Trending topics

#

Bonk Eco continues to show strength amid $USELESS rally

#

Pump.fun to raise $1B token sale, traders speculating on airdrop

#

Boop.Fun leading the way with a new launchpad on Solana.

Pudgy Penguins x Suplay Partnership is huge and its bigger than you think.

I'm excited and here's why 🧵👇

(1/15)

First, let's understand what Suplay actually is (most missed this):

Founded 2019 by Alex Huang (@suplay_alex), headquartered in Beijing's Zaha Hadid-designed Wangjing Soho.

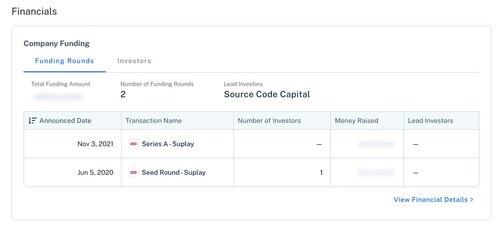

Series A funding from Source Code Capital (manages $1.5B, backed ByteDance/Meituan).

This isn't some random manufacturer. They're venture-backed infrastructure.

(2/15)

Suplay's real business model (this is key):

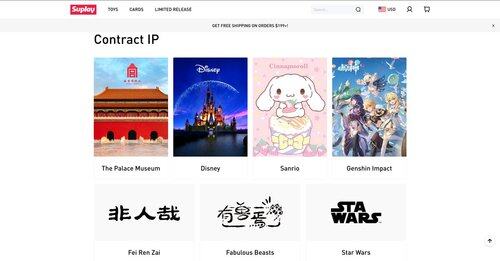

They call themselves a "trendy IP consumer goods company" with full industry chain control.

Translation: they don't just make toys, they control IP → Design → Manufacturing → Distribution → Cultural positioning.

That's why Disney, Marvel, and Warner Bros chose them.

(3/15)

The numbers everyone's missing:

> China's designer toys: CNY 57.4B ($8.9B) in 2023

> Projected CNY 110B ($15.4B) by 2026 = 24% CAGR

> 30M active collectors → 49M by 2030

> Average spend: CNY 20,000 ($2,800) annually per enthusiast

> Top spenders: CNY 1M+ ($140K+) annually

This isn't casual hobby money.

(4/15)

Here's the cultural insight most Westerners miss:

China's "chaowan" (潮玩) culture isn't about toys, it's about identity.

Post-95 consumers use collectibles to signal taste, status, and cultural alignment.

Pop Mart's success (24.5% market share, $1.8B revenue) proves this isn't a

short lived thing.

(5/15)

Suplay's competitive positioning is genius:

While Pop Mart focuses on original IP, Suplay built the licensing infrastructure for global brands.

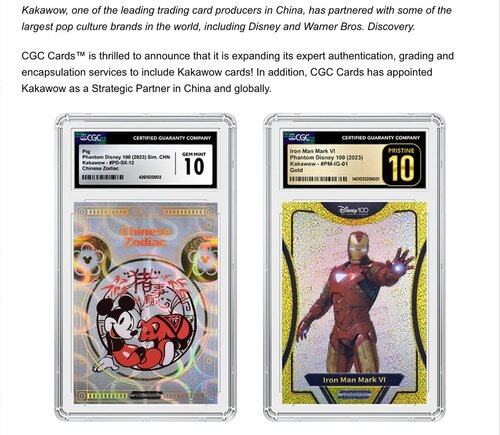

Their @kakawow_global subsidiary produces premium trading cards for Disney, Marvel, Star Wars.

Result: instant credibility + proven execution + global IP relationships.

(6/15)

17.46K

Top

Ranking

Favorites