Trendaavat aiheet

#

Bonk Eco continues to show strength amid $USELESS rally

#

Pump.fun to raise $1B token sale, traders speculating on airdrop

#

Boop.Fun leading the way with a new launchpad on Solana.

链研社

Explain why it is said that the net is being closed. SBET holds over 310,000 coins, worth more than 1 billion USD, but most of these holdings are just being shuffled from one hand to the other, with a small portion purchased from the market. Holding 1 billion USD worth of ETH cannot dominate the crypto market.

So SBET has taken a different approach, using 1 billion USD to leverage a market cap of 400 billion for ETH. Recently, many people have started to claim that ETH has risen due to value discovery, but the relationship is not significant; it is not an improvement in fundamentals, but rather that a consortium has discovered a way to print money. Let me explain this to you in detail.

1. Buy a shell company in the US stock market, inject 1 billion USD into the publicly listed company, and dilute existing shareholders through a secondary offering. They control 90% of the circulating shares, then say, look, my company's net assets are now equal to the ETH I hold, why don't you buy in?

2. In the crypto market, they say that US-listed companies are starting to accumulate ETH, and the company still has cash and will continue to purchase tens of billions of USD from the market, so ETH is bound to skyrocket.

3. When ETH rises, it becomes easier to raise funds through issuing junk bonds in the US stock market, raising a few hundred million USD, all used to buy ETH.

In the end, not only do they gain a company worth tens of billions of USD, but they also hold tens of billions of USD in ETH. With SBET's current market cap being only around 3 billion, they still want to issue more shares to raise 5 billion USD. After deducting liabilities, they could net tens of billions of USD in just a few months? Faster than Trump's money printer!

Raising funds through junk bonds is even more than raising funds through US stock listings, which is absurd. It is similar to the previous SPAC shell company hype, and it will eventually be called to a halt by regulators. If that happens, the stock could face a drop of 50%-70%, and ETH might also drop back to its original point, falling by 30%.

I don't know how long this market irrationality will last, but these are things you need to understand clearly before participating. This is neither a new model nor a perpetual motion machine.

链研社16 tuntia sitten

Complete success! SBET has once again closed the net, hope you haven't been trapped.

185,58K

Meitu has taken a script of rebirth similar to Pop Mart. Meitu's stock peaked at HKD 11.96, dropping 96%, and is now at HKD 10.6. Based on the lowest point in 2022 of HKD 0.46, it has already seen a 23-fold increase, while Pop Mart rose from its lowest point of HKD 8.8 to HKD 266, a 30-fold increase.

Meitu has 266 million monthly active users. It has 14 million paying users, with a revenue growth rate of 30%. Meitu's AI tools are among the top in the market, focusing on solving the issues of e-commerce product images, providing essential solutions for product conversion rates and bulk image generation, making commercialization easier. Additionally, it is backed by Alibaba's server computing resources, creating a certain moat. Even if other companies level the playing field with Meitu in terms of algorithms, without the advantage in computing power, they still cannot shake Meitu's position.

Moreover, Meitu consistently ranks in the top 5 for overseas revenue in China, with its ranking relying on some overseas hit features like AI dressing and portrait photography. Long-term competitiveness will depend on the global penetration of AI productivity tools and the deepening of paid conversions.

Meitu's moat lies in: the ability to solve essential needs in vertical scenarios (such as e-commerce design) + Alibaba's computing power positioning + the potential for global paid deep exploration. If it continues to fulfill the explosive expectations of "productivity tools going overseas," it may replicate Pop Mart's trajectory to a market value of hundreds of billions.

