Trendaavat aiheet

#

Bonk Eco continues to show strength amid $USELESS rally

#

Pump.fun to raise $1B token sale, traders speculating on airdrop

#

Boop.Fun leading the way with a new launchpad on Solana.

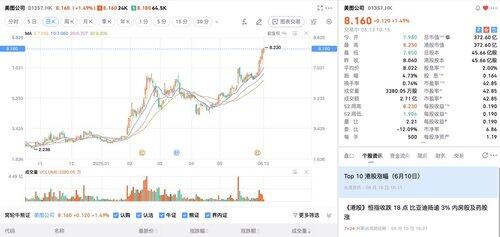

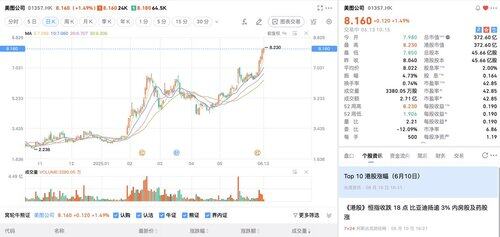

Meitu has tripled its value year-to-date, and there are several reasons to pay attention to Meitu

1. When the crypto assets are at a high level, all the dividends are withdrawn to shareholders, and there is abundant cash in the account for development

2. Alibaba's US$250 million strategic investment, with a debt-to-equity swap share price of about HK$6, can be used as a reference standard for stock price support

3. China's non-game manufacturers rank second in terms of overseas revenue, the first is Byte, and with the high growth rate overseas, AI tools are naturally suitable for going overseas, and Meitu is also the best at tools

This year, Hong Kong stocks are speculating on new consumption concepts, Bubble Mart, Xiaomi, Laopu Gold, and Mixue Bingcheng are all super bull stocks, and the development of AI technology has reached the part that Chinese companies are best at, and there is a considerable probability that a 10 bagger stock will be born.

13.6.2025

If you want to provide emotional value tools, isn't Meitu actually the same? Isn't it a great pleasure to have your own photos photographed beautifully? The audience is also larger, and Meitu made 570 million yuan after clearing cryptocurrencies at a high level, all of which were distributed to shareholders, and then cooperated with Alibaba to all in AI.

There is nothing special about the tool, but in certain scenarios, you are willing to spend money and be optimistic about Meitu, which may be 10 baggers this year

AI+ emotional value believes that Meitu can do a good job, and will continue to look for such a company.

80,1K

Johtavat

Rankkaus

Suosikit