Trendaavat aiheet

#

Bonk Eco continues to show strength amid $USELESS rally

#

Pump.fun to raise $1B token sale, traders speculating on airdrop

#

Boop.Fun leading the way with a new launchpad on Solana.

Jurrien Timmer

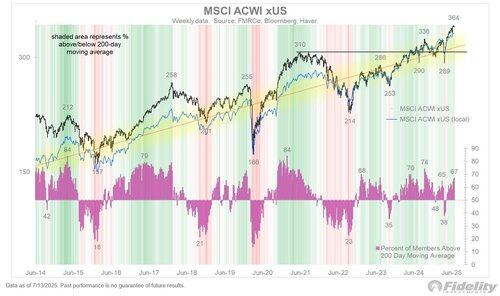

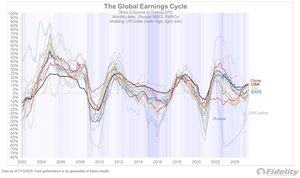

If the dollar does lose some of its supremacy premium, while global earnings are converging on US earnings and non-US valuations are lower than in the US, it should provide a good backdrop for a prolonged period of mean reversion between US and non-US equities.

The two charts below show just how important the currency component can be for investing globally. That’s especially the case for emerging markets, where the USD-based EM index (solid blue) has vastly outperformed the local currency index (dotted line) over the past 25 years. In local currency terms, the MSCI EM index is where the S&P 500 was in the year 2000.

For EAFE (non-US developed), that currency difference is much less. For me, that makes EAFE an easier region to say yes to than EM. Either way, the momentum curves in both charts suggest that the long-awaited mean reversion is upon us.

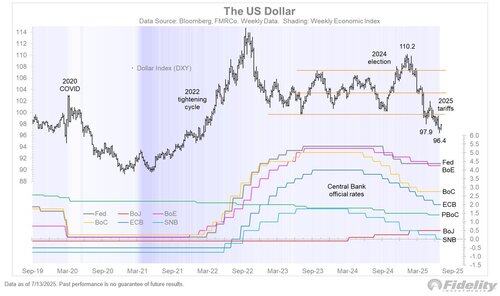

13,44K

If the Fed is forced back into the bond market to hold down nominal and real rates, the dollar may well lose more of its supremacy premium. Currencies are the release valve for unsustainable fiscal policy, as Japan found out a few years ago. The same is now true for the dollar, which continues to lose strength despite the Fed’s hawkish policy stance.

19,99K

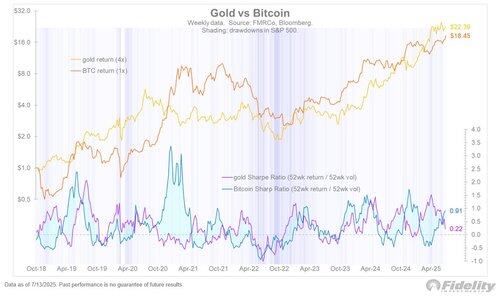

Bitcoin’s adoption curve has continued to grow, as evidenced by the ongoing influx of capital entering the scene via the various ETPs. Whether these flows are from true believers or “momentum renters” is hard to tell.

The Bitcoin chart shows a clean stairstep process of new highs followed by consolidations followed by new highs. As such, bitcoin has continued to follow both the Power Law curve of its wallets as well as my demand model based on the internet adoption curve from a few decades ago. We are right in the middle.

61,78K

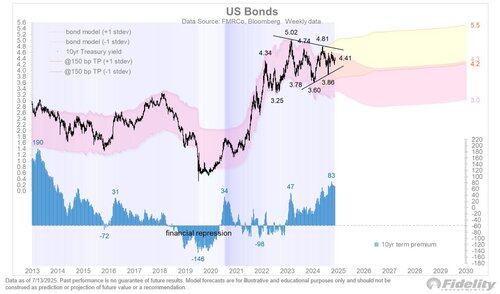

Bonds continue to churn in a narrow range, and I am pleasantly surprised that yields haven’t already moved above 4.5%. Nothing good happens above 4.5%. The term premium has reverted from its -146 bps financial repression extreme in 2020 to a much more reasonable +83 bps. Whether it keeps rising will likely depend not only on inflation but also the debt composition of the OBBB. We will find out more soon when the quarterly refunding announcement is released.