链研社8.7. klo 20.52

如果你看我推文在 6 月 13 号的时候买入 7.77 买入,现在也有 20% 的涨幅了,美图今年的表现其实比泡泡玛特、小米、蜜雪都还要强,但是讨论的人并不多,美图到底发展怎么样只要看他们的海外收入是否有增长就行了。

美图我是在阿里投资美图后买入的,现在同样被低估的公司还有阿里,被错杀的太严重了,昨晚买入了最后一笔阿里巴巴就建仓完毕了,可以躺平半年,相信阿里正走在正确的道路上,短期有阵痛很正常。

22,62K

链研社 kirjasi uudelleen

Mr. Wang Chuan's sentence has been used for life: the key to understanding tsunamis is to pay attention to and observe earthquakes in the deep sea, rather than inconsequential waves on the shore.

It just takes the heart of the following tweet: most investors are staring at the waves to see the good news in the market, and only a few are listening to the crust that has been ambushed before the waves come.

Obviously, when it comes to investment, we must realize that the observation of deep-sea earthquakes in the earth's crust is the first principle, and everything else is everything else!

This passage actually illustrates the three-tiered realm of tsunami philosophy:

The first layer: watch the waves: chase the news, listen to KOLs, follow the trend and buy up; Emotionally driven, fluctuations are signals;

Level 2: Look at the tides: study data, trends, liquidity changes; Macro-driven, cyclical understanding;

The third layer: looking at the earthquake: insight into institutional change, technical paradigm, value logic reconstruction; Structurally driven, the certainty that the bet did not occur;

But the real "rising tide" is actually a window of opportunity for system reconfiguration, and you can get the benefits of the first few layers at the first few layers.

Any investment with a large cycle of return is the result of structural fission + predictive betting + position crossing, which is the tsunami: the tsunami is not the norm, but the tsunami is the only leverage, and the investment that can truly achieve the "destiny step" must be completed in the tsunami.

Other words:

The tsunami moment is the reshuffling of wealth; Standing in the direction of the tide is more important than any effort.

37,28K

The United States is reshaping its global financial hegemony through stablecoins and U.S. stocks.

For decades, the dollar has seemed to hold an unassailable hegemonic position in the global financial system. However, in recent years, geopolitical tensions, the ongoing expansion of debt, and the "weaponization" of financial sanctions have led to a backlash, gradually weakening the dollar. Although the process is slow, the trend is evident.

The three major issues currently facing the dollar are:

1. Declining reserve status

2. Continuous debt expansion

3. Backlash from financial weaponization

Now, the core strategy of the United States relies on two pillars: compliant dollar stablecoins and tokenized U.S. quality assets. The goal is to build a parallel, technology-driven dollar value network that deeply binds the global digital economy to the dollar ecosystem once again. On-chain dollars solve circulation and payment issues, while on-chain U.S. stocks provide quality assets, effectively depriving third-world countries of their minting rights.

➤ The first pillar: Regulated "on-chain dollars" — transforming global demand into U.S. Treasury purchasing power.

The first pillar of the U.S. strategy is to establish compliant dollar stablecoins as the default medium of circulation in the global digital economy. Recent key legislation, such as the Lummis-Gillibrand Payment Stablecoin Act, has accelerated the formal inclusion of mainstream stablecoins like USDC into the federal regulatory framework.

The brilliance of this legislation lies in its requirement that stablecoin issuers must invest the vast majority of their reserves in highly liquid quality assets, with short-term U.S. Treasury bonds being the core option. This means that every purchase and use of digital dollars in the global market will almost equate to an indirect purchase of U.S. government debt.

This mechanism has found a continuous, global new buyer for the massive U.S. national debt. When users in Asia purchase USDC for cross-border payments, or when investors in South America use stablecoins to enter the decentralized finance (DeFi) market, most of the funds exchanged from their fiat currency will flow to the stablecoin issuers, who will then buy U.S. Treasury bonds as reserves. According to industry experts and some research institutions (such as the Atlantic Council), as the stablecoin market expands (expected to reach trillions of dollars by 2030), this mechanism is likely to effectively alleviate the issuance pressure of trillions of dollars in U.S. debt in the coming years, converting external demand into direct support for U.S. finances.

➤ The second pillar: Tokenized "on-chain U.S. stocks" — attracting global capital.

