Trendaavat aiheet

#

Bonk Eco continues to show strength amid $USELESS rally

#

Pump.fun to raise $1B token sale, traders speculating on airdrop

#

Boop.Fun leading the way with a new launchpad on Solana.

Everyone knows that LPing Concentrated Liquidity has some of the highest yields in DeFi

But most people are too afraid of Impermanent Loss

Here's how to hedge Impermanent Loss in a CL LP using @GammaSwapLabs to create a delta neutral USDC position yielding 28% APR

Fair warning that you will only enjoy this thread if you're a massive (and i mean MASSIVE) defi nerd

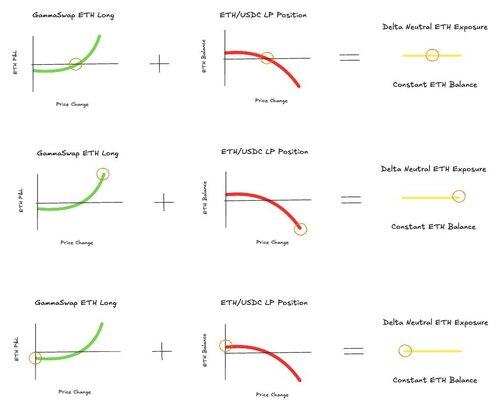

Here's the GammaSwap diagram for how to hedge IL to become ETH delta maximal

My strategy will show you how to hedge for IL to become USDC delta neutral

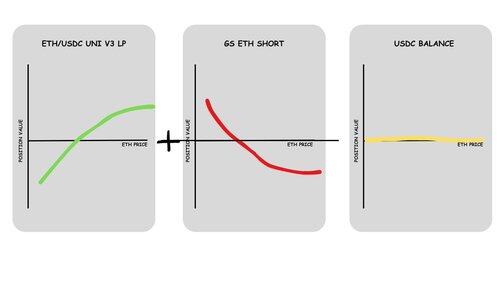

✅ Farm clAMM WETH/USDC on @Uniswap at +-30% range

✅ Hedge with GS ETH Short on @GammaSwapLabs

(Hedges IL and shorts ETH equivalent to the LP)

✅ Starting Parameters

Starting date is 19.07.2025

Starting ETH price is $3575

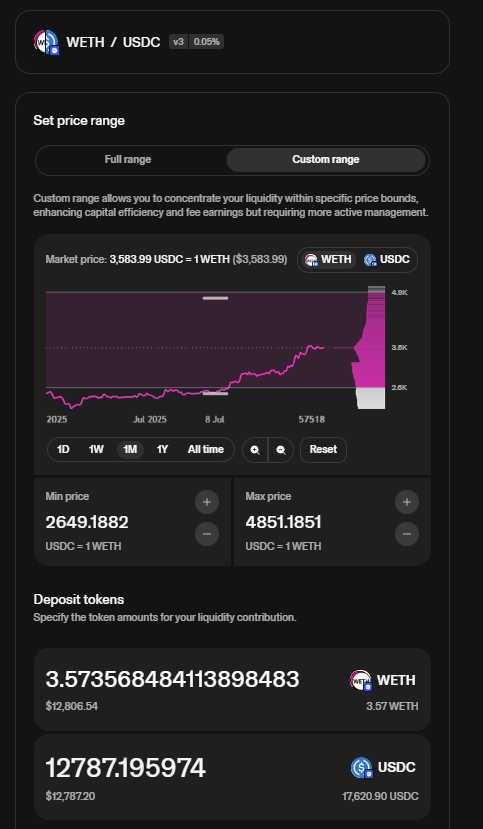

Farming concentrated Liquidity in WETH/USDC pool on Uniswap

Range is $2649-4831

-30% +30% distribution

APR is estimated to 58% for the CL position by defillama (30 day avg)

✅ Wallet

Starting out with $30,4k in USD

(doing this to be able to track my progress)

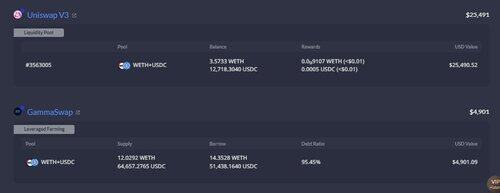

✅ The Hedging calculator

We punch the numbers into the GammaSwap calculator for hedging IL

This calculates the size we need to use on each platform

Deposit Uniswap $25,819

Deposit GS $4,574

Deposit total $30,393

We see that annualized APR is 28%

How to figure out the yield for your uni v3 position?

