Trendaavat aiheet

#

Bonk Eco continues to show strength amid $USELESS rally

#

Pump.fun to raise $1B token sale, traders speculating on airdrop

#

Boop.Fun leading the way with a new launchpad on Solana.

Ben

head of growth and chief intern @zkp2p

surely the most performative action ever?

why give yourself an allocation in the first place 😭😭

Andre Cronje18 tuntia sitten

Sonic Labs just burned 100% of its 1,866,256.59 $S allocation from the airdrop.

Current value: $754,902.66.

283

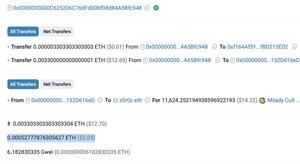

so cool to see users sign up to sniper alerts from the telegram bot i built and directly onramp using @zkp2p

BRINGING ARGENTINA ON CHAIN

ZKP2P11 tuntia sitten

Argentinians are waking up to our new @worldcoin mini app

$80 offramped from $WLD to pesos in 19 minutes

@zkp2p are bringing Argentina on chain

5,8K

Ben kirjasi uudelleen

Back then, we owed $12M in DOLA bad debt, went from over $100M to no TVL, no users, no revenue, no hope.

So we did the only thing we knew how to do: Built a better product from scratch. Created the most sophisticated risk mgmt tools in DeFi such as daily borrow limits and pessimistic price oracle among others. Grew loans borrower by borrower, collateral by collateral, feature after feature, over 3 years of slow consistent growth while surviving multiple bank runs due to the bad debt.

Today, the numbers speak for themselves:

Almost $100M actively borrowed, collateralized by nearly $150M TVL, generating $9M/year in revenue. All All-Time-Highs.

By end of week, governance is likely to approve and execute the DOLA bad debt elimination proposal, finally releasing us from this burden.

Post-bad debt, we will continue to build:

- Better risk management tools. We will be the most prepared for the worst to happen. Junior tranche, bad debt socialization, better liquidations.

- Better stablecoins. Monolith will set a new standard for stablecoins: immutable, permissionless, un-censorable and unstoppable. It will also create a more resilient class of collaterals that can replace DOLA’s centralized backing such as USDC, USDe, etc.

- Better collateral types. Monolith is our first move in this direction. Expect new DeFi products built primarily to be used as crypto collateral on FiRM. We will also use FiRM and DOLA to finance the growth of these products vs existing incumbents in their markets.

- DBR derivatives. New financial products for advanced DBR users/speculators/borrowers and to grow the public market capital raise arsenal of the DAO. E.g. a long-term fixed income product for savers, discounted DBR debt instruments for long-term borrowers, etc.

If DeFi ends up replacing TradFi, we are building Decentralized JP Morgan of the new world; the largest, oldest and most prestigious decentralized lender.

To do that, we aim to build the best most diverse collection of lending products, create the best risk mgmt tools, serve the best clients (quality over quantity) and hire the best talent. It will require a lot of trial and error, a lot of capital, a lot of talent and most importantly a lot of patience.

But time is in our favor. In September, Inverse DAO will be 5 years old. This is already 5 years of reputation that cannot be bought with money. We will continue to accumulate this reputation year after year and cycle after cycle, building, growing and serving.

15,11K

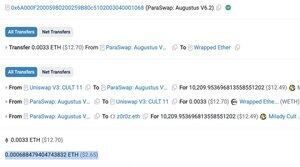

cheaper than ever

faster than ever

zkp2p is better than ever

ZKP2P12 tuntia sitten

Europooor no more 🇪🇺

The cheapest way to go from EUR to USDC

Fast. Reliable. Permissionless.

1,19K

Johtavat

Rankkaus

Suosikit

Ketjussa trendaava

Trendaa X:ssä

Viimeisimmät suosituimmat rahoitukset

Merkittävin