Trendaavat aiheet

#

Bonk Eco continues to show strength amid $USELESS rally

#

Pump.fun to raise $1B token sale, traders speculating on airdrop

#

Boop.Fun leading the way with a new launchpad on Solana.

Simon

Research @Delphi_Digital | @USC Alum | Sharing my best ideas daily | NFA

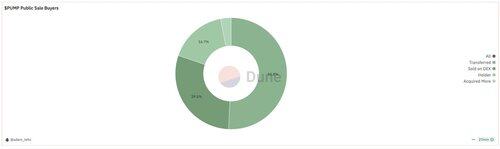

How have $PUMP public sale buyers positioned since the sale?

Of 10,145 buyers who purchased 150B tokens at $0.004 (15% of supply):

1,692 (16.7%) still holding

5,156 (50.8%) transferred

2,995 (29.5%) sold on DEX

302 (3.0%) acquired more

Most transfers likely went to exchanges for selling. Combined with DEX sales, ~80% have exited or are positioned to exit.

Taking 65% gains at $0.0065 was rational given unlimited ICO size without lockups.

Key question: does $0.004 act as natural support from new buyers, or psychological resistance as remaining holders capitulate below their entry?

*Data excludes 18% institutional allocation

18,05K

Did you know SBF got the rights to 888 million $SUI tokens for just $1 million?

It was a side-deal to a larger $101M investment, all confirmed in court docs.

Fast forward to today: $SUI is trading at ~$4.04 per token. That side position alone would be worth $3.59 BILLION.

But it gets crazier.

FTX's total $SUI haul with incentives from its larger $101M investment was reportedly ~1.6 BILLION tokens, a stash worth $6.46 BILLION.

Plot twist: The estate sold the entire potential position back to Sui's founders for just $96M

90,25K

"Companies are the only entities in the world other than the U.S. government that can print money."

When people talk about selling BTC or supply overhang from certain majors, it kind of makes me wonder where they are planning to allocate once they sell/how good the alternatives really are.

For example:

- You don't want to park your assets in USD (long term, the denominator is worthless)

- Stocks are tricky because it's very hard to accurately pick and outperform the index

(even if you are a great stock picker, doesn't mean you'll be able to have conviction through drawdowns or be able to allocate a meaningful % of your net worth like you could with BTC, which has outperformed 99% of stocks over the past 5 years)

- Furthermore, like the quote mentions, companies (unlike BTC's fixed supply) can issue new shares, diluting shareholders as they see fit (S&P 500 actually net reducing ~1% per year from buybacks, but smaller caps and tech/growth companies average about 1-3% net dilution annually).

So where exactly are you all planning to rotate to?

1,25K

ICYMI the Pump team just started buying back $PUMP on the open market

With 33% of supply circulating, $PUMP holders are receiving daily buybacks of $538k (assuming 25% revenue share) based on 180-day trailing numbers.

That's $196.6M annually flowing directly to token holders.

Current valuation: $6B FDV / $2.12B market cap

- Market Cap/Earnings: 10.78x (180D)

- FDV/Earnings: 30.51x (180D)

Peer comparison shows Pump trading at a discount:

- $JUP: 14.17x MC/E, 32.33x FDV/E

- $RAY: 13.09x MC/E, 27.08x FDV/E

- $HYPE: 26.78x MC/E, 80.24x FDV/E

146,18K

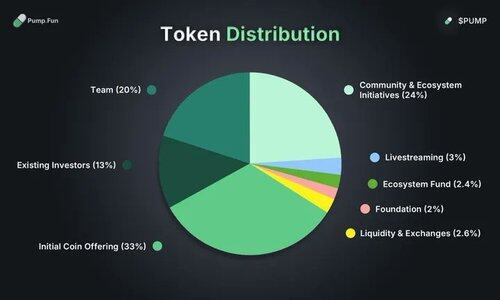

The $PUMP airdrop is coming btw - and it could rival $HYPE as the most lucrative of the cycle

$HYPE airdropped 310M tokens (31% of supply) worth $620M at launch. Today, that's worth $14.6B at $47

If $PUMP allocates just half of its 24% community allocation (12% of supply), the airdrop would be worth ~$648M at $5.4B valuation

I expect this airdrop to happen later, likely in a few weeks though, as this would give more room for some initial price discovery for $PUMP

2,42K

In hindsight, exchanges not listing $HYPE backfired spectacularly.

By forcing users to bridge and actually use Hyperliquid for exposure, they created a reflexive loop where:

→ Users realized the product is genuinely better than CEX and started using it beyond getting $HYPE exposure

→ Drove more adoption, accelerating the CEX/DEX shift and giving Hyperliquid more market share

→ Users bought more $HYPE as they grew bullish on the long-term thesis

The blacklisting (due to threat perception) only strengthened their position. Streisand effect.

54,08K

Everyone's worried about how inflationary Trump's new economic plan might be...

But it may not matter much to DJT.

His empire isn't built on golf courses and licensing deals anymore — it's being rebuilt on crypto.

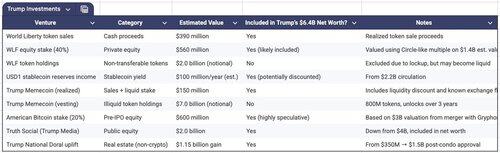

Over the past year, the Trump family has accumulated:

- $2B+ in liquid crypto wealth

- $9.6B+ in illiquid/speculative holdings

Here's how they did it:

- World Liberty Financial (@worldlibertyfi) — The big one. Sold $550M in tokens with $390M going to Trump. Family holds 40% equity (~$560M) plus 22.5B locked tokens worth $2B on paper.

- USD1 Stablecoin — $2.2B in circulation generating roughly $100M annually in yield. Got a major boost when Abu Dhabi's MGX used it for a $2B Binance deal.

- Trump Memecoin — Already pulled $150M from sales. Another 800M tokens unlock over the next 3 years, theoretically worth $7B+ at current prices.

- American Bitcoin (@AmericanBTC) — 20% stake in a crypto mining operation valued at $3B despite having $120M in actual equipment. Pure valuation arbitrage.

- Truth Social — Down from its $4B peak but still worth ~$2B as it pivots into crypto and finance.

Consider this: traditional Trump Org licensing brought in $34M last year. These crypto ventures generated 20x that in months.

Trump's wealth is now tied to digital assets that typically benefit from the very monetary conditions his policies might create.

57,34K

Johtavat

Rankkaus

Suosikit

Ketjussa trendaava

Trendaa X:ssä

Viimeisimmät suosituimmat rahoitukset

Merkittävin