Trendaavat aiheet

#

Bonk Eco continues to show strength amid $USELESS rally

#

Pump.fun to raise $1B token sale, traders speculating on airdrop

#

Boop.Fun leading the way with a new launchpad on Solana.

Michael Egorov

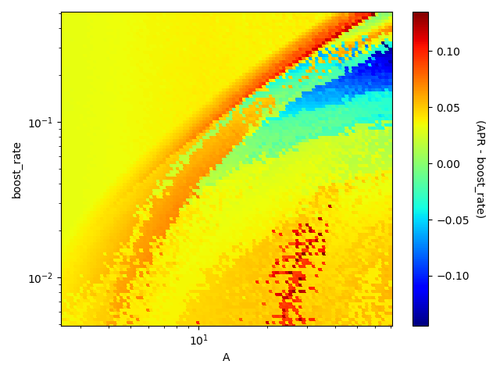

Liquidity crisis which did not happen (thanks to @CurveFinance pools)

hell0men.hl Pro DeFi24.7. klo 01.42

🩸wstETH Liquidity Crisis

1. Major ETH providers withdrew liquidity from AAVE

2. Farmers with wstETH/ETH looping positions are at loss and forced to sell at market, taking leveraged losses and driving down wstETH value

3. Arbitrageurs buy discounted wstETH and unwrap through Lido, pushing validator exit queue to $2.2B (11-day wait)

Concentrated liquidity pools (V3-style) with their narrow ranges can trigger cascading liquidations due to insufficient liquidity depth.

Without @CurveFinance's deep pools, the depeg could be far worse.

73,93K

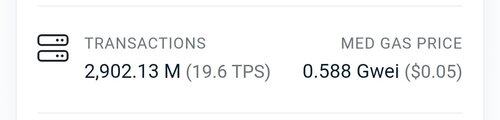

Ethereum tps is at ATH while transaction prices are at their lows

Giulio Rebuffo22.7. klo 18.59

Very proud to see @ethereum hitting 20 TPS.

Congratulations to everyone involved in making this happen!

20,79K

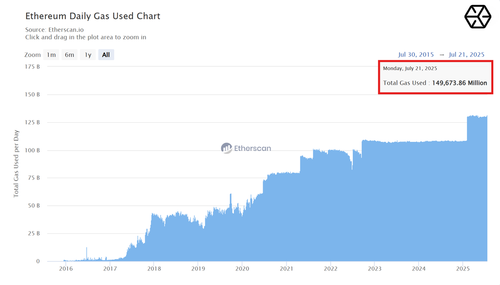

They won’t tell you when Ethereum will start scaling, but there will be signs

everstake.eth (💙,💛)23.7. klo 00.11

Ethereum just hit an all-time high in daily gas usage!

149,673,860,000 gas used on July 21, 2025 - the most ever recorded in a single day.

Let’s break down what this means 👇

17,7K

Michael Egorov kirjasi uudelleen

🎙️ @newmichwill, Founder, @CurveFinance

Michael Egorov built one of DeFi’s most influential stablecoin AMMs, and helped kick off a new era of onchain liquidity.

Join him at Stablecoin Summit to explore what’s next for stablecoin infrastructure.

📌 Andaz Singapore

🗓️ 2 Oct

10,22K

This situation with Resupply caught me off guard. Every project that builds on-with Curve is important to me, and I tend to take everything that happens in our ecosystem quite personally—maybe even too emotionally at times. But my intentions are sincere: I truly want to make DeFi better and more effective. That’s why we not only build ourselves but also encourage other project to build on top of @CurveFinance!

Right now, the Resupply team and our ecosystem partners finished re-checking Resupply codebase for similar issues, investigating the attack itself and working on recovery for the affected users.

Personally, I feel that while these ecosystem projects aren’t under my direct control and we all operate in a decentralized world, they still have a critical impact—both on Curve itself and on my own reputation.

Resupply was audited by some top of the top firms, but it was still exploited. That’s why I believe it would be a good idea to create a dedicated Curve-specific team for auditing community projects. I’d love to hear your thoughts or suggestions on this!

Thank you all. I hope to see positive news from the investigation.

Resupply28.6.2025

We have published our post-mortem on the exploit in the wstUSR market as well as the recovery plan. Please use the links below.

Post-mortem:

Recovery Plan:

78,8K

Most important part. Do you think that a special Curve-specific team for auditing projects built on top of @CurveFinance is a good idea? Please comment!

Michael Egorov29.6.2025

This situation with Resuply caught me off guard. Every project that builds on-with Curve is important to me, and I tend to take everything that happens in our ecosystem quite personally—maybe even too emotionally at times. But my intentions are sincere: I truly want to make DeFi better and more effective. That’s why we not only build ourselves but also encourage other project to build on top of @CurveFinance!

Right now, the Resuply team and our ecosystem partners finished re-checking Resupply codebase for similar issues, investigating the attack itself and working on recovery for the affected users.

Personally, I feel that while these ecosystem projects aren’t under my direct control and we all operate in a decentralized world, they still have a critical impact—both on Curve itself and on my own reputation.

Resuply was audited by some top of the top firms, but it was still exploited. That’s why I believe it would be a good idea to create a dedicated Curve-specific team for auditing community projects. I’d love to hear your thoughts or suggestions on this!

Thank you all. I hope to see positive news from the investigation.

4,78K

Was observing recent attack and resolution process for @ResupplyFi as a bystander. Some takeaways:

- Resolution process goes as professionally as it can. Great top-tier team there;

- Some people from community made false accusations, especially a bunch of people connected to @OneKeyHQ. Will not tell conspiracy theories I have about that, but at least will avoid ever buying OneKey products;

- A bug which made it possible is very unobvious (missed by excellent team and excellent auditors), however could be avoided very simply (seeding markets before they are voted). Seeding ERC4626 vaults before use is a good way to address even unknown bugs of that class!

- One should be very paranoid about smart contract code, and even auditors are not a guarantee. Always good to have more audits and more fuzzing. Safety first!

73,68K

Johtavat

Rankkaus

Suosikit

Ketjussa trendaava

Trendaa X:ssä

Viimeisimmät suosituimmat rahoitukset

Merkittävin