Trendaavat aiheet

#

Bonk Eco continues to show strength amid $USELESS rally

#

Pump.fun to raise $1B token sale, traders speculating on airdrop

#

Boop.Fun leading the way with a new launchpad on Solana.

Tom Wan

head of data @entropyadvisors | prev. @21co__ @21shares

views are my own & NFA

Tom Wan kirjasi uudelleen

Delegate Spotlight #6: @SEEDGov

They operate across 15+ ecosystems - blending hands-on participation, community engagement, and governance experimentation.

In Arbitrum, they hold 2.6M ARB from 273 delegators.

Let’s break down their DAO activity via our @Dune dashboard 👇

4,89K

Arbitrum DATA Everywhere powered by @EntropyAdvisors

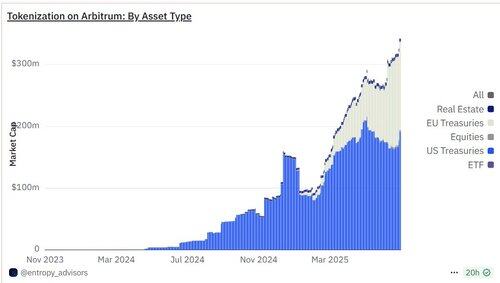

RWA is a trend that you can't miss.

The DeFi Investor 🔎22 tuntia sitten

Tokenization on Arbitrum is going vertical.

In the past 365 days, Arbitrum's RWA value increased by more than 20 times.

Still early, but RWA adoption is growing.

1,57K

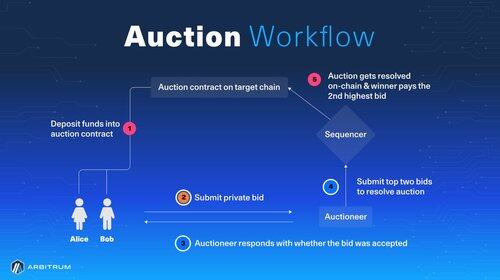

A Must-read thread to understand Timeboost and Arbitrum

Ali Taslimi18.7. klo 01.35

What if there were a way to gain priority on a First-Come, First-Served chain, not through latency reduction, but by paying for it?

That's what Timeboost brought to the @arbitrum network 3 months ago.

A novel approach to transaction ordering, where the DAO earns the upside 🧵👇

1,26K

Tom Wan kirjasi uudelleen

1/ What is Timeboost?

It is a sealed-bid, second-price auction that lets participants bid for faster inclusion in blocks.

The highest bidder wins, pays only the second-highest bid, and gets to submit priority transactions in the next round, and all the revenue goes to the Arbitrum DAO.

Each auction gives the winner control of the express lane for 60 seconds. Bidding stays open for 45 seconds and closes 15 seconds before the round begins.

It's still a first-come, first-served system, just with a paid express lane added on top.

All of this can be adjusted by the chain owner.

247

Tom Wan kirjasi uudelleen

What if there were a way to gain priority on a First-Come, First-Served chain, not through latency reduction, but by paying for it?

That's what Timeboost brought to the @arbitrum network 3 months ago.

A novel approach to transaction ordering, where the DAO earns the upside 🧵👇

3,52K

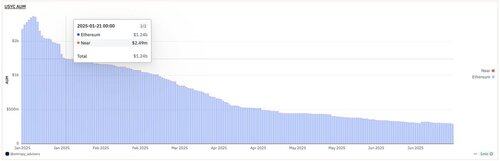

BlackRock just filed to add Staking in their Ethereum ETF

Another fuel for the continuous inflow for ETH Spot ETFs

Tom Wan7.11.2024

Ethereum ETFs with Staking: What Could it Mean for Investors and the Network?

1. 0% Management Fee

The staking yield on Ethereum is around ~3.2%. Assuming a conservative scenario where issuers stake only 25% of total assets and incur a 20% operating cost (for the staking provider, custodian, issuer, etc.), the staking yield could cover the management fee of ETH ETFs (excluding ETHE).

