Trendaavat aiheet

#

Bonk Eco continues to show strength amid $USELESS rally

#

Pump.fun to raise $1B token sale, traders speculating on airdrop

#

Boop.Fun leading the way with a new launchpad on Solana.

Jeff Liang

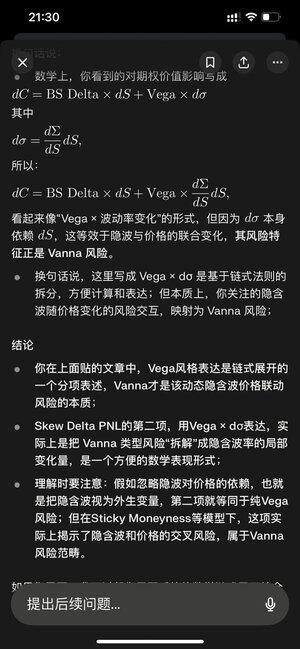

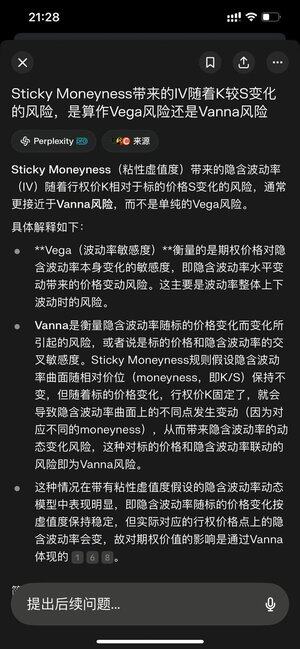

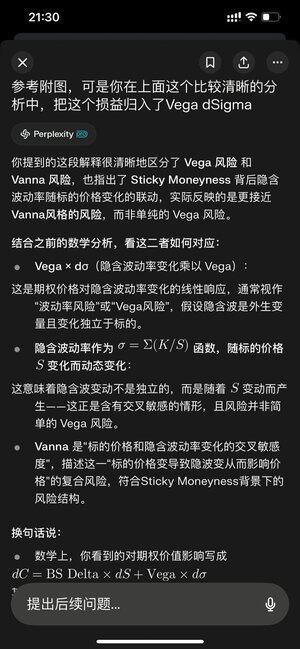

A draft of a short paper examining the coupling of Vanna and Volga to Delta, as well as the realization path of Vanna and Volga profits. I am surprised that neither textbooks nor academic papers discuss these topics much, assuming that second-order gains and losses are realized along with the portfolio, which is vague and unclear; I still have to reason it out myself.

1,74K

Using Monte Carlo simulations to run skew trading (such as selling RR) for expected returns will unexpectedly capture the Skew spread completely on average. In Monte Carlo simulations, the implied volatility of the underlying asset remains unchanged, resulting in a correlation coefficient of 0 between the price movement of the underlying asset and implied volatility, with the volatility of volatility also being 0, and the realized value of Vanna risk being 0. Selling Skew captures the implied value of Vanna, and if the realized value from the Monte Carlo simulation is 0, then it is indeed a great victory. However, the actual situation is far from this.

7,15K

I've recently been looking into the Heston model, and concepts like complex variable functions, Fourier transforms, characteristic functions, and inverse Fourier integrals have really blown my mind.

Imaginary numbers, complex planes, sine waves, cosine waves, frequency, convolution—it's a lot to take in.

I've made quite a bit of progress in my understanding of probability theory lately. I even bought a textbook to systematically review the material.

And occasionally, I flip through Derman's discussions on stochastic volatility models; what seemed like complex formulas back then now feel refreshingly cute.

2,67K

Volatility trading, holding positions until expiration delivery, be sure to maintain a positive Gamma position.

You don't need to be positive Gamma in every scenario, just maintain a positive Gamma locally around the current price.

This small Gamma can amplify sharply as expiration approaches, and even a slight fluctuation in the spot market can trigger Delta Hedge. At this point, if someone comes to mess things up by crashing or pumping the market, it's quite popular.

If you are intentionally or unfortunately holding negative Gamma at expiration, harboring hopes or fears of harvesting those last positive Theta. If a small fluctuation occurs that triggers your Delta Hedge a few times, you'll understand what pin risk means. It's quite comfortable. I've experienced it before. It's more intense than a Thai massage.

3,71K

Johtavat

Rankkaus

Suosikit

Ketjussa trendaava

Trendaa X:ssä

Viimeisimmät suosituimmat rahoitukset

Merkittävin