Trendaavat aiheet

#

Bonk Eco continues to show strength amid $USELESS rally

#

Pump.fun to raise $1B token sale, traders speculating on airdrop

#

Boop.Fun leading the way with a new launchpad on Solana.

Kairos Research

Crypto Research Firm | Staking with @Firstset_

Fogo delivers:

-40ms blocks

- Firedancer's full potential

- The fastest SVM experience possible

This creates world-class trading infrastructure

We're excited to be partnering with @firstset_ as a validator on @FogoChain 🔥

Fogo22.7. klo 23.08

From today, you can get hands-on with the greatest onchain trading experience.

From today, the hoodies and sneakers will have the edge.

From today, Fogo Testnet is open to the public.

(that’s you btw) 🧵

2,29K

The @PlasmaFDN public sale via @echodotxyz is currently ongoing and will conclude in roughly 6 days, on Monday, July 28 at 9:00 AM ET

So far, the $50m public sale is 1.17x over-committed in total, even with 36.6% of reserved allocation remaining unclaimed.

The average committed amount by users is 51x their reserved amount, while the median committed amount is 1.8x.

According to Plasma's blog post:

"Depositors who (i) secured an allocation during the deposit period and (ii) successfully completed onboarding through Sonar are guaranteed an XPL allocation during the public sale and can commit their funds at any point during the sale window.

Additionally, overcommitments are permitted to secure any allocated, but unpurchased XPL.

At the conclusion of the sale, any unpurchased XPL from reserved allocations will be sold proportionally to participants who commit additional funds, based on their share of total committed funds.

To be eligible, you must include the additional funds as part of your commitment during the sale window. This mechanism ensures unused allocation is efficiently reallocated to long-term aligned participants.

Over-committed capital will be returned to participants after the token sale is completed."

We predict there will be an influx of reserved allocations purchased in the last few hours, and we'll post an update once the sale has completed where we unpack the data.

10,09K

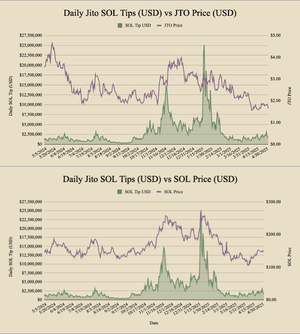

100% of Jito Protocol Revenue Will Go To the DAO

Jito just unveiled their most important product to date, and while there is lots to unpack from the product standpoint - an important market catalyst was revealed:

"Jito Foundation and Jito Labs are collaborating on a JIP to direct *all fees* collected by Jito from BAM and the Jito Block Engine to the DAO Treasury."

Currently, the DAO and Jito Labs split a collective 6% take rate on tips 50/50 (3% each), but this upcoming proposal would change that, directing all value towards the DAO.

Using the current 30, 60, and 90 day moving averages, along with the median daily tip amount over the last year, the 6% take rate on Tips annualizes to the following:

30-D: $27,820,634

60-D: $25,876,009

90-D: $35,457,431

Median 1-Y: $39,912,695

In addition, the median weekly JitoSOL staking reward fee annualizes to an additional $9.3m for the DAO. Add in interceptor, a lesser known product, and the DAO is looking at approximately $45m-$50m in annual revenue for the DAO.

Directing 100% of take rates on fees are set to bolster Jito's strongest existing revenue stream.

On BAM:

We will share some deeper thoughts within an upcoming research report, but our high level takeaway is that Jito's success has always come from obsessing over improving the user experience on Solana, and this is continued progress in that direction.

They made a controversial decision in the past to deprecate their mempool, only to see that decision lead to a surge of activity on the network.

And while moving away from an incumbent solution with a dominant market share is bold, we believe the continued desire to improve overall network functionality will, in hindsight, once again prove obvious for driving increased user activity.

With BAM Jito is offering protocols an opportunity to enable more efficient, transparent, and decentralized block-building via plug-ins.

We believe this will boost revenue and unlock a new wave of value creation for all stakeholders.

In Summary, we several postiive tailwinds for Jito right now

- Staked SOL ETFs

- SubDAO on Token-Economics funded

- 100% of Revenue going to the DAO (full alignment)

- and now the Block Assembly Marketplace (BAM)

We are excited to share more of our thoughts on all these topics in our upcoming research report.

Be sure to follow and subscribe to our substack so you can get it first!

Jito21.7. klo 21.52

Introducing BAM: The Block Assembly Marketplace that revolutionizes how Solana processes transactions.

Private. Transparent. Verifiable.

This is how Solana wins ⬇️

46,99K

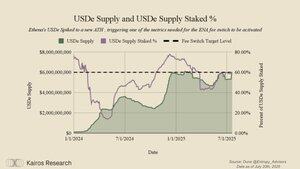

Ethena's $ENA is up 47% over the last 7 days, but what is driving the rally?

Aside from positive market tailwinds with crypto asset prices rising across the board, ENA's rally stands out for one key reason: Speculation on Fee-Switch Activation

ENA is unique, where the fee switch parameters have already been established, but require certain thresholds to be met or exceeded for It to be formally activated, in which case sENA holders would be the fee recipients.

These fees are primarily generated via 10 bip mint fees on USDe, but other protocol revenue streams exist as well.

