Trendaavat aiheet

#

Bonk Eco continues to show strength amid $USELESS rally

#

Pump.fun to raise $1B token sale, traders speculating on airdrop

#

Boop.Fun leading the way with a new launchpad on Solana.

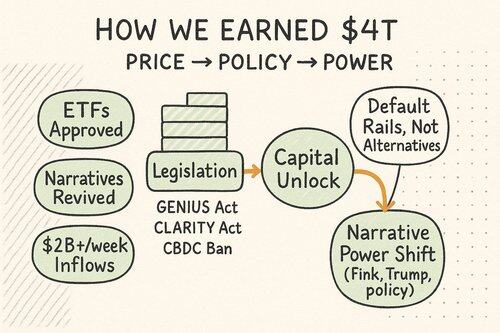

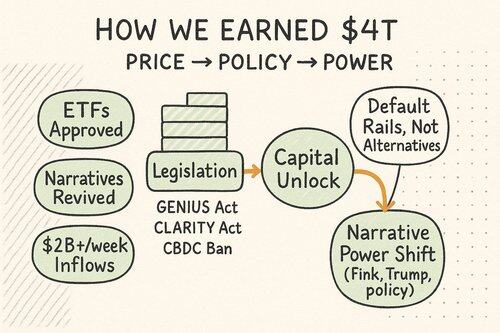

Crypto didn’t drift into a $4 trillion market cap by accident.

It was a convergence;

Of price catalysts.

Of political will.

Of power shifting from incumbents to internet-native institutions.

Let’s walk through the major milestones that turned a fringe movement into a parallel financial system on the rise.

● When the Charts Turned Conviction Into Capital

Bitcoin reclaimed the narrative in late 2024.

- Spot ETFs got greenlit.

- Sovereigns started stacking.

- Halving supply shocks coincided with fresh demand.

BlackRock, Fidelity, and Ark were no longer talking about digital gold, they were buying it on behalf of retirement savers.

The ETF flows snowballed:

- $5B+ net inflows per month since April

- Ethereum ETFs followed suit, with a delayed launch but faster catch-up

By mid-2025:

✅ $BTC broke past $120K

✅ $ETH rallied past $3.6K

✅ $XRP hit ATHs

✅ Even meme coins surged, as liquidity returned in force

But price alone doesn’t explain the $4T milestone.

● How Policy Turned the Tide

The bigger unlock was regulatory alignment.

In July 2025, three monumental bills passed the US House:

1. GENIUS

- Establishes a stablecoin framework

- Opens the door for tokenized dollars to flow with certainty

2. CLARITY

- Defines what a digital asset is, and who regulates it

- Clean division between CFTC, SEC, and Treasury

3. Anti-CBDC Bill

- Reinforces private crypto over state-controlled surveillance coins

Combined, these bills delivered something crypto has lacked for over a decade: a federal framework.

Suddenly, institutions didn’t need to guess.

They had rules. And rules meant scale.

18.7. klo 03.49

🚨🚨🚨 The House just passed my bill – The GENIUS Act!

This historic legislation will bring our payment system into the 21st century. It will ensure the dominance of the U.S. dollar. It will increase demand for U.S. Treasuries.

I look forward to @POTUS signing GENIUS into law – the first step in making America the crypto capital of the world.

● The Power Transfer: From Institutions to the Internet

The third leg of the journey? Power dynamics.

Crypto didn’t just win on price or policy.

It started winning the narrative war.

‘’Trump signaling support for crypto in 401(k)s? That’s political capital being spent.

Larry Fink calling Bitcoin ‘a flight to quality’ ? That’s Wall Street capitulating.

Developers shipping permissionless AI, DeFi, and sovereign chains? That’s cultural momentum.’’

We’re witnessing a rebalancing:

✅ From custodians to code

✅ From KYC rails to crypto rails

✅ From middlemen to smart contracts

Crypto became not just an asset class, but a movement with direction.

● Why $4T Is Just the Starting Line

Today, we’re at $4 trillion.

But the more important takeaway is why.

It wasn’t just hype.

It was the result of layered catalysts:

- Narrative legitimacy (ETFs)

- Regulatory validation (GENIUS/CLARITY)

- Structural flows (retirement + RWAs)

- Cultural tailwinds (anti-CBDC, AI synergy, alt-chain growth)

If crypto felt like a question mark in 2022, it now feels like an inevitability in 2025.

The next $4T will be faster.

Because now the pipes are laid, and belief is compounding.

✍️ Conclusion

We didn’t just wake up at $4 trillion.

We built it. Brick by Brick. Law by Law. Bet by Bet.

The question now isn’t whether crypto will survive.

It’s how far, how fast, and how global it can go.

Let’s find out.

chads, $4T mc! it’s DeFi time :D

@0xAndrewMoh, @Mars_DeFi, @0xDefiLeo, @Flowslikeosmo, @crypto_linn, @CryptoGirlNova, @arndxt_xo, @0xRetardio, @web3_alina, @TheDeFiKenshin, @Hercules_Defi, @Kaffchad, @0xelonmoney, @_SmokinTed, @thelearningpill, @Nick_Researcher, @splinter0n, @eli5_defi, @Tanaka_L2, @Elikrypt, @0xAmin7, @St1t3h @0xCheeezzyyyy, @yashasedu, @jeff_degen.

21 tuntia sitten

Crypto didn’t drift into a $4 trillion market cap by accident.

It was a convergence;

Of price catalysts.

Of political will.

Of power shifting from incumbents to internet-native institutions.

Let’s walk through the major milestones that turned a fringe movement into a parallel financial system on the rise.

● When the Charts Turned Conviction Into Capital

Bitcoin reclaimed the narrative in late 2024.

- Spot ETFs got greenlit.

- Sovereigns started stacking.

- Halving supply shocks coincided with fresh demand.

BlackRock, Fidelity, and Ark were no longer talking about digital gold, they were buying it on behalf of retirement savers.

The ETF flows snowballed:

- $5B+ net inflows per month since April

- Ethereum ETFs followed suit, with a delayed launch but faster catch-up

By mid-2025:

✅ $BTC broke past $120K

✅ $ETH rallied past $3.6K

✅ $XRP hit ATHs

✅ Even meme coins surged, as liquidity returned in force

But price alone doesn’t explain the $4T milestone.

11,44K

Johtavat

Rankkaus

Suosikit