Trendaavat aiheet

#

Bonk Eco continues to show strength amid $USELESS rally

#

Pump.fun to raise $1B token sale, traders speculating on airdrop

#

Boop.Fun leading the way with a new launchpad on Solana.

THEDEFIPLUG

Crypto Researcher on All Chains | L1, L2, L3 & Coin Expert. @Eigenpiexyz_io

“are we in 2099?” yes, haha, we might be! :D

This isn’t a tech flex, it is a real glimpse at the future of how we’ll see, interact and think.

I can see @mawariXR isn’t about throwing some 3D objects into your AR glasses, it’s solving the real problem, like streaming spatial content in real time, anywhere!

I take it as “the backbone of the spatial internet”.

@Grok and @xAI into the mix? This is engaging with live intelligence layered into our world. AI that sees what you see, knows where you are and talks back in context.

Miyoko, Ani and Elon didn’t just have a chat they cracked open the idea of AI as presence, not just interface.

On this scale of innovation, yes, it’s giving 2099!

Mawari16 tuntia sitten

Rate Elon’s @AniAnichat & our Miyoko’s convo about Mawari on a scale of 1 to “holy sh*t are we in 2099”

(XR + AI, @mawariXR + @grok/@xAI)

781

“are we in 2099?” yes, haha, we might be! :D

This isn’t a tech flex, it is a real glimpse at the future of how we’ll see, interact, and think.

I can see @mawariXR isn’t about throwing some 3D objects into your AR glasses, it’s solving the real problem, like streaming spatial content in real time, anywhere.

I take it as “the backbone of the spatial internet”.

@Grok and @xAI into the mix? This is engaging with live intelligence layered into our world. AI that sees what you see, knows where you are, and talks back in context.

Miyoko, Ani, and Elon didn’t just have a chat they cracked open the idea of AI as presence, not just interface.

On this scale of innovation, yes, it’s giving 2099!

Mawari16 tuntia sitten

Rate Elon’s @AniAnichat & our Miyoko’s convo about Mawari on a scale of 1 to “holy sh*t are we in 2099”

(XR + AI, @mawariXR + @grok/@xAI)

70

THEDEFIPLUG kirjasi uudelleen

Sei from all indicators is rapidly evolving into the backbone of performant, parallelized, and composable DeFi infrastructure.

Now with USDY joining the party, Sei unlocks a new era of modular yield-bearing finance — and here’s why that’s a big deal

• Ondo’s USDY is more than just another stablecoin — it’s a tokenized note backed by short-term US Treasuries, offering yield while preserving dollar exposure.

• Bringing USDY to Sei means users and protocols can now access yield-bearing dollars natively, without bridging or wrapping complexities.

• On a chain built for speed and parallel execution, this changes the game:

→ Lending markets with real yield

→ Yield-backed stablecoin LPs

→ Leveraged yield strategies

→ Composable money markets

______________

• For developers?

They can now integrate USDY into DeFi primitives without compromising on performance or composability — enabling faster innovation with real-world assets.

• For institutions?

A modular finance stack on Sei now looks more attractive than ever — compliant, capital-efficient, and high throughput.

This unlocks new DeFi opportunities and accelerates Sei’s position as a leader in onchain modular markets.

2,22K

Not enough people are paying attention to $BLOCK.

The market is favouring revenue generating projects right now, & this is one showing MOM growth, with success tied directly to token price.

Over $90M wagered on @blockbetgg since launch

$1.5M+ in $BLOCK bought back using revenue since January this year

8% of supply already bought and removed

On top of this, the team have now announced 100% of profits from $BLOCK wagers are now being burned.

The token is either bought by users to play… or bought back by the protocol. Just a constant flow of $BLOCK leaving circulation.

They’re aiming to retire 20% of the supply this year.

If BlockBet keeps growing, that number gets hit sooner.

To put things into perspective, $BLOCK is 9x away from $SHFL’s FDV, but with much stronger utility and a deeper integration into the platform.

Not financial advice, but this is one of the only tokens I’ve seen where product traction directly translates to both buy pressure on the token and the removal of tokens from the supply.

That’s rare.

10,04K

If users aren’t being paid to show up, and they still do, that’s what you call product-market fit.

