Trendaavat aiheet

#

Bonk Eco continues to show strength amid $USELESS rally

#

Pump.fun to raise $1B token sale, traders speculating on airdrop

#

Boop.Fun leading the way with a new launchpad on Solana.

TVBee

Panty investment research | Data + Macro Analysis for Grade 4 Elementary School Students | Financial blogger + pseudo-programmer | Web3 migrant workers, pure originality, never carry or wash manuscripts, never brush powder or brush volume |

Please call Sister "Brother Bee"

Actually, it's not that "institutions are just big retail investors."

Mainly ETF institutions, Grayscale crypto trust funds... these institutions themselves do not invest in cryptocurrencies.

Instead, these institutions provide investment, trading, and custody products and services for cryptocurrencies based on the needs of their clients.

The clients are retail investors or smaller institutions, and these people are essentially still influenced by emotions.

It's just that these people don't monitor Twitter all day like we do, and they aren't as emotionally sensitive as we are; they just have some relatively analytical frameworks for their investments; they are just relatively rational.

But it's only "relatively" rational.

So, don't hold institutions in too high regard!

蓝狐18.7. klo 09.15

Institutions can also infect each other; they are like super-sized retail investors. Their logic is sometimes constrained by the thinking of traditional companies, and they may not truly understand Ethereum, but that doesn't prevent the emotional contagion or the need to manipulate among them.

8,56K

As ETH rises, various analyses and praises begin.

Brother Bee doesn't have much to write about now, so let's pull out the old stuff.

(Suspecting that those before, due to ETH's poor performance, didn't attract much attention 😂)

In July 2024, analyzing the differences between Ethereum's POS and other public chain POS mechanisms:

In July 2024, analyzing that Layer 2 will not distribute Ethereum's ecosystem and value:

In November 2024, reiterating that Ethereum's POS has no issues:

In November 2024, analyzing the reasons for ETH's poor performance:

In November 2024, analyzing ETH's change of hands:

In January 2025, raising the issue of incentives in the Ethereum ecosystem:

In February 2025, analyzing that the market's accusations against Ethereum are double standards:

In March 2025, analyzing the reasons why hackers like Ethereum:

In May 2025, confirming that ETH's change of hands is complete:

On July 2, 2025, ETH shows signs of improvement and reversal:

Really the E Guardian, daring to face the bleakness of Ethereum, daring to confront the bloodshed...😎

TVBee22.7.2024

Several viewpoints on #Layer2

First, some believe that Layer2 decentralizes the Ethereum ecosystem and value. In fact, it does not! Most protocols still primarily rely on Ethereum Layer1, and large funds that prioritize security feel more secure with Ethereum Layer1, while this group of users is also not sensitive to its high Gas fees.

Ethereum Layer2 does not take away the ecosystem and value of Ethereum Layer1. What Ethereum Layer2 takes away is the ecosystem and value of high-speed public chains like BSC.

Second, the positioning of Ethereum Layer2 is essentially like a discounted version of Taobao. Ethereum, as the earliest and largest public chain for developing applications, is like Taobao Tmall. The high-speed public chains that have developed later are equivalent to Pinduoduo, where low prices (low gas) are one of the main advantages.

Although Layer2 has a very complex and profound technical narrative on the supply side, its use and positioning are akin to a discounted version of Taobao, used to compete with Pinduoduo public chains.

Third, the more technically and securely advanced technology is #ZK technology. However, the better user experience is with #optimism, and the ecosystem that is developing faster is currently also optimism and #arbitrum.

Fourth, as a part of the Ethereum ecosystem, with the development of the Ethereum ecosystem (possibly web3), Layer2 is unlikely to be absent from a major bull market.

Fifth, as a discounted version of Taobao, Layer2 has received high expectations, but its explosive potential may be limited.

So-called viewpoints are subjective judgments, and everyone is welcome to discuss!

-------

This tweet is sponsored by #XT Exchange @XTExchangecn @Xt100U | Value coins on XT.

22,27K

The wise ancestors have long provided the answer.

One monk fetches water to drink,

Two monks carry water to drink,

Three monks have no water to drink.

One child carries their father,

Two children lift their father,

Three children push their father away.