Check defillama yield page

Currently 7d avg 58% APY for a +-30% range

(Obviously yields will vary in high and low volatility periods, i've seen ranges from 30% APR to 100% APR over the last months)

Other options if you want to use other ranges is @vfat_io to figure out approx APR

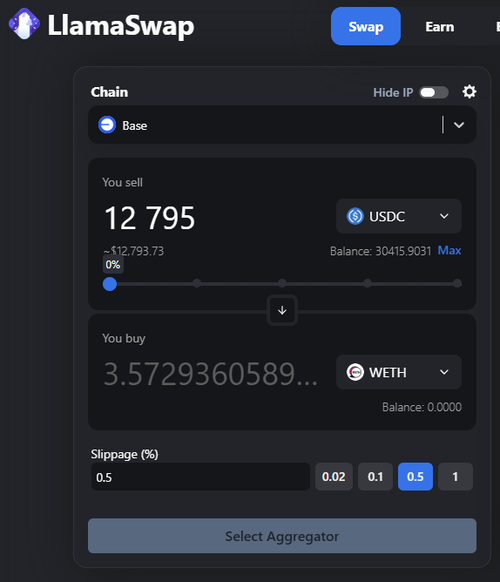

✅ Swap for ETH

We start off by swapping USDC for WETH so we have 3.573 WETH

To be used in Uniswap LP

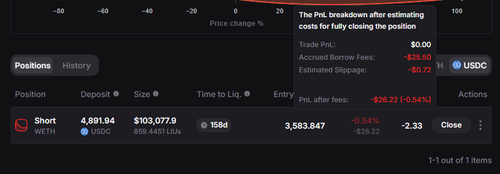

✅ Deposit to Uniswap LP

3.573 WETH

13005 USDC

Range: 2649 - 4831

APR = estimated 58 % APR (by defillama)

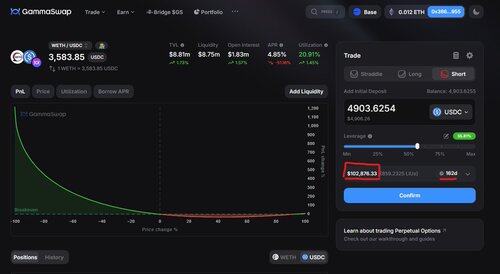

✅ Open GammaSwap ETH Short to hedge the IL

Put the rest of the USDC (4900) into the GammaSwap ETH Short

Opening Debt = $103,5k (from calculator sheet, this is the important number)

This position cannot be liquidated by price, but it can be liquidated by time (funding fees)

Currently this can stay open for 162 days (but this can change if borrowing rates change)

Im paying a $25 fee to open the position

(so very frequent rebalancing can hurt you if you put rang too tight, i know you are already considering doing this with +-10% range or even tighter)

This fee will also be higher according to how tight your range is

My exposure to ETH in the Uni v3 LP should now be hedged by the GammaSwap ETH Short

(For the nerds: This is done by calculating the leverage the Concentrated Liquidity LP uses compared to a full range LP)

At +-30% range you are providing liquidity with 7.17x leverage compared to a full range LP

For rebalancing we want to do it a little bit before we hit the end of the ranges

We would prefer to rebalance around $2750 or $4700 ish to not go out of range

Remember that we are only hedged within the range from 2649 - 4831

To rebalance just close all positions and open new positions after running the calculator sheet again

We now have the following positions after opening all positions at $3580 ETH

After 2 days of running the strategy, @revertfinance shows that the uni v3 position is currently yielding 38% APR (over a weekend)

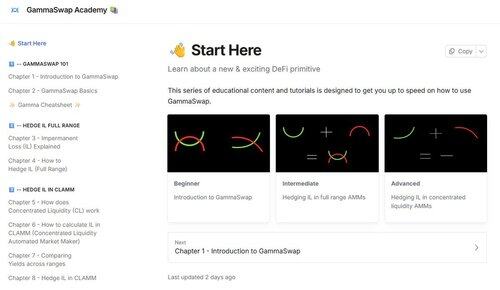

Confused about all of this?

@GammaSwapLabs just released guides for how to hedge IL in Concentrated Liquidity AMMs with a lot more detailed explainations

My strategy differs a bit from the Academy strategy of hedging IL

Academy strategy = Yield bearing ETH derivative

My strategy = Yield bearing USDC derivative

I replaced "GS ETH Long" and "ETH Perp Hedge" with an "GS ETH Short"

Think this looks fooking hard?

That's why @GammaSwapLabs is automating the strategy and tokenizing it as the "Yield Token"

Tokenized Concentrated Liquidity AMM Yield

They will launch multiple yield tokens giving exposure to different assets with AMM yield

gETH

gUSDC

gBTC

And basically this can be applied to any token

The Ethena of AMM Yield

A composable token that can be pendiddled through @pendle_fi and leveraged through @SiloFinance or @MorphoLabs

Think this looks fooking cool and is exactly how defi should be played?

Welcome to the club

Ticker is $GS

Target is moon

Will post some updates of how this position plays out later on, make sure to follow me @Slappjakke for more alpha and defi deepdives

If you made it this far, please support with a Like/Retweet the first tweet below if you can:

22.7. klo 23.01

Everyone knows that LPing Concentrated Liquidity has some of the highest yields in DeFi

But most people are too afraid of Impermanent Loss

Here's how to hedge Impermanent Loss in a CL LP using @GammaSwapLabs to create a delta neutral USDC position yielding 28% APR

20,93K

Johtavat

Rankkaus

Suosikit