Trendaavat aiheet

#

Bonk Eco continues to show strength amid $USELESS rally

#

Pump.fun to raise $1B token sale, traders speculating on airdrop

#

Boop.Fun leading the way with a new launchpad on Solana.

Fascinating insights on tech investing and macro from a few decades of experience. Here is what I found most intriguing from Coatue's 100 page deck 🧵

18.6.2025

Our Co-Founders @plaffont @thomas_coatue kicked off our annual East Meets West conference with their keynote address "Coatue View on the State of the Markets."

Check out some highlights, including our outlook below.

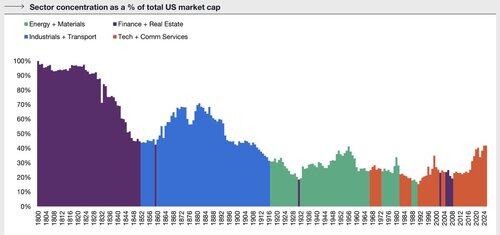

1/ Tech concentration at ~40% of US equity market cap is not the anomaly ppl make it out to be. In mid 20th century energy and materials was ~50%, 19th century industrials and transport was ~70%.

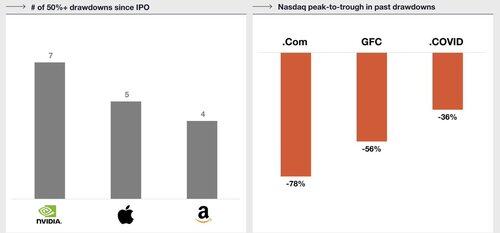

2/ The issue with tech concentration is drawdowns are frequent and violent.

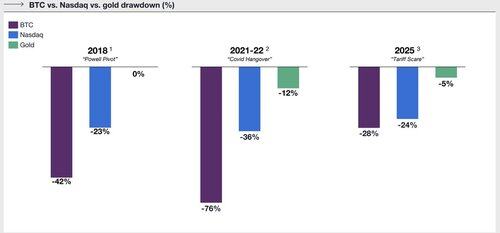

3/ BTC is of increasing interest to institutional investors bc of its outperformance vs Nasdaq and gold, and its recent drawdowns are more muted than historically.

4/ We're at an AI inflection point

- MSFT Q1 earnings call "We processed 100 trillion tokens this quarter, up 5x y-o-y, including a record 50 trillion tokens last month alone." and "expect AI capacity constraints beyond June"

- Cloud capex estimates continue to rise. Today's 2025 estimates are +70% from where they were in Jan '24.

- ChatGPT growing faster than anything ever seen

- Share of US businesses with an AI related subscription has 3x'ed since Q4'22

- Took 6-8 years of investment to reach "SaaS Golden Age" we're only 3 years into AI spend

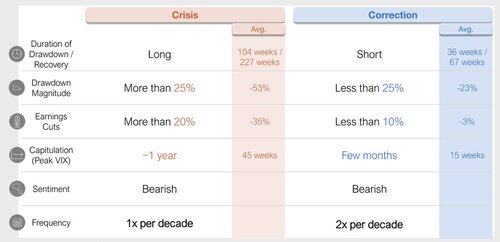

5/ Assess if you're in a market crisis or correction, they're different. Liberation Day seems more like a correction.

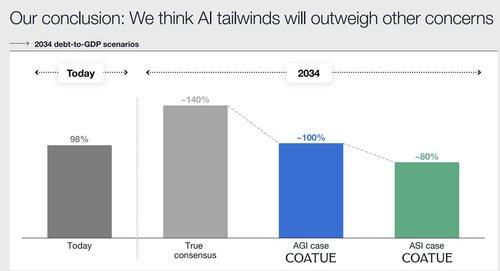

6/ AI will drive a massive productivity boost, which will reduce debt/GDP more than consensus estimates and keep US T 10 yr at 3.5%

629

Johtavat

Rankkaus

Suosikit