The parameters are:

✅ USDe circulating supply: $6.08bn (threshold: >$6bn)

✅ Cumulative protocol revenue: $431.31m (threshold: >$250m)

❌ CEX adoption: USDe CEX adoption: 3 (threshold: 4 of the top 5 CEX by derivatives volume)

✅ Reserve Fund ≥ 1% of USDe supply

❌ sUSDe APY spread vs benchmark: (threshold: 5.0-7.5%)

While the last parameter is not yet within range, the current spreads for sUSDe vs other benchmarks are as follow:

Spread vs AAVE USDC: 3.03%

Spread vs T-Bill: 2.48%

Spread vs sUSDS: 2.05%

The avg 30d apy for sUSDe is 5.59% and the current apy is 9.74% at the time of writing.

Additionally, the influx of staked sUSDe vs other key benchmarks like Maker/Sky's sUSDS signal that capital allocators expect the spread to widen in Ethena's favor, as seen in the chart below

77,12K

Great piece from @asxn_r on @ethena_labs

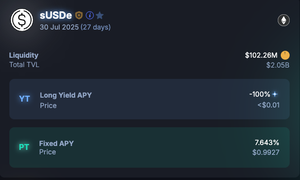

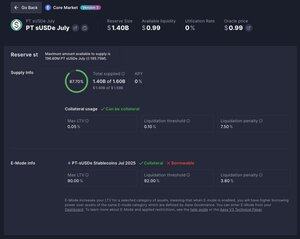

sUSDE has quickly become a pivotal piece of the DeFi ecosystem, with $2.05bn (65% of toal sUSDE) currently in Pendle via the sUSDE-31JUL2025 market

The PT for this market is also being productively utilized via Aave, and is currently the 8th largest asset by collateral asset supplied on the platform.

While the top 10 suppliers of the PT on Aave account for 46% of the total amount, none of the top borrowers are taking any non-stable borrow risk against their collateral - highlighting the appetite and opportunity for stablecoin yield at size

Be sure to read ASXN's full report to get the deep dive look on all things Ethena

ASXN3.7. klo 03.14

USDe, Converge and The New Frontier: A @ethena_labs and @convergeonchain report

Where we look at:

- USDe, USDtb and iUSDe mechanics, growth, risk profiles and yield

- Ethena's complementary product suite

- Converge's architecture and initial ecosystem

4K

Kairos Research kirjasi uudelleen

Last week I had the opportunity to discuss my proposal for Jito's token-economic model to bring real-time value accrual to JTO through SOL-for-JTO epoch auctions.

I haven't shared my idea / proposal on Twitter yet, so here we go:

Today, only a handful of protocols make meaningful amounts of revenue, and even fewer have a model which directs the value created back to the token itself.

With the introduction of TipRouter, Jito is now directing a meaningful amount of revenue to the DAO treasury with a 2.7% take rate on Tips, but that value is not mechanically captured to the token.

Therefore, I'm proposing a flat 2% take rate on Tips from TipRouter which is then auctioned off on a per-epoch basis via an English Auction mechanism.

Mechanically, this looks similar to bundle style auctions, which also utilize the English auction method, where the highest bidder at the end of the duration wins. Simply put, the SOL that is taken via fees is auctioned off, with the important caveat that bids can only be placed in JTO.

A breakdown in the table below can used for assumptions of how this would potentially play out, using the current, 30, 60, and 90 day moving averages for Tips.

I believe this mechanism would take the volatility of Tips as a revenue stream, and use market forces to capture value back into the JTO token directly. For example, when looking at the largest days of Tips ever around the $TRUMP launch, SOL itself saw greater reflexivity than JTO itself.

If this mechanism would've been implemented during those epochs surrounding the largest day of Tips Jito has ever seen, it would have led to 4 consecutive Epochs of $500k+ SOL<>JTO auctions. And over one year of epochs, it would have led $21m of JTO being used to buy SOL from the protocol.

When analyzing the CEX float, as well as onchain liquidity, this leads me to believe that this could have had a material impact for JTO given the current market structure. (Details on float + liquidity found on forum post)

While this may at first seem like a slightly complex option, I think the market is the ultimate arbiter of complexity - delivering order out of chaos. This is a mechanism which I believe would consistently drive market demand for JTO throughout each epoch, reflexive to the amount of Tips seen during that time period.

The DAO + Foundation already have a significant portion of the tokens, and I think this would help further corner the market for JTO - thus allowing for enhanced control of token emission programs.

The end goal is of course to continue growing the protocol, and with the entire LST penetration rate of Solana still around only 10%, and jitoSOL at 40% market share, the game is far from over.

With all growth incentives being denominated in JTO, this sort of real-time value capture mechanism could create a synergistic flywheel where if JTO's price increases, the incentives for various products to grow increase in dollar terms, enhancing Jito's multiple forms of existing revenue streams.

Additionally, there are plenty of other products Jito could launch, many of which were discussed in the same conversation below.

Overall, I think Jito's monopoly on the MEV supply chain makes it incredibly valuable today, and this will likely continue to be its primary revenue driver for the foreseeable future.

Therefore, its also important the value Jito creates is captured and reflected back into the token price to fortify Jito's growth prospects, wherever they may arise - whether it be through M&A, new product launches, etc.

Overall, this was a great discussion alongside some fellow delegates and investors in the space, highly suggest listening in on all the ideas put forth, AND reading the summary in the Jito forum, along with the full posts found there. Also if you've got thoughts or feedback on Jito's future - I encourage you to share them.

But I'll leave it with this:

If we want high quality DeFi tokens to actually outperform like "beta" to the native network's asset, then real-time value capture to the token is a must.

16,07K

Johtavat

Rankkaus

Suosikit

Ketjussa trendaava

Trendaa X:ssä

Viimeisimmät suosituimmat rahoitukset

Merkittävin