Trendaavat aiheet

#

Bonk Eco continues to show strength amid $USELESS rally

#

Pump.fun to raise $1B token sale, traders speculating on airdrop

#

Boop.Fun leading the way with a new launchpad on Solana.

Arcana

Research @Delphi_Digital | Shitcoin Connoisseur

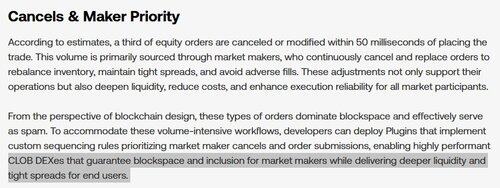

Wonder how this plays out for prop AMMs assuming this unlocks private txns and maker priority

Even more interesting how things will shape out now that CLOBs have priority cancels and can tighten the spread

Jito21.7. klo 21.52

Introducing BAM: The Block Assembly Marketplace that revolutionizes how Solana processes transactions.

Private. Transparent. Verifiable.

This is how Solana wins ⬇️

21,93K

The @PlasmaFDN Thesis: Everyone is going full stack

Stablecoins continue to be crypto’s largest use case, with outstanding supply now exceeding $262B. Tether has grown another ~4% within the last month, maintaining ~66% of that overall market share.

Much of Tether’s success has hinged on the adoption and need for a stable and accessible unit of currency in emerging global markets and economies plagued with hyperinflation.

This is where the disconnect lies. The echo chamber of CT underestimates the actual TAM of stablecoins. Tether has become the most practical form of digital dollar exposure for millions around the world.

Capturing that value by owning the full stack is where most players are moving toward. Codex is now following this playbook as the USDC native chain.

It isn’t necessarily about having another specific chain, but rather about distribution.

In reality, Plasma’s architecture and GTM strategy is optimizing for global payments and remittance services.

Their approach focuses on an already existing demand from corridors outside the US where a majority of the unbanked populations reside.

From a narrative perspective, Plasma is currently the most direct bet towards stablecoin adoption outside of CRCL.

And if you want to know just how deprived the space is for stablecoin exposure, just take a look at Circles recent IPO success.

13,86K

The @PlasmaFDN Thesis: Everyone is going full stack

Stablecoins continue to be crypto’s largest use case, with outstanding supply now exceeding $262B. Tether has grown another ~4% within the last month, maintaining ~66% of that overall market share.

Much of Tether’s success has hinged on the adoption and need for a stable and accessible unit of currency in emerging global markets and economies plagued with hyperinflation.

This is where the disconnect lies. The echo chamber of CT underestimates the actual TAM of stablecoins. Tether has become the most practical form of digital dollar exposure for millions around the world.

Capturing that value by owning the full stack is where most players are moving toward. Codex is now following this playbook as the USDC native chain.

It isn’t necessarily about having another specific chain, but rather about distribution.

In reality, Plasma’s architecture and GTM strategy is optimizing for global payments and remittance services.

Their approach focuses on an already existing demand from corridors outside the US where a majority of the unbanked populations reside.

From a narrative perspective, Plasma is currently the most direct bet towards stablecoin adoption outside of CRCL.

And if you want to know just how deprived the space is for stablecoin exposure, just take a look at Circles recent IPO success.

2,38K

The @PlasmaFDN Thesis: Everyone is going full stack

Stablecoins continue to be crypto’s largest use case, with outstanding supply now exceeding $262B. Tether has grown another ~4% within the last month, maintaining ~66% of that overall market share.

Much of Tether’s success has hinged on the adoption and need for a stable and accessible unit of currency in emerging global markets and economies plagued with hyperinflation.

This is where the disconnect lies. The echo chamber of CT underestimates the actual TAM of stablecoins. Tether has become the most practical form of digital dollar exposure for millions around the world.

Capturing that value by owning the full stack is where most players are moving toward. Codex is now following this playbook as the USDC native chain.

It isn’t necessarily about having another specific chain, but rather about distribution.

In reality, Plasma’s architecture and GTM strategy is optimizing for global payments and remittance services.

Their approach focuses on an already existing demand from corridors outside the US where a majority of the unbanked populations reside.

From a narrative perspective, Plasma is currently the most direct bet towards stablecoin adoption outside of CRCL.

And if you want to know just how deprived the space is for stablecoin exposure, just take a look at Circles recent IPO success.

2,62K

I understand that this is satire, but it's really not that shocking once you think about it

There's always been a cohort of retail that got exposure to crypto back in 2017 that bought into all these "dino coins"

every time the market turns around, these legacy coins always catch a bid. Since retail never sticks around for the majority of the cycles, they're never entrenched and exposed to any new protocols in the space like the rest of CT

all they remember is XRP, HBAR, etc. And once the market pumps that's the first thing they come back to

21,06K

Arcana kirjasi uudelleen

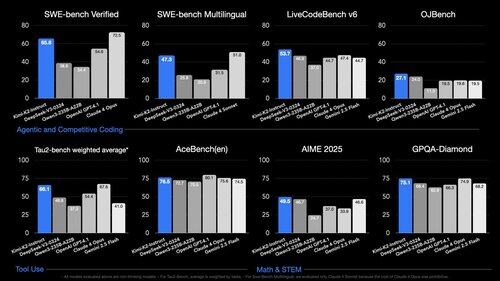

🚀 Hello, Kimi K2! Open-Source Agentic Model!

🔹 1T total / 32B active MoE model

🔹 SOTA on SWE Bench Verified, Tau2 & AceBench among open models

🔹Strong in coding and agentic tasks

🐤 Multimodal & thought-mode not supported for now

With Kimi K2, advanced agentic intelligence is more open and accessible than ever. We can't wait to see what you build!

🔌 API is here:

- $0.15 / million input tokens (cache hit)

- $0.60 / million input tokens (cache miss)

- $2.50 / million output tokens

🔗 Tech blog:

🔗 Weights & code:

🔗 Github:

Try it now at or via API!

2,14M

Lots of hints that Solana’s market structure is changing in favor of sophisticated players to market make onchain

The shift in the DEX landscape is currently rewarding those that provide tighter spreads and better quotes for deeper, more liquid pairs

SolFi and ZeroFi alone execute over half of the volume routed through Jupiter. But these metrics aren’t unique to just these two

A relatively new prop AMM called GoonFi is averaging ~$30M in volume daily on a single pair (SOL/USDC) alone

This makes me believe that MMs are catching on to this trend and seeing it as an opportunity to widen their presence onchain

Don’t think it’ll be long before we catch more of these so-called prop AMMs cropping up left and right

1,26K

Johtavat

Rankkaus

Suosikit

Ketjussa trendaava

Trendaa X:ssä

Viimeisimmät suosituimmat rahoitukset

Merkittävin