Trendaavat aiheet

#

Bonk Eco continues to show strength amid $USELESS rally

#

Pump.fun to raise $1B token sale, traders speculating on airdrop

#

Boop.Fun leading the way with a new launchpad on Solana.

Michael Nadeau | The DeFi Report

It's not 1971.

It's 2025.

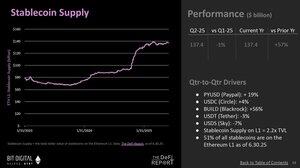

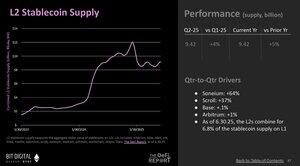

Stablecoins are the new mechanism to amplify the network effect of the dollar + generate a (decentralized) new global buyer of US debt.

55% of the stablecoins are on the Ethereum Network.

What does it all mean for ETH holders?

Link to the Q2 edition of The ETH Report and supporting @Dune dashboard below 👇

Michael Nadeau | The DeFi Report21.7. klo 23.13

Bessent is Kissinger.

Trump is Nixon.

Stablecoins are the new "petro dollar."

Tether is the new Saudi Arabia.

We just entered a new regime. A new "magic trick" — one designed to amplify the network effect of the dollar and decentralize the holder base of U.S. debt.

It's not a "Mar-a-Lago accord"

It's called the GENIUS Act

---

I wrote about this last week for readers of @the_defi_report

If you'd like to check out the latest research, you can so via the link below 👇

17,68K

Michael Nadeau | The DeFi Report kirjasi uudelleen

ETHEREUM WILL PUMP EVEN HARDER 🧐

ETH is nearing $4,000. And I can’t wait to get there…

Because there’s a wall of shorts that need to be liquidated.

But what’s really driving this move?

Yes, adoption is real. Institutions are buying.

But fundamentals matter too.

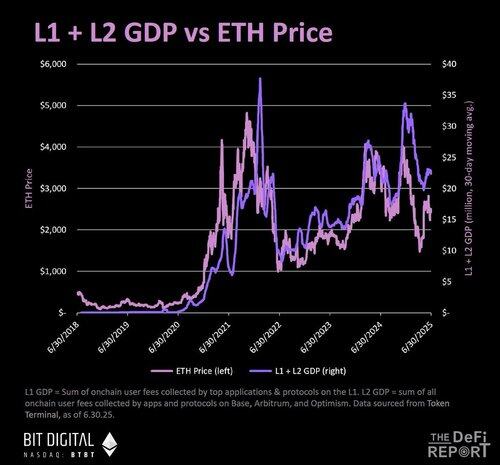

ETH grows with the GDP of its top applications.

The stronger the revenues from protocols like @aave , @MorphoLabs , @eulerfinance , or leading DEXs…

The stronger the case for ETH price appreciation.

This flipped my view.

DeFi apps are now real businesses. Some with massive volume, user base, and yield dynamics.

And they’re building the economic engine that powers Ethereum.

We’ve hit a point where:

– Aave is making headlines with historical revenue highs and TVL inflows.

– Morpho loops are the standard

– DEXs are eating CEXs in spot volume ratios

– On-chain derivatives can go toe-to-toe with TradFi

If that thesis holds, ETH doesn’t just go to ATHs…

It goes WAY beyond.

2,02K

Bessent is Kissinger.

Trump is Nixon.

Stablecoins are the new "petro dollar."

Tether is the new Saudi Arabia.

We just entered a new regime. A new "magic trick" — one designed to amplify the network effect of the dollar and decentralize the holder base of U.S. debt.

It's not a "Mar-a-Lago accord"

It's called the GENIUS Act

---

I wrote about this last week for readers of @the_defi_report

If you'd like to check out the latest research, you can so via the link below 👇

2,37K

If you know, you know

Michael Nadeau | The DeFi Report21.7. klo 04.54

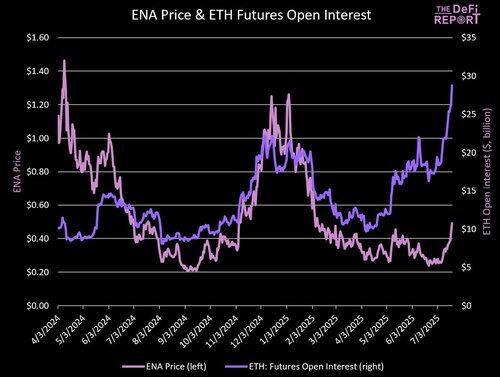

We shared our memo on @ethena_labs with readers of @the_defi_report on 6/20

The setup and thesis were simple:

1. We're bullish ETH

2. Ethena has a reflexive relationship to ETH (in particular, ETH open interest)

3. Ethena has several tailwinds at its back: stablecoin narrative, yield-bearing stablecoin, integrations w/TradFi, roadmap catalysts (fee switch)

Not to mention, we feel strongly about Ethena's team.

