Trendaavat aiheet

#

Bonk Eco continues to show strength amid $USELESS rally

#

Pump.fun to raise $1B token sale, traders speculating on airdrop

#

Boop.Fun leading the way with a new launchpad on Solana.

Asaf Nadler

Co-Founder & COO @addressableid | Software Eng. PhD | Turning data to crypto growth, one block at a time 📈

Asaf Nadler kirjasi uudelleen

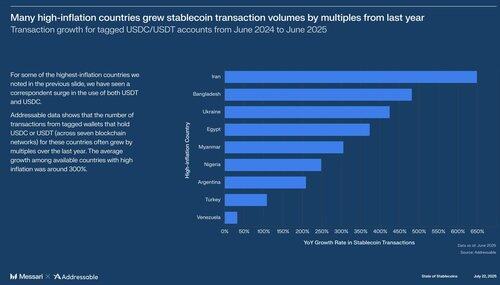

In the last year, stablecoin transaction volume in Iran grew over 600%.

In Nigeria, over 250%.

In Turkey, over 100%.

While you're worried about a 2% inflation target, they're worried about their currency collapsing.

You see crypto as an investment.

They see it as an escape hatch.

This isn’t theory. It's a conclusion drawn from analyzing 23 million wallets with @MessariCrypto for their new "State of Stablecoins" report where we found the average growth across high-inflation countries was around 300%.

It's a bank run and not a bull run. A quiet, orderly, digital exit from failing fiat systems.

While you were yield farming, they were wealth preserving.

While you were chasing a 10x, they were just trying to hold on to 1x.

We talk about crypto's "killer app."

For millions, it's not a new DeFi protocol. It's just a stable place to save their money.

So when you ask "when mass adoption?"

You're asking the wrong question.

It's already here. You're just not the one being onboarded.

Messari dropped the full report, it’s in the first post below ↓

4,74K

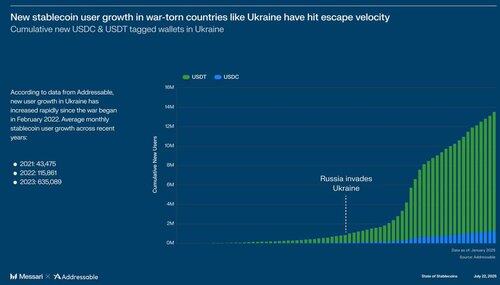

When Russia invaded Ukraine, the financial system crumbled.

Banks shut down. ATMs stopped working.

But something else turned on.

Stablecoins.

Analyzing 23M wallets at @addressableid with @MessariCrypto for the State of Stablecoin report revealed an interesting truth.

In 2021, only 43k Ukrainians used USDC, USDT.

In 2023? Over 635k.

That’s 14x growth. In a warzone.

Ukraine saw the fastest rise in stablecoin adoption, globally.

They didn’t “buy crypto”. They used it to survive.

The banks failed. Crypto cleared its throat.

So when we question whether “crypto is a promise”... A war proved the case.

The Genius Act passed in the U.S.

Now Congress scrambles to catch up to what Ukrainians already knew:

• Stablecoins don’t need your permission.

They show up when everything else collapses.

This isn’t speculation. It’s financial infrastructure, born on-chain.

The West is still debating.

The rest of the world is already moving.

The unbanked? They’re not asking.

They’re using.

And when your system fails…

Who’s banking you?

You think this is just about Ukraine, until it’s your currency, your borders, your banking crisis.

9,68K

What happens when stablecoin wallet data of 23M+ users meets offchain signals like geolocation?

Find out in @MessariCrypto’s State of Stablecoins report dropping tomorrow, featuring insights powered by @addressableid . Can’t wait to see it live.

AJC22.7. klo 00.13

🚨STATE OF STABLECOINS REPORT TOMORROW🚨

When it comes to industry-defining reports, no one does it better than @MessariCrypto.

Tomorrow, we drop the most expansive report on stablecoins yet: State of Stablecoins.

The best part? The report is FREE! Keep reading for a preview 👇

12,07K

Asaf Nadler kirjasi uudelleen

The launch of @base app reveals the entire industry's holy grail.

Base Pay and Base Wallet together signal something most projects are missing:

User retention.

Blockchains spend millions on grants, incentives, and marketing protocols to bring users to their ecosystem. They come, they engage, and then they move with the protocol to another blockchain.

The cycle repeats.

But here's what Base figured out that everyone else missed:

You can't own users if you don't own their experience.

Think about what a wallet is in 2025.

It's not just a place to store tokens.

It's a browser. A social network. An app store. A gateway to the entire crypto ecosystem.

And whoever controls that gateway controls the user forever.

This is exactly what Google did with Chrome and Android.

Base isn't trying to be "just another L2."

They're playing the Silicon Valley game that crypto never learned: own the user, own the future.

Base will never rely on transaction fees alone to make money. That's thinking like a blockchain.

They're thinking like a platform.

Social network inside the wallet. App store for dApps. Direct relationships with users who never need to leave their ecosystem.

Sound familiar?

It's the same playbook that made Apple and Google the most valuable companies in the world.

Here's what most people don't realize about the Base App:

Base is betting that owning the user experience is worth more than collecting gas fees.

While other blockchains fight for TVL, Base is fighting for something much more valuable: daily active users.

Every L1 and L2 is about to face the same struggle: if you don't own the user experience, you're just infrastructure.

And infrastructure is commoditized.

Most people don't want a wallet.

They want an experience.

And this super app experience is how crypto actually gets adopted.

Because in the end, users don't care about your blockchain.

They care about their experience.

And whoever owns that experience owns the future.

331

Asaf Nadler kirjasi uudelleen

For years, crypto marketing has had a fatal flaw.

We took 20 years of sophisticated ad technology... and connected it to... nothing.

On-chain revenue became a black box. Anonymous. Unattributable. We celebrated on-chain wins without knowing what drove them.

At HackSeasons by @mpost_io, our co-founder @TomerSharoni broke down how we finally connected the dots.

335

Johtavat

Rankkaus

Suosikit

Ketjussa trendaava

Trendaa X:ssä

Viimeisimmät suosituimmat rahoitukset

Merkittävin