Trendaavat aiheet

#

Bonk Eco continues to show strength amid $USELESS rally

#

Pump.fun to raise $1B token sale, traders speculating on airdrop

#

Boop.Fun leading the way with a new launchpad on Solana.

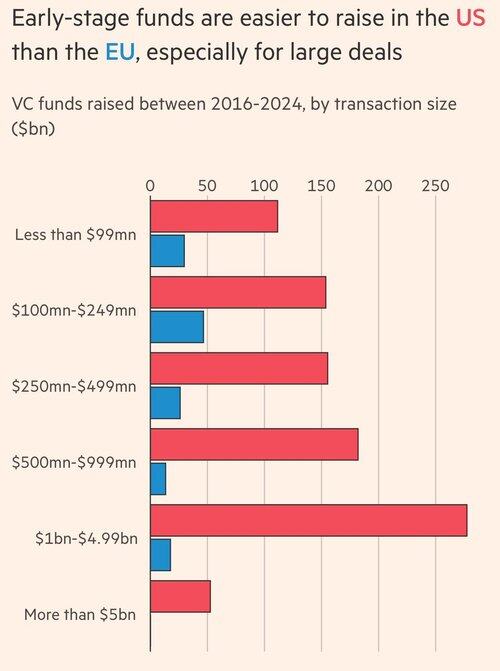

Europe is so cooked.

Even if a startup had an innovative product and a viable go-to-market strategy, the capital wouldn’t be there to support them.

The EU has zero VC funds with $5B+ capital pools, compared to more than 50 in the US. Fewer than 25 with $1-5B, compared to more than 250 in America. The money simply isn’t there.

And AI is only going to exacerbate the dynamic. The dominant AI startups are virtually all American, backed by a combination of US venture capital, US strategic investors, and middle eastern sovereign wealth. As these startups work toward (eventual) liquidity events, the power law of VC returns will become even further tilted toward US firms managing huge asset pools (hence why a16z, Sequoia, Thrive, and Founders Fund are all now RIAs).

Massive US funds will return massive amounts of capital to LPs, making it even easier to raise their next—and even larger—fund, which will invest in the next round of innovative American startups. The synergistic flywheel of American capital and innovation will spin even faster, all while Paris, Berlin, and Brussels get even further left behind.

It would be tragic. If they hadn’t done it to themselves.

50,83K

Johtavat

Rankkaus

Suosikit