Trendaavat aiheet

#

Bonk Eco continues to show strength amid $USELESS rally

#

Pump.fun to raise $1B token sale, traders speculating on airdrop

#

Boop.Fun leading the way with a new launchpad on Solana.

Things I tell people about AMMs:

(running list)

1. You can get all the volume you want out of an AMM if your prices are wrong.

5. If you are fixing impermanent loss by changing your design to create permeant loss every time the price moves, it's probably worse.

6. LP money wants to be passive.

7. LP money wants to be an ERC20

8. If you make a new AMM design that's uniswapV2, but better in one way, it's probably going to be worse than uniswapV2.

9. Static trading fees are obviously, spectacularly wrong.

11. Dynamic fees that only track volatility/off twapness are great, but only halfway there.

21. I never want to write bin based concentrated liquidity code.

God bless everyone who has.

22. I hate oracles.

Not really relevant, but just throwing this in there.

Because I hate oracles.

23. In the formula `profit = revenue - losses`, a small percent reduction in losses or a small percent increase in revenue can have a huge impact on profit.

24. To a first approximation, LP profitabitly is

(fee x volume) - (assets exposed * asset price changes)

25. Orderbook based market making is the pinnacle of hundreds of years of evolution in traditional finance. The most efficient way humans have ever found to do this.

But every time it's been tried onchain, it's failed. Pls don't build another one until you know why.

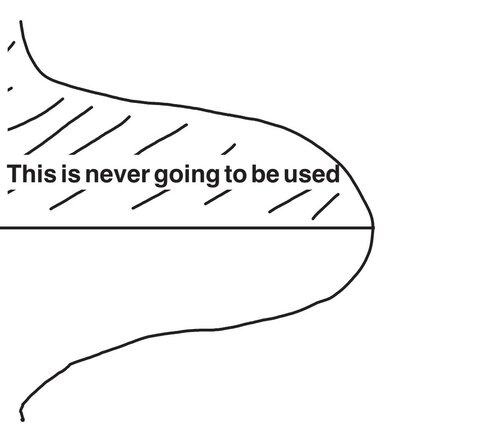

26. For everyone concentrating liquidity around the 1:1 between an asset and it's more risky derivative asset that also has a time delay to redeem:

27. If your AMM competitors for a pair are boneheadedly losing money, there may be no possible way to be profitable, since to compete for trades you would have to lose more money than they do.

@martinkrung See:

7.6.2025

22. I hate oracles.

Not really relevant, but just throwing this in there.

Because I hate oracles.

28. A more accurate profit equation for AMMs is:

+(fee x volume)

- (assets exposed * asset price changes)

- (cost of capital)

29. Most recent AMM designs headline reducing the cost of capital (via concentration or earning idle liquidity). It's easily understood.

I think reducing the even bigger cost of assets exposed to price changes is under appreciated right now.

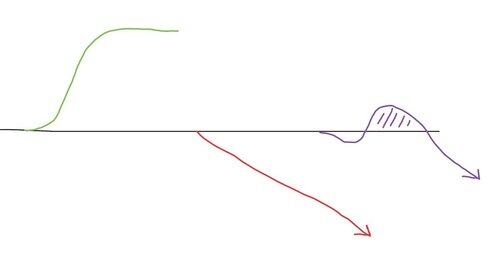

30. People claim you can defeat impermanent loss by just creating a "Delta Neutral" LP position via borrowing the funds for one side of your initial LP position. No.

You have _exactly_ the same impermanent loss doing this.

@guil_lambert Figure 3 is a great chart.

But still show the impermanent loss - and lots of it - against a true delta neutral position (which would be a horizontal line). The only place it breaks even is when the price has not changed, and everywhere else it's worse.

@guil_lambert Figure 2 still shows impermanent loss.

The number you get doing the strategy is is worse than setting up a delta neutral borrow and lend and then keeping your money out of an AMM.

31. More liquidity can be BAD.

At first more liquidity on a pair makes the income go up, but that tops out once all trades are supported. But more exposed liquidity only increases the losses. There's a sweet spot between the two effects, and then it's pure downhill from there.

187,95K

Johtavat

Rankkaus

Suosikit