We’re already seeing examples in Europe, like @CoinSharesCo’s ETHE with a 0% management fee + 1.25% staking reward, and @BitwiseInvest’s ET32 with a 0% management fee and 3.1% staking reward. Other issuers, such as @vaneck_us's VETH and @21Shares's AETH, do charge a management fee, but their staking yield is still sufficient to offset this cost.

2. ETH ETFs Staking can add 550k-1.3M ETH being staked (Staked Ratio +1% to ~30%)

Issuers like 21Shares, Bitwise, and VanEck have a strong track record in staking. They already possess the infrastructure, service providers, and expertise needed to support staking, making it likely they’ll be among the first to file for staking-enabled ETFs. For firms with lower AUM, adding staking could be a valuable differentiator to capture market share.

Given the liquidity risks and the current ~10-day withdrawal and exit queue for staking, issuers may initially use a lower staking rate, around 20-50%. This approach could benefit lower-AUM issuers, allowing them to be more aggressive with higher staking yields to attract investors.

Notably, the withdrawal queue is expected to decrease after Ethereum’s Pectra upgrade (EIP7251), which could make staking even more appealing for ETFs/ETPs. Key benefits include:

1. Higher effective balance (32 -> 2048): This would reduce staking costs by decreasing the number of validators required.

2. Lower initial slashing penalties: Reducing risk for stakers.

3. Shorter exit queue: Validators can merge together, resulting in a lower number of validators in the queue for partial withdrawal

European Products Utilization Rate:

VETH: ~70%

ET32: ~95%

3. Staking Landscape would slowly shift to Staking Pools and CEXs

While liquid staking is an ideal solution for ETH stakers to maintain liquidity while earning rewards, the first wave of staking providers for ETFs will likely be institutional staking pools and centralized exchanges (CEXs).

- Staking Pools: @Kiln_finance, @P2Pvalidator, @Figment_io, @BlockdaemonHQ

- CEXs: @coinbase (possibly @krakenfx as well)

In the future, I hope to see @LidoFinance’s stETH included in an ETF/ETP. stETH offers clear advantages:

1. Maturity: Lido is the largest staking provider, holding a 27.7% market share on Ethereum.

2. Liquidity:

- Primary Market: ETFs/ETPs using stETH could benefit from Lido’s buffer mechanism, enabling faster withdrawals compared to other staking providers.

- Secondary Market: stETH can be swapped for ETH on DEXs/CEXs, providing instant liquidity.

- DeFi: stETH can also be used as collateral, allowing ETFs/ETPs to borrow ETH to fulfill redemption requests.

With these options for ETH liquidity, stETH could be a “holy grail” for ETH ETFs/ETPs, potentially enabling close to 100% utilization rates. However, regulatory concerns remain a challenge. Still, I’m optimistic about the future of liquid staking and have high hopes for the new Lido Institutional team.

4. Time for ETH ETFs to Live Up to Their Full Potential

ETH ETFs are currently only 10% the size of BTC ETFs, even though ETH’s market cap is 23% of BTC’s. One key factor holding ETH ETFs back from reaching their potential is the absence of staking.

For institutional investors, who are likely new to crypto, Bitcoin is already a novel asset—Ethereum is even newer. To attract inflows, ETH ETFs need a clear differentiator that’s easy for investors to understand.

Enabling staking yield could be a game changer. Even if the yield starts low, if issuers offer a 0% management fee plus ~1% yield, it would present a competitive alternative to BTC ETFs. Some may argue that institutional investors don’t care about an additional 1% yield, given its modest impact, but for others, even a small yield could be a meaningful differentiator.

92,26K

Johtavat

Rankkaus

Suosikit

Ketjussa trendaava

Trendaa X:ssä

Viimeisimmät suosituimmat rahoitukset

Merkittävin