Trendaavat aiheet

#

Bonk Eco continues to show strength amid $USELESS rally

#

Pump.fun to raise $1B token sale, traders speculating on airdrop

#

Boop.Fun leading the way with a new launchpad on Solana.

ETHEREUM WILL PUMP EVEN HARDER 🧐

ETH is nearing $4,000. And I can’t wait to get there…

Because there’s a wall of shorts that need to be liquidated.

But what’s really driving this move?

Yes, adoption is real. Institutions are buying.

But fundamentals matter too.

ETH grows with the GDP of its top applications.

The stronger the revenues from protocols like @aave , @MorphoLabs , @eulerfinance , or leading DEXs…

The stronger the case for ETH price appreciation.

This flipped my view.

DeFi apps are now real businesses. Some with massive volume, user base, and yield dynamics.

And they’re building the economic engine that powers Ethereum.

We’ve hit a point where:

– Aave is making headlines with historical revenue highs and TVL inflows.

– Morpho loops are the standard

– DEXs are eating CEXs in spot volume ratios

– On-chain derivatives can go toe-to-toe with TradFi

If that thesis holds, ETH doesn’t just go to ATHs…

It goes WAY beyond.

18.7. klo 20.55

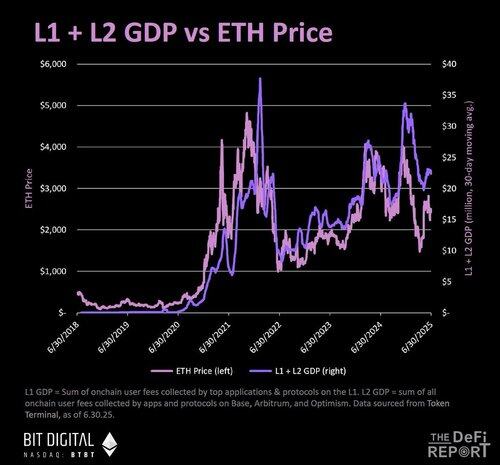

If you're an ETH holder, you should understand which KPIs tend to drive price action.

1. Real Onchain Yield? Low correlation.

2. L1 + L2 Transactions? Relatively correlated.

3. L1 + L2 GDP? Tightly correlated.

You might also want to know what "fair value" looks like. How ETH's token economics impact Store of Value. Onchain Velocity. Operating Performance. And Network Fundamentals.

The Q2 version of The ETH Report covers everything you need to know from the tokenholder perspective.

No noise or hype. Just fundamentals. Core KPIs. And qtr-to-qtr explanation.

Download a copy + access the @Dune below 👇

Brought to you by @BitDigital_BTBT

2,01K

Johtavat

Rankkaus

Suosikit