Trendaavat aiheet

#

Bonk Eco continues to show strength amid $USELESS rally

#

Pump.fun to raise $1B token sale, traders speculating on airdrop

#

Boop.Fun leading the way with a new launchpad on Solana.

😎 The good news is that ETH is finally starting to gain momentum

😂 The bad news is that copycat season may not be coming

😉 There may be good news: "Copycat building season" may be about to begin

In November last year, it was said that ETH changed the bank, who believed it?

On May 8, I wrote that the change of village has been completed, who believes it?

On July 2, it was said that the market share of ETH has improved, and the ETH/BTC exchange rate has generally reversed, who believes it? e

Liquidity is spilling over to ETH. You can not believe it, but you can't believe those ETF institutions, right?

Ni Da has said countless times, ETF institutions, the smartest people in the world, help us choose the best ETH. Thanks to the data of Ni Da @Phyrex_Ni, the data in recent days shows that the ETH held by ETF institutions is increasing overall:

💠 But why didn't the copycat season come?

🔹 The macro environment has not yet provided sufficient marginal liquidity

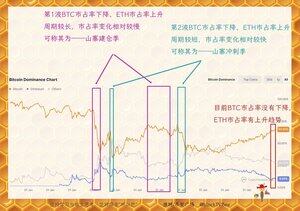

Brother Bee has analyzed in the top post that the rise of BTC and the decline of BTC market share are the performance of the start of the copycat season.

And this situation where BTC rises and altcoins rise more requires sufficient market liquidity. If in July 2017, the total crypto market capitalization was $100 billion, the whole plate is still relatively small.

Today, the total crypto market capitalization is $3.7 trillion, which is more than 30 times the size of the original, so greater liquidity is needed, which is closely related to the macro environment.

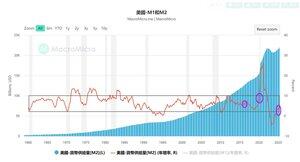

At present, the market is not illiquid, but marginal liquidity. M2 in the United States is not low, but the annual growth rate of M2 is about 4.5%, which is not high.

I'll give you the simplest example, you are very rich, you have a lot of money, and you spend it all the time. But if you earn less this year than you did last year, will you still spend as much money as you used to? Will there be a slight reduction in spending?

Therefore, the main factor affecting the market is not the existing liquidity, but the marginal liquidity, that is, the growth of liquidity.

Obviously, the annual growth rate of M2 is still at most in the middle of the middle compared with history.

🔹 The annual growth rate of M2 in the United States corresponds to the beginning of 19~20|Q3 of 15Q3~16

Still looking at the chart above, the annual growth rate of M2 in the United States now corresponds to the beginning of 19~20, and Q3 of 15Q3~16. There may be friends who are disgusted with carving a boat to ask for a sword, but you have to admit that the so-called 4-year cycle is even more carved for a sword.

The impact of macro marginal liquidity on traders' psychology and behavior is actually logical. The annual growth rate of M2 reflects the marginal liquidity of the macro.

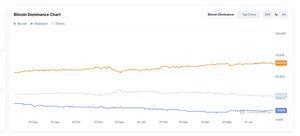

🔹 The market share of altcoins has not risen

Obviously, now BTC is rising, but BTC market share is not decreasing. This is the market share of the past 1 year, and the market share of BTC has not been declining, and the market share of other coins has not been on an upward trend.

On the contrary, the market share of ETH is on the rise, and liquidity is spilling over to ETH, but not to altcoins.

💠 Next could be "copycat season" (note I'm not sure)

In this article, Brother Bee put forward two theories: the cottage building season and the cottage outbreak season.

ETH has become stronger, but the market share of copycats has not increased, at most it is the beginning of the copycat opening season.

Liquidity from BTC to ETH to altcoins, investors are getting bolder, and this process should take some time. Of course, there is also the need for an optimistic impact of macro liquidity factors. So the cottage season shouldn't have come yet.

At most, it could be the beginning of the copycat season.

March ~ June 2017 is the first round of cottage building season.

September 2019 ~ September 2020 is the second round of cottage building season.

Note:

First, in the past two rounds of copycat warehouse building season trends, BTC is volatile and upward, and the performance of copycats is different, so the copycat opening season is not equal to stud.

Second, not all copycats are suitable for opening positions. The biggest feature of this round of narrative is the participation of traditional institutions and the integration of Web2 and Web3.

The tracks that traditional financial institutions and traditional investors will be more interested in may be more suitable for opening positions.

For example, RWA and RWAFi related to traditional finance,

Defi with stronger financial attributes,

Relatively strong technical chain abstraction and cross-chain with long-term growth,

Depin, which has cost support and has a certain degree of decentralization, etc.

In addition, traditional financial institutions and investors seem to prefer old leading projects.

On the contrary, instead of being very optimistic about AI, compared with Web2 AI, the conceptual gimmick of Web3+AI is far stronger than the practical application.

If you are not good at discovering potential projects in the track, the faucet is a better choice.

8.5.2025

兄弟们原谅我刻个舟!

2021年8月5日,在牛市第一波落幕以后,519的消极情况平复以后,ETH迎来了伦敦升级,并走向牛市第二波。

2025年5月8日,在牛市第一波落幕以后,关税的消极情况平复以后,ETH迎来了Pectra升级。

这两个阳线,让人相信庄并没有放弃ETH😂

纯属刻舟啊,不构成多空判断。毕竟川普的政策和美国经济衰退还存在一定的不确定性。

14,9K

Johtavat

Rankkaus

Suosikit