Trendaavat aiheet

#

Bonk Eco continues to show strength amid $USELESS rally

#

Pump.fun to raise $1B token sale, traders speculating on airdrop

#

Boop.Fun leading the way with a new launchpad on Solana.

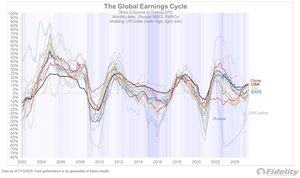

If the dollar does lose some of its supremacy premium, while global earnings are converging on US earnings and non-US valuations are lower than in the US, it should provide a good backdrop for a prolonged period of mean reversion between US and non-US equities.

The two charts below show just how important the currency component can be for investing globally. That’s especially the case for emerging markets, where the USD-based EM index (solid blue) has vastly outperformed the local currency index (dotted line) over the past 25 years. In local currency terms, the MSCI EM index is where the S&P 500 was in the year 2000.

For EAFE (non-US developed), that currency difference is much less. For me, that makes EAFE an easier region to say yes to than EM. Either way, the momentum curves in both charts suggest that the long-awaited mean reversion is upon us.

13,41K

Johtavat

Rankkaus

Suosikit