Trendaavat aiheet

#

Bonk Eco continues to show strength amid $USELESS rally

#

Pump.fun to raise $1B token sale, traders speculating on airdrop

#

Boop.Fun leading the way with a new launchpad on Solana.

OneKey

The protection offered by a seed phrase alone… might no longer be enough for you.

What if it’s phished, exposed, or even forcibly taken?

Is there a way to stay one step ahead?

That’s where the Passphrase (hidden password) comes in:

It’s an extra layer of security —

combined with your seed phrase, it creates a completely separate hidden wallet.

This wallet can’t be guessed, and it can’t be derived from your seed phrase alone.

Even if someone gets your seed phrase, without your passphrase, your real assets remain safe.

In simple terms:

> Seed phrase + No Passphrase = Surface wallet (for decoy or daily use)

> Seed phrase + Your Passphrase = Hidden wallet (your true vault)

We’ve created a step-by-step beginner tutorial to walk you through this feature.

Once you’ve learned it, you’ll gain true multi-layer control over your crypto.

Click to watch and get started👇:

926

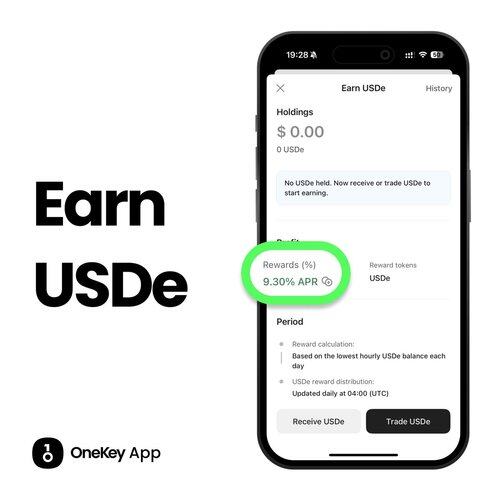

USDe is now earning close to 10% APR !

No staking, no lockups.

Open the OneKey App, hold USDe and activate to start earning daily rewards👇

OneKey4.7. klo 19.38

OneKey Earn now supports USDe.

No staking.

No lockups.

Just hold USDe in your wallet and activate to start earning.

Enabled and secured by OneKey.

DeFi rewards, fully self-custodied.

Watch the video to learn how to get started 👇

2,55K

APR vs APY — Don’t Let These Numbers Fool You

"10% APR" vs "10% APY" — same number, totally different story. Some protocols use shiny APY figures to sell you a dream that never pays out.

To most beginners, yield is yield. But APR and APY are built on entirely different assumptions — and mixing them up can cost you.

What APR and APY Actually Mean

APR (Annual Percentage Rate) shows your annual yield without compounding — it assumes you never reinvest your rewards.

Let’s say you deposit $1,000 into a USDT/USDC pool showing 20% APR. If you do nothing — no reinvesting, no compounding — you’ll earn $200 after one year. That’s simple interest.

But what if you keep reinvesting the rewards? Re-depositing fees, token incentives, all of it?

That’s where APY (Annual Percentage Yield) comes in. It calculates your return assuming you compound consistently — earning interest on your interest.

Let’s walk through the math with an example 👇:

Without compounding: Profit = Principal × APR

$1,000 at 20% APR → $200 after one year

With compounding: Profit = Principal × APY

APY = (1 + APR / n)^n - 1, where n is how often you compound per year.

If you auto-compound daily (n = 365), then 20% APR → ~22.13% APY, or $221.30 in a year. That’s an extra $21 — just from reinvesting regularly.

What They Don’t Tell You About Yield

Understanding APR and APY is just the beginning. Knowing the terms doesn’t mean you’re safe. In DeFi protocols, clever design choices and hidden mechanics can still leave you with less than what you thought you’d earn.

Let’s go over a few things most people overlook 👇

1/ High numbers don’t always mean high returns: Whether it’s APR or APY, these are often estimates based on past performance. Actual returns can drop fast due to things like declining pool activity, token price depreciation, or diluted rewards.

