Trendaavat aiheet

#

Bonk Eco continues to show strength amid $USELESS rally

#

Pump.fun to raise $1B token sale, traders speculating on airdrop

#

Boop.Fun leading the way with a new launchpad on Solana.

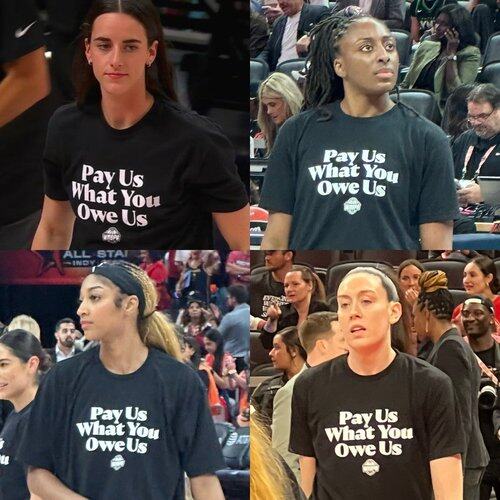

This fake charity organization is subsidized by a real business (the NBA) because it can't actually sustain itself. It's never turned a profit: a baby bird who can't leave daddy's nest but pretends it can fly on its own with BOLD t-shirts and FIERCE platitudes.

Sweetheart if you wanted actual equality you'd be unemployed. What you crave is a dichotomous handout while also being told "wow look at how independent and powerful you are!"

These women operate in the world of a child, subscribing to the magic of jellybeans and anything can be true if you say it enthusiastically enough.

At a certain point you just tell children "no" and let them throw impotent tantrums in the corner until they tire themselves out.

20.7. klo 10.08

Imagine being an employee at a company that has NEVER turned a profit and showing up to work in these shirts.

They should come work in crypto. We love magical thinking here and making stuff up and proclaiming it true.

Come form a WNBA DAO where you issue jellybean coins and then do a jellybean "buyback" to "return value" to the jellybeans. Your finance understanding is perfect for our industry we love WNBA economics here.

> "It works for the stock people, so it must work for the token people"

> "It works for the NBA, so it must work for the WNBA"

Seriously ladies you guys will make a killing in DeFi as tokenomics KOLs.

19.7. klo 08.12

The futility of token buybacks: unwittingly borrowing a stock concept and assuming the two assets are the same. On what basis? Well, if it works for the stock people, it must work for the token people??

On stock buybacks: reducing share count does not create value; it concentrates value that already exists.

We must ask “why is this instrument valuable in the first place?” before we determine if arbitrarily reducing its supply constitutes an act of 'returning capital'. VALUE MUST ALREADY BE PRESENT FOR THIS TO WORK.

Buybacks are not by themselves a form of value accrual, as a simple illustration: a worthless asset is still worthless even if you shrink its supply.

This is effectively what DeFi token buybacks do: they borrow stock abstractions for assets with no stock characteristics and no intrinsic worth… “Here are 100 units of vapor, we’ll now reduce the supply to 70 units, returning value to vapor holders. It works for the stock people, so it must work for the token people?”.

Reducing quantity alone cannot manufacture intrinsic worth; it merely redistributes whatever value already exists. If there was no value present pre-buyback, my brother in Christ there won't be any there post-buyback either. No amount of circular reasoning will save you here.

Something must already have innate value/utility for a scarcity-inducing action to increase its worth.

Despite vibes that have deceived you otherwise, stocks are not memes; they possess intrinsic value per legally and enforceably controlling the underlying company, which is why buybacks are great for them! Boy I love me a good share buyback; what an excellent way to return capital.

However, the token is not a stock. A crypto bro's words will say "I know the token isn't a stock", but his actions demonstrate he has not actually internalized this reality.

4,53K

Johtavat

Rankkaus

Suosikit