Trendaavat aiheet

#

Bonk Eco continues to show strength amid $USELESS rally

#

Pump.fun to raise $1B token sale, traders speculating on airdrop

#

Boop.Fun leading the way with a new launchpad on Solana.

DefiMoon 🦇🔊

#Defi news, updates and opinions.

Tweets are not financial advice, please don't send me PMs asking for financial advice.

Wow, the gap between $ETH and $BTC 24h volume just keeps growing.

Also notice how big the gap is between $USDT and bitcoin 24h volume:

It used to be that majority of Tether's volume was concentrated in the #bitcoin market, but that seems to no longer be the case.

Michael Saylor and $MSTR shareholders might be starting to get a little nervous here as Ethereum and the rest of the altcoin market is now commanding majority of the daily crypto volume, as well as ETF flows.

Saylor could really turn out to be the egg-man🥚🥺

5,14K

🔥UPDATE: Savings $crvUSD APY has increased from 7.4% to 9% as weekly distributions to scrvUSD hit a new record high this week:

Demand for crvUSD is expected to increase dramatically due to the strong performance of $CRV which is pushing yields up across all @CurveFinance pools, especially crvUSD pools.

The CRV pump is already starting to push up crvUSD mcap:

August outlook:

If CRV starts rallying towards $2 into end of July, early August, crvUSD mcap + daily volume could see significant increases from borrowers, LPs looking for competitive yields in the Curve ecosystem.

#DeFi 🌑🌘🌗🌖🌝

DefiMoon 🦇🔊9.7. klo 02.12

scrvUSD is currently offering some of the highest organic stablecoin yield in all of DeFi @ 7.4%

That's much higher than the 4% $sUSDe offers, or the 3.5% average supply rate of $USDC, $USDT on AAVE, or even Hyperliquid's HLP vault, which is currently offering 6% APR on USDC deposits!

Savings $crvUSD holders have been receiving record distributions since start of June due to elevated borrow rates📊📈

The savings rate has steady increased since the beginning of May:

The rising yields have attracted a lot of new depositors into the savings vault in May, June.

On June 26th, scrvUSD supply hit a record high of $50.7m

The solid performance of scrvUSD over the past 2 months has stabilized the crvUSD peg considerably as @CurveFinance noted in this post:

If scrvUSD APY continues to climb and rises above 8%, or even 9-10% into July and August, demand for crvUSD could rise considerably.

$CRV $CVX

15,09K

UPDATE: $SBET is going for a $5b ATM and they still have $279M left over from the previous one! 😍

🔥💰

Looking increasingly likely that ETHBTC going to 0.1 by the end of 2025, which puts $ETH above $12k given where bitcoin is trading today....

If the ETFs start seeing sustained inflows of $1b+ then anything becomes possible lmao 🌝

DefiMoon 🦇🔊16.7. klo 00.37

1⃣ ETFs sustaining $200m+ of inflows per day

2⃣ $SBET raised $413m in 4 days via ATM sales

3⃣ ETH flowing out of exchanges at record pace

4⃣ $ETH / $BTC near lows from 2020

What happens next? 🍿📊🔥

2,06K

🔥UPDATE: $CRV 24h volume has now surpassed $TRUMP and is closing in on $HBAR, $PUMP

DefiMoon 🦇🔊18.7. klo 02.40

$CRV 24h volume almost matching $TRUMP, and exceeding $AAVE, $UNI, $LINK, $ENA and $ARB

But CRV also has the smallest FDV of all these coins🙃

I love this timeline 🌑🌘🌗🌖🌝

51,28K

~26 days until the next $CRV "halving."

Coinbase 🛡️18.7. klo 02.43

~1,000 days until the next Bitcoin halving.

2,64K

1⃣ ETFs sustaining $200m+ of inflows per day

2⃣ $SBET raised $413m in 4 days via ATM sales

3⃣ ETH flowing out of exchanges at record pace

4⃣ $ETH / $BTC near lows from 2020

What happens next? 🍿📊🔥

SBET (SharpLink Gaming)15.7. klo 20.38

In addition to becoming the largest $ETH holder among corporate entities, SharpLink raised approximately ~$413M in net proceeds through its ATM program between July 7–11

Of that total, ~$156M has already been deployed into ETH, with ~$257M in capital still available for future Ethereum acquisitions.

We remain committed to transparent, best-in-class treasury reporting

6,64K

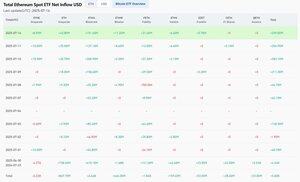

Ethereum spot #ETF inflows came in @ $259m for 7/14/2025

This is the 4th consecutive trading day where inflows exceeded $200m 📊📈💪

Total ETH purchased was 87.2k

This is a really impressive figure considering only 2676 ETH was issued to Ethereum network validators over the past 24h, and 460 ETH was burned via gas fees, so net issuance was only 2216 ETH!

The ETFs in one day gobbled up ~40x the daily issuance!!! 🤯

Even if the #ETFs can average 5-10x daily issuance, the long-term impact on price should in theory be enormous, and that's not even counting all the ETH that will be absorbed by existing and upcoming treasury companies like $SBET

How is ETH not above $10k already? lmao

$ETHA $ETHE $FETH

6,89K

Johtavat

Rankkaus

Suosikit

Ketjussa trendaava

Trendaa X:ssä

Viimeisimmät suosituimmat rahoitukset

Merkittävin