We’re in a market where every protocol is launching a token, dangling points, or bootstrapping with emissions.

That makes it harder (and more important) to filter signal from noise.

This post breaks down three protocols scaling without incentives:

Base, Meteora, and Yei Finance.

Each one is quietly compounding adoption. No airdrops. No mercenaries. Just usage.

Let’s unpack why this filter matters. It might be your highest-conviction bull market screen.

● Why Most DeFi Growth Isn’t Real

There’s a pattern:

- Launch with high emissions.

- Bribe for liquidity or usage.

- Hope the market forgets when it stops.

But when incentives dry up, so does the usage.

That’s not a bug. It’s the design.

Token-led growth is a marketing tool, not a retention engine.

The question smart capital is asking now:

Who’s growing without the bribes?

16,37K

THEDEFIPLUG kirjasi uudelleen

Chainlink CCIP + USDC on Sei is a powerful catalyst for SEI’s growth across multiple dimensions and you guys are sleeping on this announcement.

First of all, Chainlink CCIP (Cross-Chain Interoperability Protocol) brings secure, audited interoperability trusted by institutions like SWIFT.

Putting this into perspective, USDC is the most regulated and widely used stablecoin in DeFi and TradFi.

Together, they provide the rails for settlement-grade cross-chain value transfer, making Sei attractive for real-world finance and fintech use cases.

• CCTP would allow USDC to move seamlessly across chains. With Sei now on the route, the entire ecosystem would get access to billions in stablecoin liquidity.

• This would eventually lead to deeper liquidity pools, better market efficiency, and more volume for Sei-native apps.

_____________________________

Chainlink's CCIP is already the backend for several TradFi experiments (e.g., tokenised treasuries, cross-border settlements).

With USDC and CCIP on Sei, TradFi players can now plug into a performant L1, enabling experiments like:

-Tokenised RWAs on Sei

-FX swaps with stablecoins

-Real-time payments between institutions with the rise of payment options.

-Increased exponential growth in the GameFI sector.

___________________________

Sei’s architecture enables sub-second finality and low fees — ideal for stablecoin transactions and real-time finance.

With native USDC and CCIP, Sei becomes the fastest highway for global stablecoin settlements across chains and platforms.

Currently, the Sei ecosystem has been in a state of frenzy if you're looking closely

-Increase in new daily users with a record of 449,379 recorded yesterday July 14, 2025.

-Clear spikes in daily dex volume and transaction count.

- Growth in TVL (currently $646m+ enroute to $700m) across protocols.

-Maintained uptime of 99.90% even with all this growth compared to some L1s.

Without doubt, this integration is a foundational unlock for real-world adoption, cross-chain composability, and DeFi scale on Sei.

14,51K

THEDEFIPLUG kirjasi uudelleen

The future of Web3 finance isn’t lawless, it’s regulated.

Join on July 17th at 11am est for ZDKL’s first-ever webinar: World Peace Through Trade, a monthly series exploring how web3 is changing the way we trade, connect and build.

Featuring @BeckmannZDKL @KyleighaZDKL , and guest @Jonathan_barry_

Proof-of-Work. Legal rails. Real utility.

4,01K

THEDEFIPLUG kirjasi uudelleen

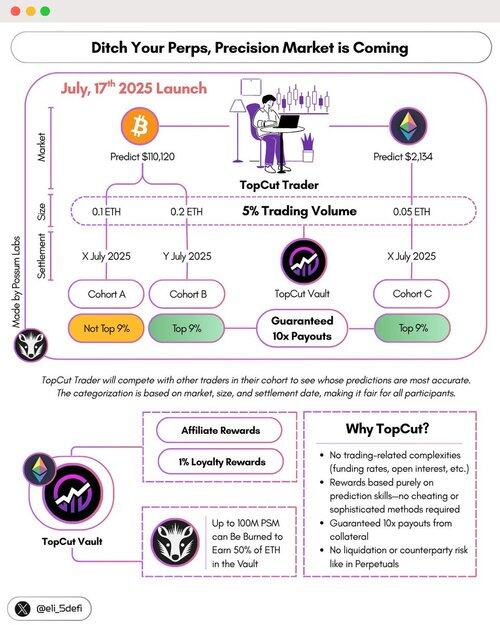

➥ Precision Markets - Fighting Against The Odds

How many of you have watched your cash vanish in Perps?