2/ You need to understand where the yield comes from: Some protocols help by breaking down the components of APR/APY directly in the UI. But in most cases, your first step should be clicking the "Docs" button — and digging. Look for the fine print. That’s where the real story usually hides.

Here’s a real example from Kamino Finance: two SOL lending vaults — "MEV Capital SOL" and "Allez SOL". At first glance, "Allez SOL" looks better with an APY of 8.54%, compared to 7.37% from "MEV Capital".

But when you check the breakdown, the actual "Lending APY" — the yield from real borrowing activity — tells a different story:

> MEV Capital SOL: 7.35%

> Allez SOL: only 5.1%

The higher total APY on "Allez SOL" comes from extra token incentives added on top. That might look great now — but it also comes with risk: token price drops, reward dilution, and less sustainable yield in the long run.

Objectively, neither pool is strictly better than the other. It’s not about chasing the highest number — it’s about understanding where the yield comes from, and choosing the one that aligns with your risk profile.

3/ When Fees Eat Your Yield: When manually compounding, don’t forget to factor in gas fees, swap fees, and other costs — especially if you’re working with a small bag.

Let’s say you are farming a 9% APR vault. You might yield about $2.25 on a $100 deposit over 3 months. But if you swapped or bridged tokens before entering, and gas was high on Ethereum, you could lose $1+ in fees — nearly half your profits gone. With smaller deposits, fees eat APY fast.

4/ When APR Pretends to Be APY

Some protocols run rewards using APR, but display them as APY — making yields look better than they are. That’s not a rounding error. It’s a red flag, especially in new ecosystems where low-quality protocols mix with legit ones. That's when you need to judge a protocol not just by numbers, but by product quality, security details, and whether the team actually seems trustworthy.

Throwback to the airdrop farming era: On ZKsync, before $ZK was launched, a lending protocol called Era Lend became a hotspot thanks to sky-high APYs and endless farming tutorials. The result? Millions were lost to an exploit. The team went silent. No compensation. Many still believe it was a pure rug.

In DeFi, while you’re chasing yields TradFi can’t offer, someone might be chasing your principal.

End

By now, you should have a clear understanding of what APR and APY really mean — and how yield in DeFi isn’t always what it seems. But remember: knowing these concepts is just a start. Making good decisions in DeFi takes more than that — it takes context, curiosity, and caution.

Disclaimer: This content is for educational purposes only and does not constitute financial advice. DeFi protocols carry significant market and technical risks. Token prices and yields are highly volatile, and participating in DeFi may result in the loss of all invested capital. Always do your own research, understand the legal requirements in your jurisdiction, and evaluate risks carefully before getting involved.

11,19K

APR vs APY — Don’t Let These Numbers Fool You

"10% APR" vs "10% APY" — same number, totally different story. Some protocols use shiny APY figures to sell you a dream that never pays out.

To most beginners, yield is yield. But APR and APY are built on entirely different assumptions — and mixing them up can cost you.

What APR and APY Actually Mean

APR (Annual Percentage Rate) shows your annual yield without compounding — it assumes you never reinvest your rewards.

Let’s say you deposit $1,000 into a USDT/USDC pool showing 20% APR. If you do nothing — no reinvesting, no compounding — you’ll earn $200 after one year. That’s simple interest.

But what if you keep reinvesting the rewards? Re-depositing fees, token incentives, all of it?

That’s where APY (Annual Percentage Yield) comes in. It calculates your return assuming you compound consistently — earning interest on your interest.

Let’s walk through the math with an example 👇:

Without compounding: Profit = Principal × APR

$1,000 at 20% APR → $200 after one year

With compounding: Profit = Principal × APY

APY = (1 + APR / n)^n - 1, where n is how often you compound per year.

If you auto-compound daily (n = 365), then 20% APR → ~22.13% APY, or $221.30 in a year. That’s an extra $21 — just from reinvesting regularly.

What They Don’t Tell You About Yield

Understanding APR and APY is just the beginning. Knowing the terms doesn’t mean you’re safe. In DeFi protocols, clever design choices and hidden mechanics can still leave you with less than what you thought you’d earn.

