Trendaavat aiheet

#

Bonk Eco continues to show strength amid $USELESS rally

#

Pump.fun to raise $1B token sale, traders speculating on airdrop

#

Boop.Fun leading the way with a new launchpad on Solana.

Scott Johnsson

current gp @ vbcap | finance lawyer | fmr @davispolk & IB @barclaysCIB | author - Chambers Global Practice Guide - Banking & Finance (US) | not your lawyer

Standard addition generally matches filings by other issuers.

Aggr News18.7. klo 00.41

ISHARES ETHEREUM TRUSTS FILES FOR STAKING

16,09K

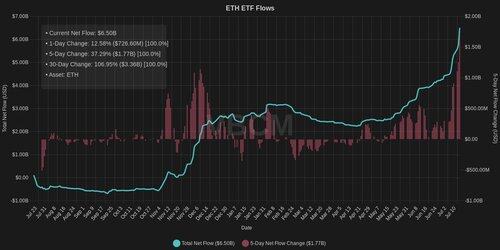

Record on single day, weekly and monthly frames. Beats BTC spot record as a % of total market cap. Pretty incredible reversal in fortunes for the asset.

Nate Geraci17.7. klo 10.01

We have a *record* daily inflow total for spot eth ETFs…

Nearly $720mil.

Obliterates previous mark of $430mil.

Spot eth ETFs w/ $1.8bil new $$$ over past 5 trading days.

Clear acceleration.

2,75K

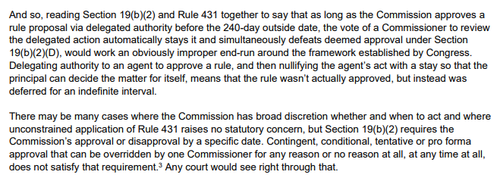

This is why (sometimes) lawyers are worth it. They're right, you know. Given Grayscale was suggesting they had productive talks with the SEC prior to approval, and they had made extensive amendments to the rule proposal in line with those discussions, my guess is the Rule 431 application was a parting gift from Crenshaw acting unilaterally. SEC then had to deal with the mess. This is going to launch, its just a matter of when imo.

James Seyffart11.7. klo 20.50

NEW: @Grayscale and their lawyers filed a letter in response to the SEC's "Stay" order on $GDLC's ETF conversion arguing that the SEC didn't have the power to do this.

18,36K

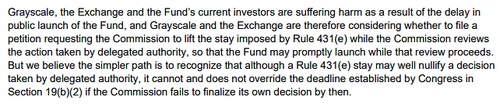

USDT is great to watch because chain distribution is a pretty good proxy for measuring the bifurcated nature of its demand. Tron issuance generally the mode for ex-US real world "save and send", while remainder (ETH, etc) representative of onchain/defi.

@PlasmaFDN aiming for both but likely primed toward the former as exposure to the fastest growing segment of the fastest growing large issuer should be interesting. $1B pre-sale deposit to bootstrap helps, but derives from the latter segment (recall it came via Ethereum deposits). You're likely able to crudely measure its segment growth through viewing impact in USDT chain distribution post-launch.

10,11K

This is really just a method to verify control over assets. It’s a spectrum and third party verification is simply more reliable for this purpose. That + repping ownership is the same process they’ll verify cash reserves held in a bank account, and will ignore “cash” you might rep to own under your mattress.

“Maybe it’s yours/ maybe not… put it into a verified identified account in your name to demonstrate control and that’s good enough for us”.

Once it’s counted toward reserves, it’s unlikely there’s any requirement to keep it there once the mortgage is issued.

Nick Neuman26.6.2025

It looks like bitcoin held in self-custody will NOT count as an asset for consideration on home loans.

This is a mistake @pulte, self-custody is fundamentally aligned w/American values. It's trivial to prove ownership of BTC in self-custody.

I'm happy to explain how & help!

3,1K

Johtavat

Rankkaus

Suosikit

Ketjussa trendaava

Trendaa X:ssä

Viimeisimmät suosituimmat rahoitukset

Merkittävin