Trendaavat aiheet

#

Bonk Eco continues to show strength amid $USELESS rally

#

Pump.fun to raise $1B token sale, traders speculating on airdrop

#

Boop.Fun leading the way with a new launchpad on Solana.

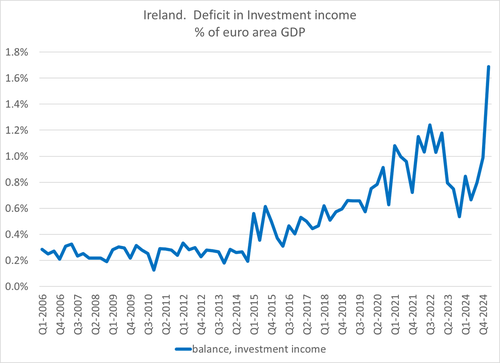

If I had my druthers, every new IMF staff economist would be asked to explain the evolution in Ireland's deficit in investment income (net profits of foreign firms in Ireland) over the last 15 years ... just to drill home that tax avoidance sometimes is the BoP!

1/

The correct answer:

a) the jump in foreign profits from 25 bps of EA GDP to 50 bps is Apple's 2014 tax reorganization

b) the rise to 1 pp of EA GDP in 21/22 is the result of OECD BEPS reforms and the end of the double Irish

c) the 2025 jump is pharma tariff avoidance

2/

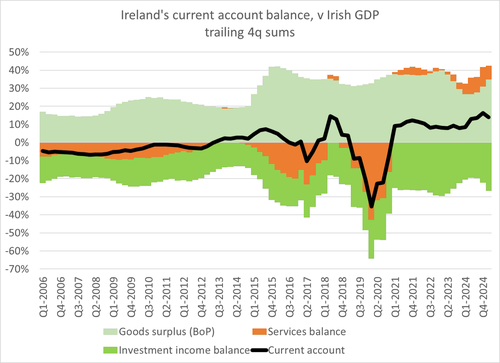

Note that all this was scaled relative to the GDP of the entire euro area ... the numbers for Ireland alone are non-sensical (even relative to Ireland's inflated GDP). a 35% of GDP BoP goods surplus (pharma + Apple), a 25% of GDP investment income deficit ...

3/

If the Europeans took the IMF's assessment of the euro area's combined balance of payments (and its assessment of the valuation of euro) at all seriously, they would be demanding that the IMF strip Ireland out of its assessment ...

4/

If theory, if done correctly, all of the activities of foreign (basically American) multinationals in Ireland should offset -- Apple's increases the BoP goods surplus (via "merchanting") and the BoP investment income deficit.

But in practice it doesn't. 5/

Ireland now runs a 15% of GDP current account surplus pretty consistently (roughly equal to that of Taiwan ... ) and that works out to about 0.5 pp of euro area GDP -- enough to impact the aggregate assessment of the euro area ...

6/

There is a more general point here -- efforts to correct for the activities of foreign multinationals in China have given China an excuse to muck around with its BoP data ... but the much bigger distortions are actually elsewhere

7/7

13,59K

Johtavat

Rankkaus

Suosikit