This is why the ancients always passed on family businesses to the eldest son. It established a system that is inscribed in bloodlines and cannot be evaded.

In modern times, most elderly people with social security find that their children are still able to take care of them.

The above is a general discussion on human nature. In real life, some elderly people are very affectionate and have a good influence on their children's education, while others have a bit of luck involved, as their environment hasn’t made their children indifferent or too busy. My grandmother is like that.

On the other hand, there are some elderly people whose children are very career-oriented, and as a result, they may neglect to care for their parents. I have a distant relative like this; their children are all in the United States, and the elderly couple is particularly proud, but they are unable to take care of their elderly parents back home, who are unwilling to go to the U.S. because they can't adapt to life there.

AB Kuai.Dong16.7. klo 12.25

Suddenly, I felt that having more babies could not alleviate the problem of providing for the elderly.

Grandpa has 5 children, each of whom has achieved a small career, but when his mother calls in the morning, he learns that all 5 children are playing back and forth to support, accompany and visit.

Even if the old man said that he wanted to see everyone more in the last few years.

I don't know if it's like this in my family, or if it's like this in the world.

5,14K

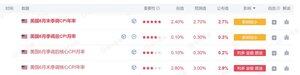

The CPI data and the estimates are not far apart. The overall CPI meets expectations, and the core CPI is slightly better than the overall forecast, but still higher than last month's data.

The expectation for the first interest rate cut in September has dropped from around 60% to 50.6%.

However, the probability of a total of three rate cuts this year is actually only 17.9%.

The probability of two rate cuts is the highest at 41.4%, which is consistent with the Fed's dot plot from June.

The expectation for one rate cut is higher than for three, with a probability of 32.3%.

TVBee15.7. klo 12.33

Tonight's CPI, the predicted data for the 4 CPI ratios is slightly higher than last month.

I looked at the non-farm data from July 3rd, and both the annual and monthly wage data are slightly lower than expected, and also lower than last month's data.

On one hand, the predicted CPI is higher than last month, while on the other hand, considering the impact of wages on the price composition, the annual and monthly wage rates are declining, leading to the speculation that tonight's CPI might be better than expected.

5,95K

The integration of Web2 and Web3 is deepening, and stock dividends are coming.

Holders of MyStonks' Procter & Gamble stock token ($PG.M) can now receive dividends, with each $PG.M token earning a dividend of 1.0568 USDT.

Holding tokens on small exchanges may not guarantee you dividends.

However, holding stocks on MyStonks does entitle you to stock dividends.

Your tokens on small exchanges may not necessarily be your tokens.

But my stocks on MyStonks are definitely my stocks.

I finally understand the value of the MyStonks name; no more words needed, here’s the registration link:

Connect your wallet to register!

MyStonks華語14.7. klo 18.33

📢 On-chain Dividend Announcement | $PG.M Each token enjoys a dividend of 1.0568 USDT

The MyStonks system will take a snapshot of all user accounts holding $PG.M at the close on July 18. For every 1 $PG.M token held, a dividend of 1.0568 USDT will be granted, and the dividend will be automatically sent to MyStonks accounts on August 15, with no action required from users.

This dividend comes from Procter & Gamble (NYSE: PG) regular quarterly dividends for the fourth quarter of fiscal year 2025. Procter & Gamble is a global leader in consumer goods, owning many well-known brands (such as Tide, Pantene, Crest, etc.), with operations in over 180 countries and regions, known for its stable dividends and strong cash flow over the long term.

The MyStonks platform maps native US stock dividends according to token holdings, ensuring that on-chain users enjoy the same dividend rights as traditional shareholders.

On-chain Dividend Mechanism and Advantages

✔️ On-chain Snapshot: The system automatically records holdings, no manual registration required

✔️ Automatic Distribution: Dividends are credited directly, no withdrawal or declaration needed

Friendly Reminder: Please confirm your $PG.M holdings before the close on July 18 to enjoy this round of on-chain dividend benefits! In the future, for every dividend and stock distribution, MyStonks will issue on-chain dividend announcements. Follow @MyStonksCN to stay updated with the latest news.

