Trendaavat aiheet

#

Bonk Eco continues to show strength amid $USELESS rally

#

Pump.fun to raise $1B token sale, traders speculating on airdrop

#

Boop.Fun leading the way with a new launchpad on Solana.

Data Wolf 🐺

ۗۗۗۗۗۗۗۗۗۗۗۗۗۗۗۗۗۗۗۗۗۗۗۗۗۗۗۗۗۗۗۗۗۗۗۗۗۗۗۗۗWolf Down The (Crypto) Data :3. Was at @castle_labs. Customer Base Audit Arc. Free EVM events data in link below by SQD

What's this LUNA vesting ?

zac.eth 🧙🏻♂️♦️6 tuntia sitten

Remember when ICOs gave you tokens the next day?

Now @EspressoSys wants your money for 2 YEARS:

- 0% tokens at launch, 50% after 12 months

- Remaining 50% over another 12 months

- $400M valuation w/ mandatory KYC

They're calling it an "investment" but it's really a 2-year interest-free loan to fund their development while you take all the risk.

2,64K

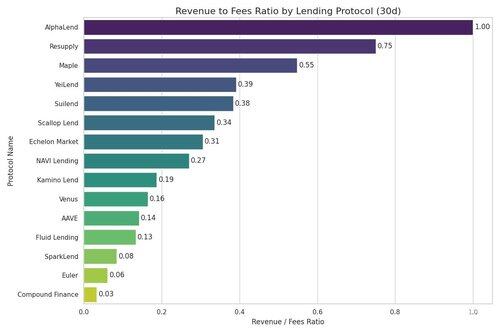

Lending protocols are quite interesting from a social mechanic because

1) As a borrower, you are trusting that other borrowers do not make big borrows that would spike your rates

2) As a borrower, you are trusting that depositors not to make big withdrawals to spike your rates

3) As a depositor you are trusting that the protocol doesn't make big marketing pushes that will increase more depositor that decreases your yield

4) As a depositor, you are trusting that borrowers do not churn that can decrease your yield

I ignore instances where the protocols or whatever manager decides to adjust the interest rate curve because that one is centralized and be communicated.

Was thinking more of prisoner's dilemma PoV where everyone wants an ideal outcome without really communicating

97

As predicted by Tech Revolutions written in 2002, bubbles mostly form around infrastructure rather than apps. Apps, especially vaporwares, are actually at the bubble popping stage. This is where capitalism rears its ugly head (pump).

After the bubble pops, it is infrastructure-based investments that survive. Capital can also move to productive apps, such as those with cash flows. Most importantly, the entire industry takes a step back and organises itself and figures out what the "best practices" are.

Then, at this point, investment capital plays a support role and actually scales with productivity. This is the "golden" e/acc capitalism stage that we talk about. But very often people use this in the bubble phase (because overly optimistic)

213

Johtavat

Rankkaus

Suosikit

Ketjussa trendaava

Trendaa X:ssä

Viimeisimmät suosituimmat rahoitukset

Merkittävin