Trendaavat aiheet

#

Bonk Eco continues to show strength amid $USELESS rally

#

Pump.fun to raise $1B token sale, traders speculating on airdrop

#

Boop.Fun leading the way with a new launchpad on Solana.

Cheeezzyyyy

part-time yapper; janitor @mementoresearch; prev @pendle_fi SWE

Cheeezzyyyy kirjasi uudelleen

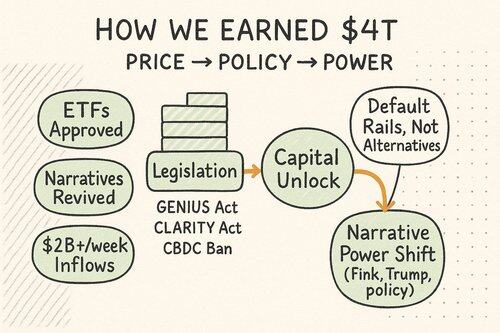

Crypto didn’t drift into a $4 trillion market cap by accident.

It was a convergence;

Of price catalysts.

Of political will.

Of power shifting from incumbents to internet-native institutions.

Let’s walk through the major milestones that turned a fringe movement into a parallel financial system on the rise.

● When the Charts Turned Conviction Into Capital

Bitcoin reclaimed the narrative in late 2024.

- Spot ETFs got greenlit.

- Sovereigns started stacking.

- Halving supply shocks coincided with fresh demand.

BlackRock, Fidelity, and Ark were no longer talking about digital gold, they were buying it on behalf of retirement savers.

The ETF flows snowballed:

- $5B+ net inflows per month since April

- Ethereum ETFs followed suit, with a delayed launch but faster catch-up

By mid-2025:

✅ $BTC broke past $120K

✅ $ETH rallied past $3.6K

✅ $XRP hit ATHs

✅ Even meme coins surged, as liquidity returned in force

But price alone doesn’t explain the $4T milestone.

7,75K

Cheeezzyyyy kirjasi uudelleen

Total crypto mcap hits a new ATH of $4T.

> The ETH/BTC ratio is attempting to rebound from levels not seen in six years

> @CryptoHayes believes that an ‘ETH season’ is approaching

> Record inflows into spot ETH ETFs are being reported, while MMs indicate strong demand

> Stablecoin mcap broke ATH, sitting at $260B+

> SharpLink has just announced that it will accumulate up to $3.6B $ETH

$ETH reached $3,600 today, leading the market rally since late June. This raises the question many are asking I.e when will altcoins follow?

Unlike previous cycles where Bitcoin led rallies, $ETH is driving this wave. The difference comes from institutional adoption in this cycle.

> $ETH was oversold for months & is now catching up

> Companies holding $ETH see their stock prices rise alongside

> Wealth effect to smaller coins hasn't happened yet like in past cycles

The current situation is showing a selective altseason rather than broad altcoin pumps. Assets connected to institutional themes & established Ethereum projects likely to benefit first.

Many DeFi tokens like $AAVE $FLUID $UNI $ENA $PENDLE & few selected alts are performing well. Here’s what’s happening👇

ETH continues leading → selective alts with strong narratives → final phase where capital flows to everything that hasn't moved yet

That final phase typically creates sharp pumps but signals cycle tops. ETH/BTC ratio reaching 0.06-0.08 would mark peak euphoria.

For now, $ETH is having its moment after being ignored while $BTC dominated.

7,67K

Cheeezzyyyy kirjasi uudelleen

Infinit figured out the next trend in web3

I already showed you what @Infinit_Labs V1 can do, it finds solid pools in just a couple minutes

What if I told you it can help you spot not just pools but maybe even where the next big trend is headed?

Let’s give it a shot and see what we get, here is the prompt I used for that

“Hey there, help me figure out the next narrative in web3, feel free to pull from trending data and use stats around narratives that are starting to pick up

Be critical and give priority to new tech that actually solves real web3 problems, Kaito is a great example of that

Also explain why this specific trend, what problem it solves, the user inflow and attention from KOLs”

Here is what it came up with

RWA is shaping up to be the next trend and here is why

◆ Institutional adoption

◆ Solves real problems

◆ User growth and implementation

◆ KOL and key player attention

You can check the full breakdown in the video 👇

5,62K

Cheeezzyyyy kirjasi uudelleen

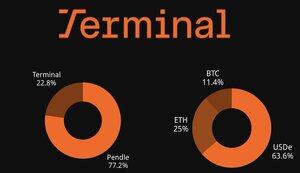

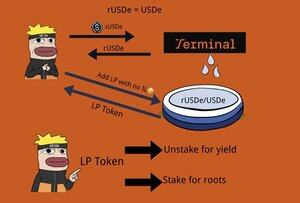

@Terminal_fi × @pendle_fi × Ethena

→ 10Bドル級の資金がConvergeに集まる理由・エアドロ狙いのチャンスについて

🔹Converge=EthenaとあのBlackRockと緊密に結びついているSecuritizeが共同で立ち上げる EVM互換L1

🔹Terminal = Convergeの流動性ハブ、Uniswap+IL最小化イノベーション

🔹Redeemable tokenと呼ばれるもので、ILを最小化することを試みる

🔹Pendleでは「ポイント60x・イールド10%以上」

Terminalについて&収益ライン試算👇

普通参加だけしたい方👇

ポイント最大、低リスク、10%イールド→

ダッシュボード・リファ

→

余談:

資金規模がConvergeの構想ほど大きくないチェーンでは、必ずしもTerminalが競争力を持つとは限りませんが、資金が大きくなると、ILによる機会損失がデカくなると着眼をして、作られたのが記事でも持っと詳しくカバーしているTerminal。

もしかするとVe3,3?にする可能性もある👀

1,24K

Cheeezzyyyy kirjasi uudelleen

When we talk about speculation in crypto, most people immediately think of price charts - longing BTC, aping into alts, or catching memecoin pumps.

But a quiet revolution is unfolding in DeFi.

@pendle_fi is redefining what it means to speculate, not on price but on yield. 🧵👇

8,46K

Cheeezzyyyy kirjasi uudelleen

If users aren’t being paid to show up, and they still do, that’s what you call product-market fit.

We’re in a market where every protocol is launching a token, dangling points, or bootstrapping with emissions.

That makes it harder (and more important) to filter signal from noise.

This post breaks down three protocols scaling without incentives:

Base, Meteora, and Yei Finance.

Each one is quietly compounding adoption. No airdrops. No mercenaries. Just usage.

Let’s unpack why this filter matters. It might be your highest-conviction bull market screen.

● Why Most DeFi Growth Isn’t Real

There’s a pattern:

- Launch with high emissions.

- Bribe for liquidity or usage.

- Hope the market forgets when it stops.

But when incentives dry up, so does the usage.

That’s not a bug. It’s the design.

Token-led growth is a marketing tool, not a retention engine.

The question smart capital is asking now:

Who’s growing without the bribes?

16,36K

Johtavat

Rankkaus

Suosikit

Ketjussa trendaava

Trendaa X:ssä

Viimeisimmät suosituimmat rahoitukset

Merkittävin