Trendaavat aiheet

#

Bonk Eco continues to show strength amid $USELESS rally

#

Pump.fun to raise $1B token sale, traders speculating on airdrop

#

Boop.Fun leading the way with a new launchpad on Solana.

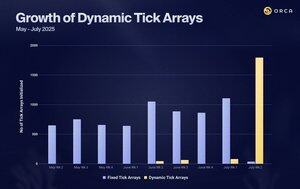

A new paradigm in LPing has been taking form and it's time to formally introduce this 1-2 combo

How does an LP lower startup costs while maximizing fees?

Simple, combine Dynamic Tick Arrays and Adaptive Fees 🧵

Standard concentrated LPing:

1. Expensive costs to create liquidity pools

2. Fixed Fees

Let's see how Dynamic Tick Arrays solve for (1) and how Adaptive Fees can be a preferred instrument over (2).

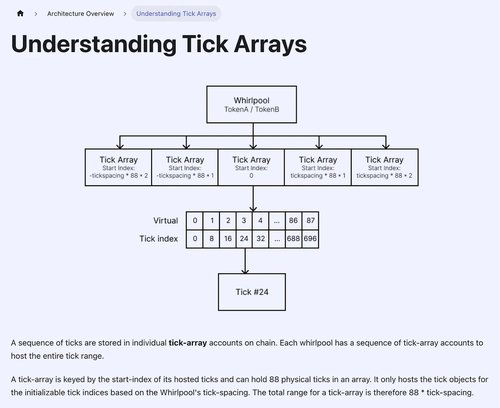

In a concentrated liquidity pool, the full price range of an asset (from 0 to ∞) is divided into discrete price points called ticks

Each tick acts like a checkpoint, tracking how much liquidity should be added or removed as the pool’s price moves past it. This is what allows LPs to concentrate their capital in specific price ranges

Storing every single tick in its own onchain account would be inefficient and costly. Orca solves this by grouping consecutive ticks (88 in our case) into a single account called a Tick Array.

This grouping is efficient, but it presents another challenge: to open a position, the entire Tick Array containing the desired ticks must be initialized and paid for upfront.

Even if an LP only needs to use one tick within that array, they have historically been required to pay the full rent for all 88. This cost could feel inefficient and unfair, especially for the first person to provide liquidity in a new price range.

With DTAs covered, let's talk about what Adaptive Fees are and then tie them together.

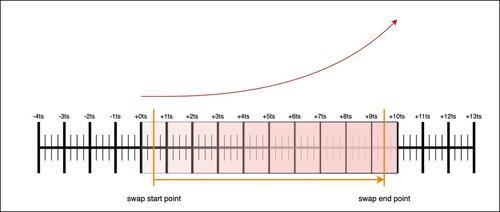

Adaptive Fees (AF) are a dynamic mechanism that increases fees alongside price volatility.

As seen in the image below, the more ticks a user's swap crosses, the higher the collected fee will be for an LP within that range. The more ticks a users swap crosses = the higher the adaptive fee.

If your strategy includes LPing a volatile token, AF can be a preferable alternative opposed to standard Fixed Fee pools.

Want to dive into the full AF math breakdown that goes on under Orca's hood? Read full developer documentation here:

Making liquidity pools 10x cheaper to create (DTA) and introducing an additional fee instrument (AF) brings LPs a premier experience for deploying strategies.

11,29K

Johtavat

Rankkaus

Suosikit