Trendaavat aiheet

#

Bonk Eco continues to show strength amid $USELESS rally

#

Pump.fun to raise $1B token sale, traders speculating on airdrop

#

Boop.Fun leading the way with a new launchpad on Solana.

Who is the marginal buyer of the coin you hold?

This is always a useful exercise to go through - especially in the current market.

1. Retail

The pool of retail buyers for non-meme altcoins is very small today. Over the years, they’ve been repeatedly rinsed by broken token market structures, largely due to early VCs dumping low-utility tokens at inflated valuations. This pool has been depleted and unlikely to reappear anytime soon.

Even now, the little retail money that trickles in, alongside the existing hot ball of money, is much more likely to chase meme coins. For better or worse, that’s where the fast money feels like it is.

Just look at the last month, the biggest movers have been memes again. When people sense a “risk-on” environment, their animal spirits don’t flow into fundamentals, they chase the fast Xs.

I’m not saying you should play that game, just pointing it out. That game is also providing diminishing returns.

A new narrative/meta may emerge like the AI agent one last year (they were memes tbh) and that will see existing retail flows, but the chances are that these will be new coins, not existing ones.

2. Institutions

Meanwhile, liquid token funds and more institutional players are showing interest, but mostly in strong DeFi tokens. These are tokens that:

•Generate revenue

•Have PMF & growing

•Are going after large total addressable markets (TAM)

These buyers are real. They’re looking for actual businesses.

3. Warning signs for weak alts

If you’re holding a token with:

•No revenue

•No flows

•No prospect of flows

• High inflation/big unlocks

…then you need to be careful.

There is no magic bid coming. You will not be rescued by a wave of fresh retail liquidity.

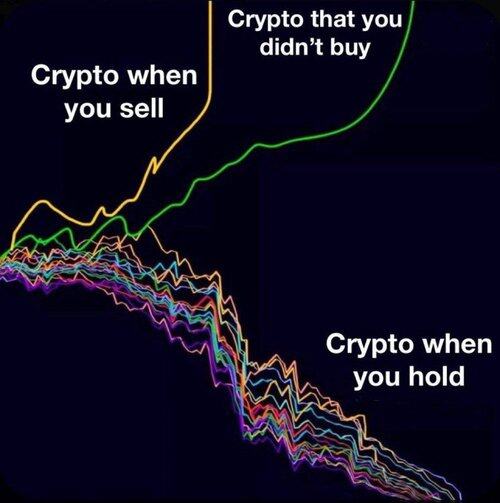

Most altcoins topped in early 2021 and never came close to reclaiming their highs, even during the late-2021 run-up. This time, it’ll be even worse. The percentage of altcoins that don’t make new highs will be higher.

4. Hard Questions to Ask Yourself

If you’re holding a coin that’s severely lagging, especially relative to BTC, it’s time for some uncomfortable reflection:

•Is your conviction based on real fundamentals?

•Are there real upcoming catalysts the market hasn’t priced in?

•Or are you a victim of sunk cost fallacy?

14,95K

Johtavat

Rankkaus

Suosikit