Trendaavat aiheet

#

Bonk Eco continues to show strength amid $USELESS rally

#

Pump.fun to raise $1B token sale, traders speculating on airdrop

#

Boop.Fun leading the way with a new launchpad on Solana.

tobi lutke

@Shopify CEO by day, Dad in evening, hacker at night. Aspiring comprehensivist. (tweets auto delete eventually) retweet=noteworthy share, not endorsement

tobi lutke kirjasi uudelleen

The @tobi “Context Engineering” post was so so so needed.

We need he and Karpathy level figures to help shift minds here.

Puts focus on where real gains can be had.

The “I’ll tip you $100 if you get this right” prompt engineering era is over.

It’s the context engineering era.

19,52K

tobi lutke kirjasi uudelleen

Canada's outdated capital gains policies are driving entrepreneurs and investors away. We need competitive tax reform to keep talent and investment here, building the businesses of tomorrow.

Today, Canada has two policies to encourage builders to start businesses the Lifetime Capital Gains Exemption (LCGE) and a proposed Canadian Entrepreneur's Incentive (CEI). Together, these mean that instead of paying taxes on half their profits, business owners might only pay on one-third, or sometimes nothing at all—but only up to $3.25 million.

But, these policies simply can’t compete with the US. The USA’s Qualified Small Business Stock (QSBS) lets entrepreneurs avoid taxes on up to $15 million in profits or ten times their original investment. That's five times more than Canada's maximum.

What's more the QSBS excludes fewer categories of company and can be used per business rather than over the lifetime of a single individual. This means repeat entrepreneurs in Canada, who have a higher chance of building successful businesses are discouraged from trying again. While, entrepreneurs, early employees, and investors in the US can use the QSBS again and again for subsequent companies.

The good news is that for the largest exits the gap between Canada and the US decreases due to a more competitive basic capital gains inclusion rate in Canada. This means that if we match the QSBS’s capital gains limit and exclusions it could actually give the Canadian policy an edge driving more investment in the country and supercharging our SMB ecosystem.

However, if we leave the policy as it stands right now companies can never get started because investors and entrepreneurs are scared away.

If we want to keep our entrepreneurs, Canada’s capital gains policies must become competitive with US policies.

You can read the full memo at the link below:

34,78K

tobi lutke kirjasi uudelleen

Top 10 Most Valuable Companies in Canada 2025 🇨🇦📈

1. RBC - $186B

2. Shopify - $152B

3. TD - $128B

4. Enbridge - $99B

5. Brookfield Corp - $98B

6. Thomson Reuters - $90B

7. BMO - $81B

8. Constellation Software - $77B

9. Canadian Pacific Railway - $76B

10. Scotiabank - $68B

51,71K

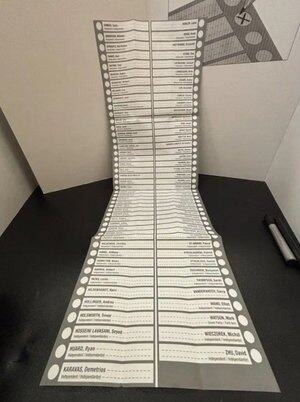

Elections Canada: your job is to not let shenanigans like this happen.

This breaks your mandate in spirit, even if you lack specific rules here. Stop abdicating your responsibility.

It’s not new, this has been going on for years, and is not a partisan issue either. Clearly someone in your office has worked out a way to strongly deter this within the current set of regulations. Listen to that person and get a move on.

Jinglai He 🇨🇦17.7. klo 00.41

BREAKING: The Longest Ballot Committee has already registered OVER 50 of their "candidates" in Pierre Poilievre's by-election and are preparing to add hundreds of more fake candidates in the upcoming week to sabotage Pierre's chances.

How on earth is this even allowed?

183,91K

tobi lutke kirjasi uudelleen

Introducing Rails New, a beginner-friendly series hosted by @typecraft_dev that takes you from installation to `rails new` to a fully deployed productivity app, all in just 10 videos. Perfect for newcomers to #Rails. You’ll learn Rails philosophy and core concepts like MVC, scaffolding, and CRUD, style your app with #TailwindCSS, and deploy with #Kamal. Let's go, nerds!

85,59K

Johtavat

Rankkaus

Suosikit

Ketjussa trendaava

Trendaa X:ssä

Viimeisimmät suosituimmat rahoitukset

Merkittävin