14,73K

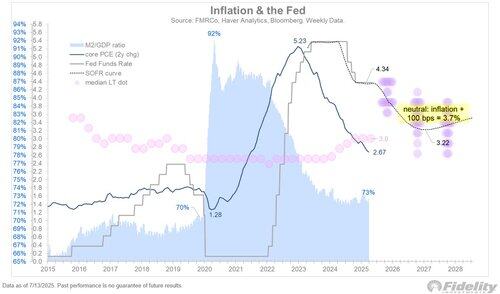

The Fed remains on hold, which in my view is the right thing to do. If neutral is 3.5-4.0% (inflation + 100 bps), the Fed should only cut rates a few times before returning from restrictive to less restrictive to neutral. Anything more is not justified given that inflation remains above target and the jobless rate is below the “full employment” rate (formerly NAIRU). The Taylor rule says the Fed should be slightly above neutral, which is where it is.

16,59K

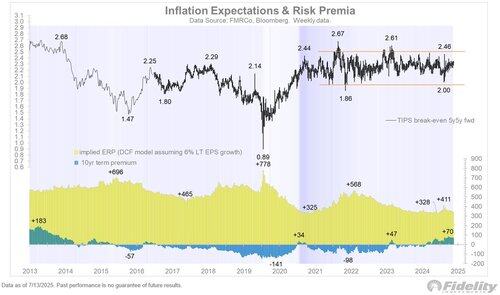

Whether the fiscal impulse from the OBBB (not to mention tariffs) will cause another inflation wave is an important question, not only for the Fed as it contemplates the timing of its next rate cut, but for fixed income and equity valuations as well. Below we see that the TIPS 5y5y forward break-even has been stuck in a tight range of 2.0-2.5% since the COVID spike in 2020. Nothing to see here. Well, we’ll see. If inflation does wake up again, it could be a problem for both the equity risk premium and term premium, both of which are on the low side of their historical range.

10,81K

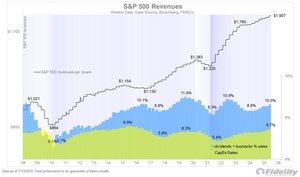

In the US, both share buybacks and capital spending have been improving, in absolute terms and as a percentage of revenues. Those revenues have continued to trend higher for the S&P 500. There appears to be nothing not to like!

The rub, of course, is that all this positive fundamental context is already priced in, with the S&P 500 index now trading at 36 times free cash flow. That’s back to the nose-bleed levels seen late last year. For the equal-weighted index the multiple is not quite as high (27x), but still near the highs of its historical range. The market is priced for success, betting on another fiscal impulse from the OBBB.

This brings me back to my question from last week. Looking only at the top panel, would you want to be long this chart? The answer is likely yes. But if you add the bottom panel to the mix, do you still want to be long this chart? That answer is likely not as easy. Starting points matter, and in terms of valuation, this is a tricky starting point.

12,08K

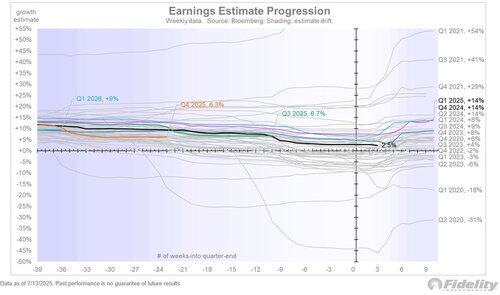

Q2 earnings season starts this week and based on the estimate markdowns in April and May, followed by improving financial conditions and a weaker dollar, my hunch is that earnings will surprise to the upside. The last few quarters produced a bounce of at least 500 bps, so we’ll see if that pattern repeats.

12,79K

Johtavat

Rankkaus

Suosikit

Ketjussa trendaava

Trendaa X:ssä

Viimeisimmät suosituimmat rahoitukset

Merkittävin