Trendaavat aiheet

#

Bonk Eco continues to show strength amid $USELESS rally

#

Pump.fun to raise $1B token sale, traders speculating on airdrop

#

Boop.Fun leading the way with a new launchpad on Solana.

Mike Cagney

@Figuremarkets co-founder, CEO, @Figure co-founder, board chair, @SoFi co-founder, former CEO. Views are my own, not investment advice. My only account.

Excited to announce that we are recombining @Figure and @FigureMarkets. I split the company in two last year given the regulatory headwinds around blockchain. I was fortunate to bring Mike Tannenbaum in as CEO of Figure, and I became CEO of Figure Markets. With the change in the regulatory environment and the growing public market enthusiasm for blockchain companies, it made sense to recombine the companies. Michael will be the CEO of the recombined Figure, and I'll be the Executive Chairman. I won't be doing anything different - I'm still 100% focused on Figure, Provenance Blockchain Foundation and bringing the best decentralized products to market through both.

18,88K

Interchange is a regressive tax. Blockchain can – and should – kill it.

When you swipe your debit or credit card, the interchange network – issuing processor, issuing bank, Visa/MC, merchant acquirer and merchant bank – all take a cut of the transaction by charging the merchant.

Your points from your card were financed by the merchant and actually paid for by you through higher prices (think about how you can buy gas cheaper with cash). Wealthy consumers who earn outsized points (think Chase Saphire rewards) are subsidized by poorer consumers who earn no points.

The big fintech payment companies like Stripe and Square are just lipstick on the interchange pig. Their whole value prop is improving the access to the interchange network, not making it cheaper through disintermediation.

Fiserv’s FIUSD is perpetuating the same model – the recent announcement of partnering with Mastercard is demonstrative that all the same parties are still part of the flow, taking the same fees. FIUSD’s primary value is displacing ACH as a settlement platform for cash. That has value, but it’s missing the bigger opportunity and is competitive to solutions today (e.g., FedNow).

Stablecoin can kill interchange. Blockchain supports bilateral transactions between buyer and seller. The Genius Act will bring a plethora of stablecoin issuers to market. They will begin to disintermediate the interchange players, but not all the way. I think JP Morgan, for example, will build a payment network that keeps issuing banks (Chase) but cuts out Visa and Mastercard.

This is a golden opportunity for entrepreneurs. Build new bilateral payment rails using stablecoin that don’t harm merchants and lower income consumers. The lift is point-of-sale (thing QR code instead of Fiserv) and integration to merchant ERP/accounting systems (think partnering with SAP, Oracle, Microsoft, etc.).

I’m looking forward to seeing – and participating through Figure – the disruption here.

4,41K

Mike Cagney kirjasi uudelleen

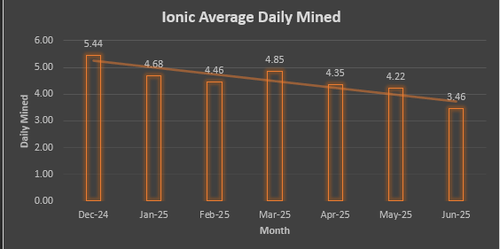

Bit of a mid-month update on @IonicDigital. As of their last received rewards on 6/20/2025 Ionic has only mined 69.10 BTC or an average of 3.46 per day. As of today, that would be a further decrease of -18.05% compared to May's 4.22, Aprils 4.35, and March 4.85.

Ionic digital continues to see substantial reduction in daily BTC as the market rallies and actual players ramp up their idle fleets and difficulty balloons.

@MichaelAbbateNW and @owiener cannot get voted into the board soon enough. Drastic and decisive changes are needed, and evidently the existing board is incapable off making the changes needed. Continue to support the gold slate by voting:

Source:

1,33K

Mike Cagney kirjasi uudelleen

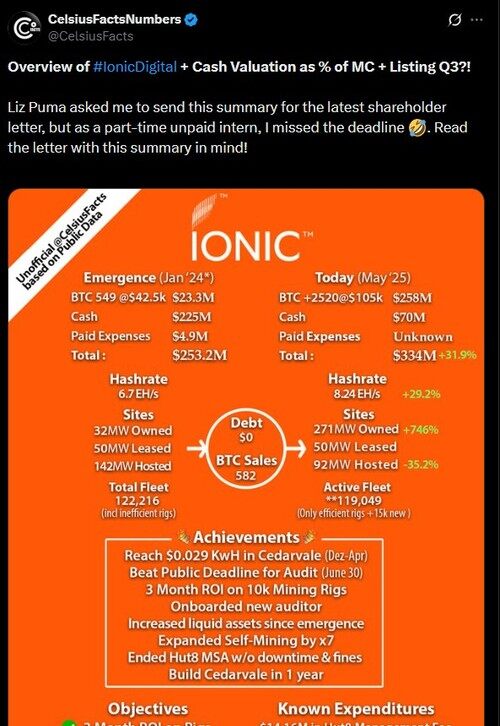

@IonicDigital is running a PR campaign through a guy who had $300 in Celsius. How much are you paying this corporate shill, and why haven't either of you disclosed it? Furthermore, he says this is unofficial, but Liz Puma asked him to send this summary. So which is it?

@RonPaulBot1234 screams about @mcagney and @SimonDixonTwitt. Neither of them has ever asked me to "send a summary" or do anything. Nor have I received a single cent. I fight with these shills every day because I'm fighting for us, the creditors. Speaking of....

Here's an interesting summary: I hold more Ionic stock than Liz Puma and @CelsiusFacts COMBINED. Which, truthfully, isn't that hard since they both hold ZERO.

I can't believe I have to go through this day after day.

No wonder a judge found them in violation of their fiduciary duty.

Vote Gold:

942

Johtavat

Rankkaus

Suosikit

Ketjussa trendaava

Trendaa X:ssä

Viimeisimmät suosituimmat rahoitukset

Merkittävin