We presented it as a high-risk/reward play that should provide beta to ETH

That's exactly what's playing out now (ENA up 80% since we posted our memo, ETH up 54% over the same period.

If you'd like to check out the deep dive on the project, you can do so via the link below 👇

3,25K

We shared our memo on @ethena_labs with readers of @the_defi_report on 6/20

The setup and thesis were simple:

1. We're bullish ETH

2. Ethena has a reflexive relationship to ETH (in particular, ETH open interest)

3. Ethena has several tailwinds at its back: stablecoin narrative, yield-bearing stablecoin, integrations w/TradFi, roadmap catalysts (fee switch)

Not to mention, we feel strongly about Ethena's team.

We presented it as a high-risk/reward play that should provide beta to ETH

That's exactly what's playing out now (ENA up 80% since we posted our memo, ETH up 54% over the same period.

If you'd like to check out the deep dive on the project, you can do so via the link below 👇

6,37K

💯

@BanklessHQ is huge because they consistently produce top notch content + have a talented team devoted to educating people

Wish more people respected how hard it is to do this day in/day out for 6+ years

A sneaky thing I've noticed about their content is the interviews that have fewer views often are packed with the most signal (they tend to be interviews with policymakers/CEOs/leaders, etc)

A recent interview with the CEO/Founder of @Tether_to is a good example

---

I'm lucky to have a behind-the-scenes look at the entire Bankless operation and can tell you that it is a top-notch professional organization devoted to providing service to our industry

The more I learn about Bankless, the more bullish I am on their future

Mike Silagadze🛡21.7. klo 00.14

I gotta say @BanklessHQ is objectively an awesome podcast. One of the best in crypto.

Tons of super high quality guests diving deep into topics that matter in crypto.

Just listening to the pod with @DinariGlobal and it’s seriously educational and great.

15,87K

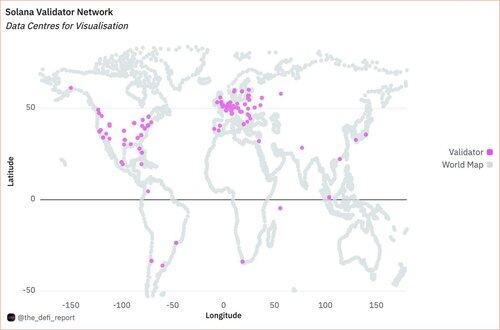

If anyone was wondering, Solana has validators located in:

- Alaska & all corners of the U.S.

- Mexico

- Colombia

- Argentina, Brazil, and Chile

- Across Western Europe

- India & UAE

- Russia

- Southeast Asia

----

You can access the chart below in our SOL Report @dune dashboard. Link below 👇

Dune20.7. klo 01.00

6/ A new dashboard by @the_defi_report breaks down the State of @solana. Some of the data points tracked:

• $2.5M+ daily REV

• ~8% staking yield (6% from issuance)

• $11B stablecoins, $9B+ TVL

• 57M SOL in liquid staking

• A stunning validator map

11,21K

Record inflows into the ETH ETFs.

Net flows are now up to $7.1b with 35% of that flooding in the last two weeks (!)

Data: @glassnode

----

P.S. we covered everything ETH holders need to know from the tokenholder perspective in the Q2 edition of The ETH Report.

Download a copy + access the @Dune dashboards below 👇

1,64K

Crypto won.

That's the takeaway from the GENIUS Act making its way through Congress and to the President's Desk yesterday.

Most will sleep through this.

Not realizing that finance and payments changed forever yesterday.

Banks will never be the same.

Fintechs will never be the same.

Visa/Mastercard will never be the same.

Not to mention. The Network Effect of The Dollar is about to explode while the holders of U.S. debt globally become decentralized by stablecoins.

Read that last sentence again.

It's probably the biggest takeaway. And why Stablecoins came before the broader crypto market structure bill.

----

We covered it all in this week's edition of @the_defi_report: Crypto's "ChatGPT" Moment.

See the link below to check out the latest research 👇

5,02K

Johtavat

Rankkaus

Suosikit

Ketjussa trendaava

Trendaa X:ssä

Viimeisimmät suosituimmat rahoitukset

Merkittävin