Trendaavat aiheet

#

Bonk Eco continues to show strength amid $USELESS rally

#

Pump.fun to raise $1B token sale, traders speculating on airdrop

#

Boop.Fun leading the way with a new launchpad on Solana.

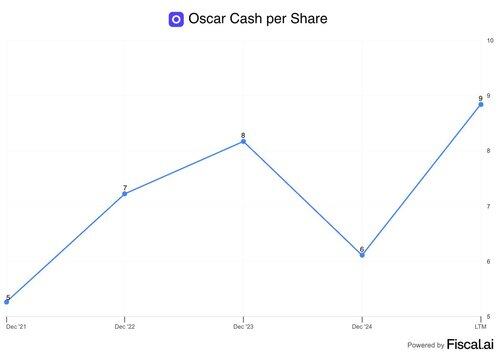

If you listened to last week’s @FuturumEquities podcast -- you know we spent time walking through why $OSCR feels like a rare setup.

At $13, you’re not actually paying $13 for the business. You’re paying $4 -- the rest is sitting on the balance sheet in cash 😳

I see a lot of messages asking if I own $OSCR. I don’t.

I’m a thematic investor. I focus on sectors where I have deep conviction -- where the outcomes feel exponential, not incremental. That usually means AI infra, space, quantum, data platforms, automation layers. Insurance has never really fit that profile for me. It’s complex, low-margin, and full of incumbents that win by being opaque, not efficient.

But here’s the thing -- I still track Oscar. Closely.

Because every now and then, a company shows up in a broken system and actually tries to fix it. With software that nudges human behavior in the right direction -- like routing members away from the ER and toward urgent care. Or matching patients to lower-complication providers with better outcomes. That’s not just a nicer insurance experience. That’s claims deflation at scale.

And if they get that right, they won’t just be a better insurer. They’ll be the Stripe of insurance infrastructure -- quietly reprogramming how money flows through the healthcare system.

Now, there are still real questions. Margins are tight. Growth isn’t explosive due to red-tape. So no, I don’t own it. It’s not in my wheelhouse. But I also can’t look away. A name I am looking into more.

333,06K

Johtavat

Rankkaus

Suosikit