Let’s go over a few things most people overlook 👇

1/ High numbers don’t always mean high returns: Whether it’s APR or APY, these are often estimates based on past performance. Actual returns can drop fast due to things like declining pool activity, token price depreciation, or diluted rewards.

2/ You need to understand where the yield comes from: Some protocols help by breaking down the components of APR/APY directly in the UI. But in most cases, your first step should be clicking the "Docs" button — and digging. Look for the fine print. That’s where the real story usually hides.

Here’s a real example from Kamino Finance: two SOL lending vaults — "MEV Capital SOL" and "Allez SOL". At first glance, "Allez SOL" looks better with an APY of 8.54%, compared to 7.37% from "MEV Capital".

But when you check the breakdown, the actual "Lending APY" — the yield from real borrowing activity — tells a different story:

> MEV Capital SOL: 7.35%

> Allez SOL: only 5.1%

The higher total APY on "Allez SOL" comes from extra token incentives added on top. That might look great now — but it also comes with risk: token price drops, reward dilution, and less sustainable yield in the long run.

Objectively, neither pool is strictly better than the other. It’s not about chasing the highest number — it’s about understanding where the yield comes from, and choosing the one that aligns with your risk profile.

3/ When Fees Eat Your Yield: When manually compounding, don’t forget to factor in gas fees, swap fees, and other costs — especially if you’re working with a small bag.

Let’s say you are farming a 9% APR vault. You might yield about $2.25 on a $100 deposit over 3 months. But if you swapped or bridged tokens before entering, and gas was high on Ethereum, you could lose $1+ in fees — nearly half your profits gone. With smaller deposits, fees eat APY fast.

4/ When APR Pretends to Be APY

Some protocols run rewards using APR, but display them as APY — making yields look better than they are. That’s not a rounding error. It’s a red flag, especially in new ecosystems where low-quality protocols mix with legit ones. That's when you need to judge a protocol not just by numbers, but by product quality, security details, and whether the team actually seems trustworthy.

Throwback to the airdrop farming era: On ZKsync, before $ZK was launched, a lending protocol called Era Lend became a hotspot thanks to sky-high APYs and endless farming tutorials. The result? Millions were lost to an exploit. The team went silent. No compensation. Many still believe it was a pure rug.

In DeFi, while you’re chasing yields TradFi can’t offer, someone might be chasing your principal.

End

By now, you should have a clear understanding of what APR and APY really mean — and how yield in DeFi isn’t always what it seems. But remember: knowing these concepts is just a start. Making good decisions in DeFi takes more than that — it takes context, curiosity, and caution.

Disclaimer: This content is for educational purposes only and does not constitute financial advice. DeFi protocols carry significant market and technical risks. Token prices and yields are highly volatile, and participating in DeFi may result in the loss of all invested capital. Always do your own research, understand the legal requirements in your jurisdiction, and evaluate risks carefully before getting involved.

5,12K

APR vs APY — Don’t Let These Numbers Fool You

"10% APR" vs "10% APY" — same number, totally different story. Some protocols use shiny APY figures to sell you a dream that never pays out.

To most beginners, yield is yield. But APR and APY are built on entirely different assumptions — and mixing them up can cost you.

What APR and APY Actually Mean

APR (Annual Percentage Rate) shows your annual yield without compounding — it assumes you never reinvest your rewards.

Let’s say you deposit $1,000 into a USDT/USDC pool showing 20% APR. If you do nothing — no reinvesting, no compounding — you’ll earn $200 after one year. That’s simple interest.

But what if you keep reinvesting the rewards? Re-depositing fees, token incentives, all of it?

That’s where APY (Annual Percentage Yield) comes in. It calculates your return assuming you compound consistently — earning interest on your interest.

Let’s walk through the math with an example 👇:

Without compounding: Profit = Principal × APR

$1,000 at 20% APR → $200 after one year

With compounding: Profit = Principal × APY

APY = (1 + APR / n)^n - 1, where n is how often you compound per year.

If you auto-compound daily (n = 365), then 20% APR → ~22.13% APY, or $221.30 in a year. That’s an extra $21 — just from reinvesting regularly.

