Trendaavat aiheet

#

Bonk Eco continues to show strength amid $USELESS rally

#

Pump.fun to raise $1B token sale, traders speculating on airdrop

#

Boop.Fun leading the way with a new launchpad on Solana.

ASXN

Boutique Digital Assets Research, Infrastructure and Validators | @asxnlabs

We first wrote our Crypto x AI thesis back in March 2024.

Since then we have been active contributors, investors and infrastructure providers to many Crypto AI projects.

Today, we are excited to announce we are joining the @talos_is council as one of the "humans on the steering wheel" (@VitalikButerin's words) to help shape Talos capital allocation and vote on treasury proposals.

Excited for the future of sovereign AI.

talos18.7. klo 02.00

the initial talos council has formed.

early contributors and strategists entrusted to steward the protocol's first phase.

@0x___Brick

@asxn_r

@salveboccaccio

@empyrealdev

their mandate: embed safeguards, refine incentives, and catalyze growth.

the future is talos.

2,77K

You can use our early access code to access the kHYPE AMM (@kinetiq_xyz).

Valantis Early Access Code: hyperps_core_stakehub

The code is only valid for the first 15 wallets!

Valantis Labs16.7. klo 01.02

Early Access: Available for only a select few.

Unlock kHYPE AMM early by entering an access code.

Each code can be used multiple times before expiring.

More may be released via X and/or Discord.

First access code in the reply below ⬇️

5,21K

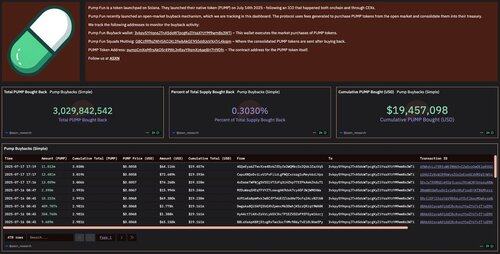

1/ We just published our @Dune dashboard tracking the @pumpdotfun PUMP buybacks.

Pump Fun has bought back 2.993B PUMP tokens (worth approximately $19.25M) over the past day. This represents 0.2993% of the total supply.

Their largest single buy was at 17:32 UTC, where the team bought $1.23M USD worth of PUMP - approximately 27.27M PUMP tokens.

41,91K

ASXN kirjasi uudelleen

Great piece from @asxn_r on @ethena_labs

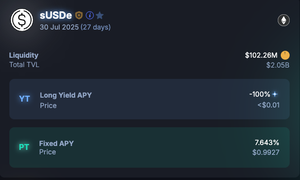

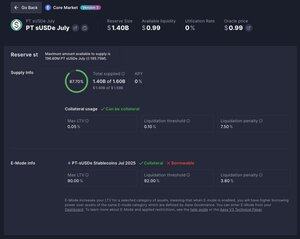

sUSDE has quickly become a pivotal piece of the DeFi ecosystem, with $2.05bn (65% of toal sUSDE) currently in Pendle via the sUSDE-31JUL2025 market

The PT for this market is also being productively utilized via Aave, and is currently the 8th largest asset by collateral asset supplied on the platform.

While the top 10 suppliers of the PT on Aave account for 46% of the total amount, none of the top borrowers are taking any non-stable borrow risk against their collateral - highlighting the appetite and opportunity for stablecoin yield at size

Be sure to read ASXN's full report to get the deep dive look on all things Ethena

3,83K

Johtavat

Rankkaus

Suosikit

Ketjussa trendaava

Trendaa X:ssä

Viimeisimmät suosituimmat rahoitukset

Merkittävin