#MyStonks #PG #OnChainDividends #DividendReceived #USStockTokens #Q2FinancialReport

12,73K

Tonight's CPI, the predicted data for the 4 CPI ratios is slightly higher than last month.

I looked at the non-farm data from July 3rd, and both the annual and monthly wage data are slightly lower than expected, and also lower than last month's data.

On one hand, the predicted CPI is higher than last month, while on the other hand, considering the impact of wages on the price composition, the annual and monthly wage rates are declining, leading to the speculation that tonight's CPI might be better than expected.

13,11K

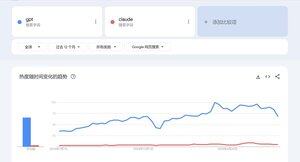

The thoughts of the delightful sister are quite worth pondering, although there are a few points where Brother Bee has slightly different ideas.

AI may be similar to humans; algorithms are like human thinking, while quality data is akin to human learning.

Learning without thinking leads to confusion, and thinking without learning leads to danger.

The inconsistency lies in Brother Bee's logic, which is that whether AI is smart or not seems to depend on the algorithm, but the overall capability of AI depends on both the algorithm and the data.

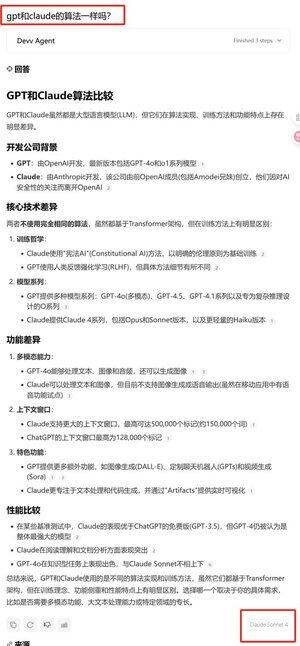

To illustrate this, Brother Bee compared the two most common AIs, GPT and Claude, and asked both GPT and Claude to answer the question regarding GPT and Claude.

By comparing the responses from GPT and Claude, it can be seen that Claude's logic and analytical ability seem to be stronger, and Claude's answer directly stated that Claude's understanding and analytical ability are superior. However, GPT excels in knowledge-based tasks.

This is because GPT has a wider influence and user base, thus having access to more data.

Just like the delightful sister's experience that Tencent's Yuanbao is superior to Deepseek, this is also due to the advantage of data.

Therefore, we have a consensus on the importance of high-quality quantity.

As for @campnetworkxyz, Brother Bee fully agrees with the delightful perspective. Camp is doing something extremely relevant to the times, which is to constrain and prevent the misuse of AI, protecting creators' data and copyright.

6,06K

😎 The good news is that ETH has finally started to gain strength.

😂 The bad news is that the altcoin season may not have arrived yet.

😉 There might be some good news: the "altcoin accumulation season" could be about to start.

Last November, when I mentioned ETH switching hands, who believed it?

On May 8, I wrote that the switch was complete; who believed it?

On July 2, I said that ETH's market share was improving, and the ETH/BTC exchange rate was reversing overall; who believed it then?

Liquidity is flowing into ETH. Brother Bee, you might not believe it, but those ETF institutions surely can’t be doubted, right?

Ni Da has said countless times that these ETF institutions, the smartest people in the world, are helping us select good ETH. Thanks to Ni Da @Phyrex_Ni for the data; recent days show that overall, ETF institutions are increasing their holdings of ETH:

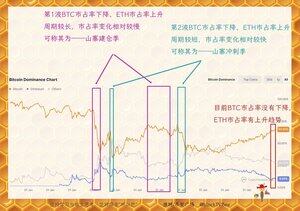

💠 But why do I say the altcoin season hasn't arrived?

🔹 The macro environment has not provided enough marginal liquidity.

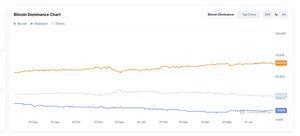

Brother Bee analyzed in the pinned post that BTC rising while its market share declines is a sign of the altcoin season starting.

This situation of BTC rising and altcoins rising more requires sufficient market liquidity. If we say that in July 2017, the total market cap of crypto was $100 billion, the whole market was still relatively small.

