Trendaavat aiheet

#

Bonk Eco continues to show strength amid $USELESS rally

#

Pump.fun to raise $1B token sale, traders speculating on airdrop

#

Boop.Fun leading the way with a new launchpad on Solana.

Great piece from @asxn_r on @ethena_labs

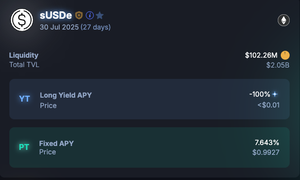

sUSDE has quickly become a pivotal piece of the DeFi ecosystem, with $2.05bn (65% of toal sUSDE) currently in Pendle via the sUSDE-31JUL2025 market

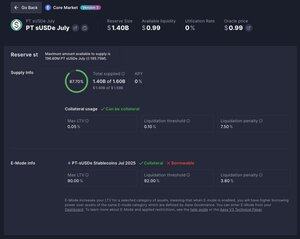

The PT for this market is also being productively utilized via Aave, and is currently the 8th largest asset by collateral asset supplied on the platform.

While the top 10 suppliers of the PT on Aave account for 46% of the total amount, none of the top borrowers are taking any non-stable borrow risk against their collateral - highlighting the appetite and opportunity for stablecoin yield at size

Be sure to read ASXN's full report to get the deep dive look on all things Ethena

3.7. klo 03.14

USDe, Converge and The New Frontier: A @ethena_labs and @convergeonchain report

Where we look at:

- USDe, USDtb and iUSDe mechanics, growth, risk profiles and yield

- Ethena's complementary product suite

- Converge's architecture and initial ecosystem

3,91K

Johtavat

Rankkaus

Suosikit