4, 5, 6, or even 7 figures? Forced liquidation? False wick?

Precision market cut all that BS, but how?

Let's discover why this one's your crypto calling. 📖

...

— WTH is Precision Market?

Precision market, as the name implies, transforms trading by focusing on the accuracy of your predictions.

Here's what it means for you:

✧ Say goodbye to trading complexities (funding rates, open interest, etc.)

✧ Get rewarded for your prediction prowess

✧ Enjoy guaranteed higher payouts (10x your collateral)

And @TopCutFinance is the only protocol making it happen.

...

— How TopCut Works

Trading on TopCut is straightforward and involves five main processes:

✧ Traders can make one or multiple predictions on a specific asset and settlement date.

✧ Based on the size and settlement date, traders are categorized into the appropriate cohort and compete within that group to become the top 9%.

✧ At the time of settlement, anyone can settle the cohort and receive a reward.

✧ The top 9% of the most accurate predictions are declared winners.

✧ All winning predictions receive a payout of 10 times the trade size and can be claimed at any time.

Distinct from other derivatives, traders on TopCut make price predictions without borrowing or needing a counterparty. No risk protection is needed since there’s no lender or market maker, hence no liquidation.

FYI, Top traders each week get loyalty rewards worth 1% of the ETH in the TopCut Vault, which comes from overall trading volume.

Winners’ points reset to keep things fair, giving active traders a better chance at the Loyalty Reward over time.

...

— $PSM and TopCut Vault

Talking about TopCut then we can't detached it from @Possum_Labs and $PSM. First TopCut was built by giga-brain at Possum Labs, and second $PSM accrues value from TopCut Vault.

✧ 5% of all TopCut trading volume will be accrued into Vault

✧ This Vault is the economic engine that provide rewards for affiliate, trader loyalty and PSM value accrual

✧ Up to 100M $PSM can be redeemed up to 50% of the Vault's $ETH balance, means that 10M PSM can be redeemed for 5% of the ETH in the vault

This mechanism allow for scale with Vault's volume without draining the system and rewarded long-term supporters.

So still think TopCut is same with others?

Mark your calendar and log out from perps, because TopCut is launching on July 16th.

9,45K

THEDEFIPLUG kirjasi uudelleen

I’ve been watching @SeiNetwork quietly stack wins but the Circle integration might be the most telling one yet.

So I can’t help but speak up my personal research today.

🔻 In a space flooded with narratives, real adoption is hard to fake. And Sei is showing real usage:

▫️ 1.6M daily txs, up from ~600K six months ago

▫️ $665M TVL (ATH)

▫️ $292M stablecoin cap with 84%+ in USDC

That last stat is important. Because now, USDC will be natively integrated on @SeiNetwork and @circle just added 6.25M $SEI to its balance sheet.

I believe @circle is betting on Sei becoming a core #DeFi rail because Circle focuses on bridging $80T TradFi market with DeFi ecosystem.

🔻 Why does this matter?

– Native $USDC means faster, cheaper, safer settlements

– CCTP V2 unlocks seamless cross-chain liquidity

– Sub-400ms finality supports high-frequency use cases

– Institutions get real UX + real performance

You don’t need speculative liquidity when you’ve got real flow.

Last week alone, stablecoin supply on $SEI grew 23%.

And the flywheel is clear:

→ Sei growth → More DeFi/Gaming protocols → USDC utility → Circle alignment → SEI holder value accrues

🔻 Also worth noting:

– 765K daily active wallets ATH (+74% MoM)

– TVL growth 33% in last 30 days, 171% since April

There’s a reason why Circle made this move, they see what’s coming.

If $SEI becomes the execution layer for institutional DeFi and high-frequency flows, this USDC integration is just the beginning.

And I think they’re early, not late. So I’m officially joining $SEI eco.

11,44K

Johtavat

Rankkaus

Suosikit

Ketjussa trendaava

Trendaa X:ssä

Viimeisimmät suosituimmat rahoitukset

Merkittävin