Trendaavat aiheet

#

Bonk Eco continues to show strength amid $USELESS rally

#

Pump.fun to raise $1B token sale, traders speculating on airdrop

#

Boop.Fun leading the way with a new launchpad on Solana.

raagulanpathy

The Stablecoin Guy | Founder at @kastcard | Investing at @JaffCap | Ex-VP of Circle APAC

“Sales saved me from ADHD”

Over a recent coffee chat, I was discussing the topic of smart people who struggle with focus.

Then I remembered my own evolution.

In my 20s, I mostly went from role to role. Though I had success, I suffered terrible issues with focus. I lost interest quickly, often started as a solid performer and but ended as a low performer, or eventually got fired.

That’s the dead truth.

I wouldn’t hire 20s me.

Big shoutout to those who did though!!!

But through some self-reflection, I realised my failures were from being in “low consequence roles”

What do I mean by that?

Well, in the majority of roles, the gap between being successful vs not, is maybe +/-20% in income.

But… in sales, the difference can be 3-5X and in companies like Zoom even 10X+

Definite personal consequences for low performance.

In founding a company, the personal consequences are even more striking - 100X or 1000X.

When I founded my first company, and then later at Amazon, I learnt that the big $$$ rewards of smashing quotas requires strong focus, exemplary hustle, and that coffee is for strictly closers.

The monetary reward structure of these roles, created the focus for me. Fixed my ADHD.

If you struggle with focus.

Find your hack.

Because I’m telling you… it can be fixed.

But just also know if you don’t fix it, the world isn’t going to magically gift you huge upside, without delivering results.

1,35K

Congrats to the Ethena team, my singular crypto holding outside majors is $ENA and it’s the #1 holding in my fund too.

G | Ethena21.7. klo 22.17

It is now obvious that the growth of digital dollars and stablecoins is not only the most important story in crypto, but all of finance.

There are hundreds of billions in latent TradFi demand for crypto exposure, but this demand is primarily focused on a narrow subset of themes:

BTC, ETH & stablecoins.

The launch of StablecoinX will provide the first pure play exposure for equity investors to the fastest growing company in the most important thematic trend in crypto: digital dollars upgrading money into the internet era and eating all of finance in the process.

12,67K

raagulanpathy kirjasi uudelleen

Critical insights on stablecoin business model fundamentals from @raagulanpathy, CEO of @kastcard.

When interest rates dropped to 0.25%, net yields after banking fees fell to just 0.1%.

Here’s the reality check: What happens when rates hit zero?

Japan's 30-year zero interest rate environment demonstrated this isn't hypothetical—stablecoin businesses face real sustainability challenges without diversified value propositions.

Build for utility, payments efficiency, and operational advantages. Interest income should complement your core business model, not anchor it.

Essential viewing for anyone in the stablecoin space from S4.5 of Stableminded, Building Stablecoins powered by @m0 ↓

1,96K

America is officially back, and officially the king again!

The White House19.7. klo 06.29

✅ GENIUS ACT SIGNED INTO LAW

"The GENIUS Act creates a clear and simple regulatory framework to establish & unleash the immense promise of dollar-backed stablecoins. This could be perhaps the GREATEST revolution in financial technology since the birth of the internet itself."

1,24K

Sent this note on JaffCap Ocean Fund:

(FYI: started as my money & >half is still my own money. Not financial advice, DYOR).

—-

Mid-July Update: Are we back?

In the last two months, crypto has gone through a long stale period of sideways action with Bitcoin between $100-110k.

It’s a funny industry, even though it can move violently up and violently down, we spend long periods, perhaps even most of the time, actually doing nothing.

And that’s been the trading strategy too, set the positions, and don’t lose out in the chop of trading. The “do nothing” trading strategy for now.

As a fund, we are sitting about 7% below inception price (April 1st 2025), whilst Solana is down 15% and ETH down 3%. The majority of Alts are down significantly, but the Bitcoin price is up about 65%.

The biggest frustration of most crypto funds, is sitting around watching Bitcoin outperform, as it gets status as a pure and “immaculate conception”. And watching Alts get bled.

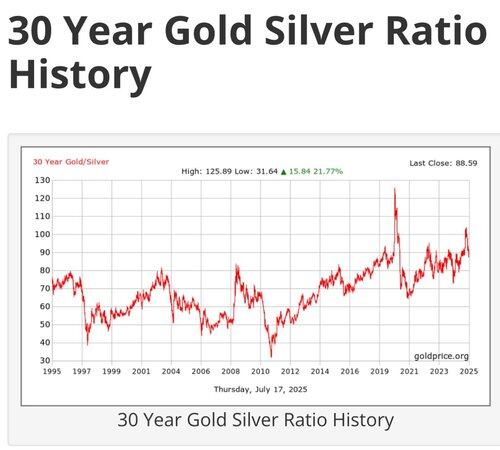

But these things just take time. One of my favourite charts of all time, is the Gold/Silver price ratio. All time high is 125, all time low is 31. 4X difference by ratio. But over decades and centuries, it reverts to the mean.

Right now, our positioning is in ETH and ETH-related Alt coins, because much like Gold and Silver, we believe ETH is an under priced Silver.

Bitcoin is some 65% above 2021 highs, and ETH is 36% below. If you put that on a ratio chart, it shows Bitcoin is up approx 2X on the ratio.

BUT - in every bull market, the ETH ratio has improved at highs, before it goes down again.

I believe we are in the early stages of a breakout, not only of Bitcoin (which recently broke record highs by 12%), but particularly in ETH and the BTC/ETH ratio.

If you also believe that Bitcoin itself is headed to $150-200k, which is 2-3x the 2021 highs and that ETH ratio will revert to the mean. Then we are looking at even a $20k price for ETH, which looks completely and utterly preposterous - until ETH doubles to $8k and then it seems reasonable.

Do we believe ETH is going to $20K?? Probably not, but we do believe it’s Bitcoins Silver, so it’s reasonable to expect $10k+

And this leg of the bull market, smells like a bull market which is going to be steadier, run longer, and eventually suck in more people.

It feels like it’s been a long time coming. Even though it’s only really been 15 months.

Question is.

Finally.

Are we there yet?

In short.

Yes I think so.

We’ll know soon.

2,04K

Johtavat

Rankkaus

Suosikit

Ketjussa trendaava

Trendaa X:ssä

Viimeisimmät suosituimmat rahoitukset

Merkittävin