If stablecoins solve the "liquidity" problem of the dollar, then the second pillar of the U.S. strategy aims to address the "attractiveness" problem — that is, to "tokenize" the highest quality financial assets of the U.S., such as U.S. Treasury bonds and blue-chip stocks, making them the preferred digital reserve assets for global investors.

Marked by the launch of the tokenized fund BUIDL by Wall Street giant BlackRock, the BUIDL fund converts high-credit U.S. short-term Treasury bonds into digital tokens that can be traded globally on the blockchain 24/7. This model, known as "real-world asset tokenization" (RWA), significantly lowers the entry barriers for global investors.

In the past, an ordinary investor from a country wanting to purchase U.S. Treasury bonds or stocks had to go through cumbersome processes of account opening, currency exchange, and cross-border transfers. Now, theoretically, anyone from any region can conveniently invest in these core U.S. assets with just a digital wallet. As BlackRock CEO Larry Fink stated, "The tokenization of any stock or bond is the next generation of financial development." This unprecedented accessibility is creating a powerful capital attraction, efficiently drawing global savings into the U.S. capital markets.

These two pillars do not exist in isolation; they form a sophisticated, self-reinforcing capital loop. Global users exchange their local currency for USDC, and stablecoin issuers then invest their reserves in U.S. Treasury bonds; subsequently, users use USDC to purchase tokenized U.S. stocks or bond funds. Starting from the wallets of global users, this supports U.S. debt, which ultimately flows back into the U.S. capital markets.

This loop cleverly bypasses many barriers and frictions in the traditional financial system, maximizing efficiency through blockchain technology. It injects new vitality into the circulation of the dollar and finds broader global buyers for U.S. core assets, representing not only an upgrade of the existing financial order but potentially a decisive shift in the future of global financial hegemony.

17,81K

pumpfun's public offering = I am Qin Shi Huang, give me money.

Carefully read the terms, they have closed off all paths for you to defend your rights, and since it's all Chinese participants, there aren't many reputable project parties left to exploit. Remember how the terms for EOS were just as bad?

At that time, they wrote: "Investors purchasing EOS tokens do not enjoy any company rights, including but not limited to voting rights, dividends, redemption rights, liquidation rights, intellectual property rights, or other financial and statutory rights. The purchase of tokens does not constitute a loan to the company, nor does it confer any ownership or equity."

You could say it's exactly the same; pumpfun has already made thorough preparations for their complete withdrawal.

链研社11.7. klo 12.51

Is the public offering of pumpfun a mindless opportunity to make money or a carefully designed "dumping" trap? After research, it seems that this might be a trade with about a 70% upside and unlimited downside, making the overall risk-reward ratio not that favorable.

Here are a few reasons:

1. Timing for extracting liquidity: Pump.fun has delayed its launch multiple times, ultimately deciding on a time window when liquidity is most abundant. If the project aims to control the market and gather chips, there’s no need to choose this moment deliberately; the goal is likely to maximize value extraction at once, rather than for long-term project operation.

2. The issue of high valuation and financing: The public offering is valued at $4 billion, ranking 50th in market cap, with $600 million raised, creating significant selling pressure and no lock-up restrictions. This also includes investors, arbitrage funds, and the project team itself. How many major players are confident they can profit after manipulation, and how much capital do they need to prepare?

3. Special supply for Chinese people: The public offering strictly excludes high-regulation markets like the U.S. and Europe, and instead supports Asia, allowing those with purchasing power to participate directly in the public offering. Who will take over later? Will Americans and Europeans step in?

4. Project fundamentals: Total revenue is $700 million, but income has plummeted by 92% compared to its peak. The problem is the rapid decline of the meme market, and Pump.fun is also struggling to maintain its market share. In this case, a normal valuation of 10 times would already be good, which means a fully diluted valuation of $7 billion, and the project team is almost certainly not considering dividends, making it impossible to support the market cap.

