Trendaavat aiheet

#

Bonk Eco continues to show strength amid $USELESS rally

#

Pump.fun to raise $1B token sale, traders speculating on airdrop

#

Boop.Fun leading the way with a new launchpad on Solana.

Another great breakdown by our devrel.

10.7. klo 23.31

GMX v1 Lost $42M Through AUM Manipulation

Yesterday GMX v1 suffered an attack that drained $42M through AUM manipulation. This was GMX's 2nd major hack of 2025 (lost $13M in March).

Disclaimer: This is not a full post-mortem, I've mainly looked into the AUM manipulation part.

The Attack Vector:

1. Exploited reentrancy in `executeDecreaseOrder` function

2. During callback, opened massive short positions at artificially low prices

3. Manipulated `globalShortAveragePrices`, inflating AUM calculation

4. System thought it had huge "unrealized profits" from shorts

5. Redeemed GLP tokens at inflated prices, extracting real assets

The Core Issue:

GMX's AUM = Physical Tokens + Stablecoins + Unrealized Trading Profits + Fees

When shorts lose money (current price > average price), the vault "profits" and AUM increases. The attacker exploited this to create artificial profits.

Simple Prevention:

An AUM bounds invariant enforcing `AUM_change ≤ net_token_inflow + 5%` would have caught this immediately.

The attack created massive artificial value with minimal real deposits - exactly what economic sanity checks detect.

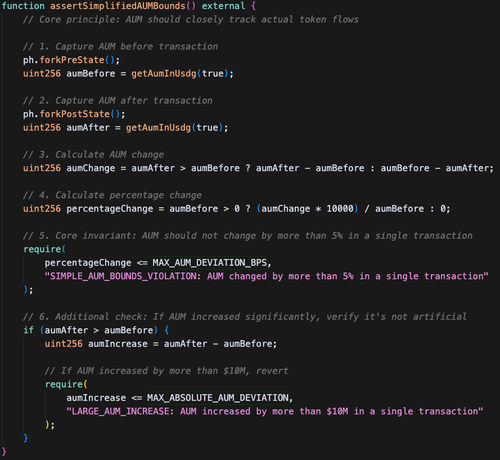

A simplified version of a @phylaxsystems assertion that could have detected and prevented the hack:

724

Johtavat

Rankkaus

Suosikit