Trendaavat aiheet

#

Bonk Eco continues to show strength amid $USELESS rally

#

Pump.fun to raise $1B token sale, traders speculating on airdrop

#

Boop.Fun leading the way with a new launchpad on Solana.

Berachain V2 Proposal: Enhancing the Protocol’s Ability to Capture On-Chain Cash Flow and Reshape Its Value Anchor

V2 Upgrade: Elevating $BERA as the Core Ecosystem Asset and Highlighting Berachain’s Technical Progress

The core objective of the PoL V2 proposal is to transform $BERA from a marginal gas token into a core, profit-generating asset.

PoL V2 proposes reallocating 33% of DApp bribe incentives from BGT governance token holders to BERA stakers, directly delivering on-chain cash flow to BERA.

V2 will support Liquid Staking Tokens (LSTs), allowing BERA stakers to earn additional PoL incentives using staking certificates, while simultaneously receiving validator rewards — significantly improving capital efficiency.

Berachain is optimizing the user experience through product and feature enhancements.

BERA stakers can benefit directly from on-chain protocol revenues without needing to engage in complex DeFi strategies or hold BGT, lowering the barrier to participation for everyday users.

The newly launched Berahub features an upgraded UI, a revamped asset portfolio dashboard, and one-click Vault access — making it easier for users to explore the Berachain ecosystem and tap into diverse PoL revenue opportunities.

Berachain On-Chain Data Analysis

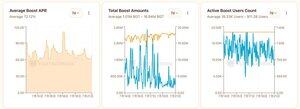

Over the past 7 days, Berachain’s daily on-chain incentive total averaged approximately $500,000. Under PoL V2, one-third of this (around $167,000/day, or $1.16 million/week) is injected directly into the BERA staking pool as protocol cash flow.

The average total daily incentive liquidity across the network was $4.12 million during the same period, down from a peak of ~$800,000/day to the current ~$400,000/day.

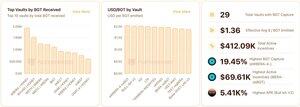

There are currently 29 active BGT incentive-capturing Vaults being tracked. The highest APR across the ecosystem is 5.50%, held by the Bull Ish V2 Vault.

$BERA’s current market capitalization stands at approximately $270 million, while the ecosystem’s peak Total Value Locked (TVL) reached $3 billion. This results in a market cap to TVL ratio of less than one-third, signaling a disconnect between the token’s valuation and the ecosystem's capital activity.

PoL V2 adjusts the on-chain incentive structure such that BERA stakers now receive 33% of DApp bribe incentives directly, with the remaining 67% allocated to BGT holders. Incentive fund flows are transparent and publicly available.

Currently, total daily incentive allocations remain around $500,000, primarily flowing into top whitelisted Vaults — which also lead the ecosystem in terms of BGT rewards and bribe volume.

Future Outlook

PoL V2 is designed to re-anchor BERA’s value by enabling it to directly capture protocol-level cash flow.

By evolving BERA into an interest-bearing asset that reflects the real income of the ecosystem, the proposal is expected to drive sustained demand and attract institutional investors seeking productive crypto assets.

The V2 mechanism is poised to create a positive flywheel within the Berachain ecosystem.

Enhanced BERA staking yields will draw in long-term holders, increase token lock-up, and reduce sell pressure. As prices stabilize and network security improves, more developers are expected to deploy DApps on Berachain — forming a closed-loop of staking → incentives → DApp growth.

6,55K

Johtavat

Rankkaus

Suosikit