37,37K

Is the public offering of pumpfun a mindless opportunity to make money or a carefully designed "dumping" trap? After research, it seems that this might be a trade with about a 70% upside and unlimited downside, making the overall risk-reward ratio not that favorable.

Here are a few reasons:

1. Timing for extracting liquidity: Pump.fun has delayed its launch multiple times, ultimately deciding on a time window when liquidity is most abundant. If the project aims to control the market and gather chips, there’s no need to choose this moment deliberately; the goal is likely to maximize value extraction at once, rather than for long-term project operation.

2. The issue of high valuation and financing: The public offering is valued at $4 billion, ranking 50th in market cap, with $600 million raised, creating significant selling pressure and no lock-up restrictions. This also includes investors, arbitrage funds, and the project team itself. How many major players are confident they can profit after manipulation, and how much capital do they need to prepare?

3. Special supply for Chinese people: The public offering strictly excludes high-regulation markets like the U.S. and Europe, and instead supports Asia, allowing those with purchasing power to participate directly in the public offering. Who will take over later? Will Americans and Europeans step in?

4. Project fundamentals: Total revenue is $700 million, but income has plummeted by 92% compared to its peak. The problem is the rapid decline of the meme market, and Pump.fun is also struggling to maintain its market share. In this case, a normal valuation of 10 times would already be good, which means a fully diluted valuation of $7 billion, and the project team is almost certainly not considering dividends, making it impossible to support the market cap.

38,62K

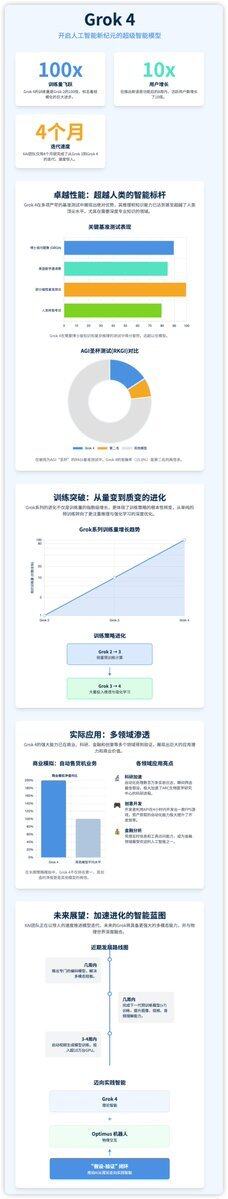

The Grok4 launch event can only be described as unremarkable; after trying it out, the performance was somewhat disappointing.

Here’s a summary of the event content👇

1. Performance: Grok 4 excelled in multi-domain tests, with a correct rate on challenging problems like the "ultimate human exam" far exceeding that of similar models. The multi-agent version performed even better, achieving full marks in programming, mathematics, and other tests, with academic capabilities at a graduate level, surpassing most humans.

2. Training Development: From Grok 2 to 4, the training volume has increased exponentially, with the 4th generation being 100 times that of the 2nd. The transition from the 3rd to the 4th generation focused on reasoning and reinforcement learning, utilizing data augmentation techniques and supercomputers to achieve principle reasoning and self-correction.

3. Functional Applications: Voice interaction latency has been halved, and natural voice has been added; after the API was opened, it has been widely applied in commercial simulations, scientific research, game development, etc., such as enhancing the net value of vending machine businesses, accelerating scientific research, and rapidly developing games.

4. Future Plans: A coding model will be launched in a few weeks to enhance multimodal capabilities; in the next 3-4 weeks, video generation training will commence, aiming to create a faster and smarter model to advance human civilization.

8,43K

Grok4 has been released, and Musk is really bold to set the price at $300 a month and $3,000 a year. However, the actual impact is still far from the shock brought by Google's Gemini launch.

xAI10.7. klo 12.01

Introducing Grok 4, the world's most powerful AI model. Watch the livestream now:

13,66K

Johtavat

Rankkaus

Suosikit

Ketjussa trendaava

Trendaa X:ssä

Viimeisimmät suosituimmat rahoitukset

Merkittävin