Trendaavat aiheet

#

Bonk Eco continues to show strength amid $USELESS rally

#

Pump.fun to raise $1B token sale, traders speculating on airdrop

#

Boop.Fun leading the way with a new launchpad on Solana.

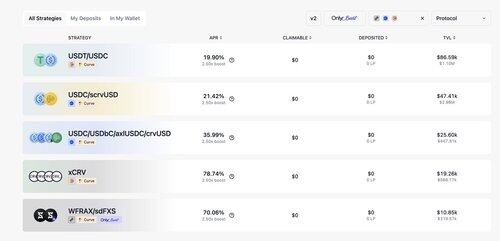

Curve Finance

Boosts outside mainnet. Finally!

Stake DAO7 tuntia sitten

Staking V2 now live on @CurveFinance: Fraxtal, @base, and @SonicLabs

Experience Stake DAO's upgraded infrastructure:

+ Instant boosted reward distribution

+ No reward dilution

+ Redesigned UI/UX (details coming 👀)

Try it before the mainnet release:

9,82K

Some people did not quite understand, so this needs explanation.

Concentrated liquidity in ranges (like Uniswap3 and others doing that) tend to have liquidity from price A to price B. And this range of prices for stable pairs is VERY tight.

Asset sometimes like to go out of that range. And if there is no one else providing liquidity out of range - REKT (asset depegs or experiences extreme volatility).

This is where ol good stableswap saves the show! It has concentrated liquidity, but it doesn't stop anywhere. Some liquidity is present at any price.

So stableswap is the pioneer of concentrated liquidity, but it is also the endgame AMM algorithm for pegged assets, even after so many years!

Michael Egorov24.7. klo 01.45

Liquidity crisis which did not happen (thanks to @CurveFinance pools)

21,95K

Curve Finance kirjasi uudelleen

🎙️ @newmichwill, Founder, @CurveFinance

Michael Egorov built one of DeFi’s most influential stablecoin AMMs, and helped kick off a new era of onchain liquidity.

Join him at Stablecoin Summit to explore what’s next for stablecoin infrastructure.

📌 Andaz Singapore

🗓️ 2 Oct

10,22K

Curve Finance kirjasi uudelleen

scrvUSD is currently offering some of the highest organic stablecoin yield in all of DeFi @ 7.4%

That's much higher than the 4% $sUSDe offers, or the 3.5% average supply rate of $USDC, $USDT on AAVE, or even Hyperliquid's HLP vault, which is currently offering 6% APR on USDC deposits!

Savings $crvUSD holders have been receiving record distributions since start of June due to elevated borrow rates📊📈

The savings rate has steady increased since the beginning of May:

The rising yields have attracted a lot of new depositors into the savings vault in May, June.

On June 26th, scrvUSD supply hit a record high of $50.7m

The solid performance of scrvUSD over the past 2 months has stabilized the crvUSD peg considerably as @CurveFinance noted in this post:

If scrvUSD APY continues to climb and rises above 8%, or even 9-10% into July and August, demand for crvUSD could rise considerably.

$CRV $CVX

21,7K

Johtavat

Rankkaus

Suosikit

Ketjussa trendaava

Trendaa X:ssä

Viimeisimmät suosituimmat rahoitukset

Merkittävin