What They Don’t Tell You About Yield

Understanding APR and APY is just the beginning. Knowing the terms doesn’t mean you’re safe. In DeFi protocols, clever design choices and hidden mechanics can still leave you with less than what you thought you’d earn.

Let’s go over a few things most people overlook 👇

1/ High numbers don’t always mean high returns: Whether it’s APR or APY, these are often estimates based on past performance. Actual returns can drop fast due to things like declining pool activity, token price depreciation, or diluted rewards.

2/ You need to understand where the yield comes from: Some protocols help by breaking down the components of APR/APY directly in the UI. But in most cases, your first step should be clicking the "Docs" button — and digging. Look for the fine print. That’s where the real story usually hides.

Here’s a real example from Kamino Finance: two SOL lending vaults — "MEV Capital SOL" and "Allez SOL". At first glance, "Allez SOL" looks better with an APY of 8.54%, compared to 7.37% from "MEV Capital".

But when you check the breakdown, the actual "Lending APY" — the yield from real borrowing activity — tells a different story:

> MEV Capital SOL: 7.35%

> Allez SOL: only 5.1%

The higher total APY on " Allez SOL" comes from extra token incentives added on top. That might look great now — but it also comes with risk: token price drops, reward dilution, and less sustainable yield in the long run.

Objectively, neither pool is strictly better than the other. It’s not about chasing the highest number — it’s about understanding where the yield comes from, and choosing the one that aligns with your risk profile.

3/ When Fees Eat Your Yield: When manually compounding, don’t forget to factor in gas fees, swap fees, and other costs — especially if you’re working with a small bag.

Let’s say you are farming a 9% APR vault. You might yield about $2.25 on a $100 deposit over 3 months. But if you swapped or bridged tokens before entering, and gas was high on Ethereum, you could lose $1+ in fees — nearly half your profits gone. With smaller deposits, fees eat APY fast.

4/ When APR Pretends to Be APY

Some protocols run rewards using APR, but display them as APY — making yields look better than they are. That’s not a rounding error. It’s a red flag, especially in new ecosystems where low-quality protocols mix with legit ones. That's when you need to judge a protocol not just by numbers, but by product quality, security details, and whether the team actually seems trustworthy.

Throwback to the airdrop farming era: On ZKsync, before $ZK was launched, a lending protocol called Era Lend became a hotspot thanks to sky-high APYs and endless farming tutorials. The result? Millions were lost to an exploit. The team went silent. No compensation. Many still believe it was a pure rug.

In DeFi, while you’re chasing yields TradFi can’t offer, someone might be chasing your principal.

End

By now, you should have a clear understanding of what APR and APY really mean — and how yield in DeFi isn’t always what it seems. But remember: knowing these concepts is just a start. Making good decisions in DeFi takes more than that — it takes context, curiosity, and caution.

Disclaimer: This content is for educational purposes only and does not constitute financial advice. DeFi protocols carry significant market and technical risks. Token prices and yields are highly volatile, and participating in DeFi may result in the loss of all invested capital. Always do your own research, understand the legal requirements in your jurisdiction, and evaluate risks carefully before getting involved.

2,83K

Newbie FAQ: What should I do if I forget the PIN to my hardware wallet?

Don’t worry — the PIN is just a local password to unlock the device.

It doesn’t affect your actual control over your assets.

As long as you’ve backed up your recovery phrase (the set of English words you wrote down when setting up the wallet),

you can reset the device and restore access to your wallet and funds.

Remember, the core purpose of a hardware wallet is to generate and protect your recovery phrase offline, away from internet exposure.

It’s the recovery phrase, not the PIN, that truly determines ownership of your assets.

For safer, long-term backup, it’s best to use a metal recovery tool instead of paper.

OneKey KeyTag is a solid choice — fireproof, waterproof, and corrosion-resistant.

Engrave it once, and rest easy knowing your recovery phrase is secure for the long run.

3,31K

Johtavat

Rankkaus

Suosikit

Ketjussa trendaava

Trendaa X:ssä

Viimeisimmät suosituimmat rahoitukset

Merkittävin