Trendaavat aiheet

#

Bonk Eco continues to show strength amid $USELESS rally

#

Pump.fun to raise $1B token sale, traders speculating on airdrop

#

Boop.Fun leading the way with a new launchpad on Solana.

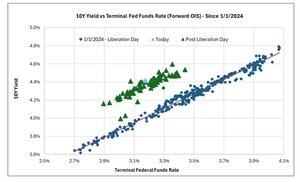

Term premium in UST10 has risen consistently since Liberation Day. Chart shows 10 year yield relationship w terminal fed funds rate implied by forward OIS.

In layman’s terms, term premium is the extra “buffer” on top market’s intrinsic expectations for short term rates to account for uncertainties like inflation surprises, economic shifts, government/central budget(s) policies :).

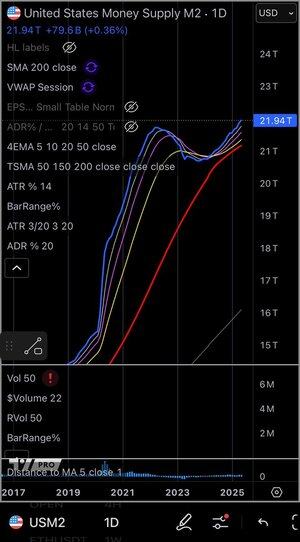

US M2 money supply recently broke out of a multi year high tight flag … important to see the forest from the trees and keep in mind what it means for the medium term direction of asset prices in general.

Credits @donnelly_brent

7,98K

Johtavat

Rankkaus

Suosikit