Now, the total market cap of crypto is $3.7 trillion, which is over 30 times what it was back then, thus requiring greater liquidity, which is closely related to the macro environment.

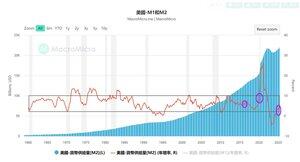

Currently, the market does not lack liquidity; it lacks marginal liquidity. The U.S. M2 is not low, but the M2 annual growth rate is around 4.5%, which is not high.

Let me give you a simple example: you are very wealthy, have a lot of money, and usually spend a lot. But if you earn less this year than last year, will you still spend like before? Will you slightly reduce your expenses?

Therefore, the main factor affecting the market is not the existing liquidity but the marginal liquidity, which is the growth of liquidity.

Clearly, the current M2 annual growth rate is still at most at a mid-level compared to history.

🔹 The U.S. M2 annual growth rate corresponds to early 2019-2020 | Q3 2015 - Q3 2016.

Looking at the above chart, the current U.S. M2 annual growth rate corresponds to early 2019-2020 and Q3 2015 - Q3 2016. Some may find it annoying to seek a sword in a boat, but you must admit that the so-called four-year cycle is even more like seeking a sword in a plate.

The impact of macro marginal liquidity on traders' psychology and behavior is actually logical. The M2 annual growth rate reflects the macro marginal liquidity.

🔹 The market share of altcoins has not increased.

Clearly, BTC is rising now, but its market share has not declined. This is the market share trend over the past year; BTC's market share has not shown a declining trend, and the market share of other coins has not shown an increasing trend.

On the contrary, ETH's market share is on the rise, liquidity is flowing into ETH, but it has not overflowed into altcoins.

💠 Next, it might be the "altcoin accumulation season" (note that I am not certain).

In this article, Brother Bee proposed two statements: the altcoin accumulation season and the altcoin explosion season.

ETH is becoming stronger, but the market share of altcoins has not increased; at most, it is the beginning of the altcoin accumulation season.

Liquidity flows from BTC to ETH and then to altcoins, a process where investors become increasingly bold, which should take some time. Of course, it also requires optimistic influences from macro liquidity factors. So the altcoin season should not have arrived yet.

At most, it might just be the beginning of the altcoin accumulation season.

From March to June 2017 was the first round of the altcoin accumulation season.

From September 2019 to September 2020 was the second round of the altcoin accumulation season.

Note:

First, in the trends of the past two rounds of altcoin accumulation seasons, BTC was oscillating upwards, and the performance of altcoins varied, so the altcoin accumulation season does not equal all-in.

Second, not all altcoins are suitable for accumulation. The biggest feature of this round of narrative is the participation of traditional institutions, the integration of Web2 and Web3.

Traditional financial institutions and investors may be more interested in tracks that are more suitable for accumulation.

For example, RWA and RWAFi related to traditional finance,

DeFi with stronger financial attributes,

Technologically strong chains with long-term growth potential,

Depin with cost support and a certain degree of decentralization, etc.

Additionally, traditional financial institutions and investors seem to prefer older leading projects.

On the contrary, they are not very optimistic about AI; compared to Web2's AI, the conceptual hype of Web3 + AI far exceeds practical applications.

In a track where one is not good at discovering potential projects, leading projects are a better choice.

TVBee8.5.2025

Brothers, forgive me for carving a boat!

On August 5, 2021, after the first wave of the bull market came to an end and the negative situation of 519 calmed down, ETH welcomed the London upgrade and moved towards the second wave of the bull market.

On May 8, 2025, after the first wave of the bull market ended and the negative situation of tariffs calmed down, ETH welcomed the Pectra upgrade.

These two bullish candles make people believe that the whales have not given up on ETH 😂

This is purely a carving of a boat, and does not constitute a bullish or bearish judgment. After all, there is still some uncertainty regarding Trump's policies and the recession of the U.S. economy.

14,82K

Johtavat

Rankkaus

Suosikit

Ketjussa trendaava

Trendaa X:ssä

Viimeisimmät suosituimmat rahoitukset

Merkittävin