rights on-chain.

---

6. Miner Adaptation and Diversification

Publicly listed miners such as @RiotPlatforms and @MARA began combining bitcoin production with data-center hosting, AI inference, and renewable energy balancing to cushion revenue volatility. This would subsidise continued hash power even during low-fee eras. It does not solve the security budget problem on its own, but it buys additional resilience.

---

7. Scenario Analysis

→ Optimistic path: Global adoption of Bitcoin as a neutral settlement rail, plus successful L2 ecosystems, drives persistent block space competition. Fees rise to several hundred thousand dollars per block, replacing the vanishing subsidy and keeping the hash rate high.

→ Stagnant store of value path: If on-chain demand plateaus and Bitcoin functions mainly as cold storage, fees stay low. The hash rate declines until only the cheapest renewable sites remain profitable. Security might still suffice for static savings but would be vulnerable to state-level attacks during periods of price weakness.

---

Bottom line

Bitcoin has roughly 115 years before the subsidy disappears entirely, but the incentives are already shifting. Either fees must rise through genuine economic demand for scarce settlement slots, or the rules must change, or security will adjust downward. Each outcome is possible. The coming decades will test these, but what will not work is a static model that ignores economics. Bitcoin stays secure only as long as someone is willing to pay for that security.

Thanks for reading!

840

Johtavat

Rankkaus

Suosikit