Trendaavat aiheet

#

Bonk Eco continues to show strength amid $USELESS rally

#

Pump.fun to raise $1B token sale, traders speculating on airdrop

#

Boop.Fun leading the way with a new launchpad on Solana.

nour

Founder & dev @InverseFinance

Not only is it the only place to get a fixed rate loan for any custom duration, it’s also the only place to get a fixed rate for your future loans before you even borrow.

There is no second best. Literally there are no competitors who offer any similar terms. Maybe they’ll show up when we’re past $1B loans but good luck catching up

Borrowers who are still missing out on the FiRM experience, here’s your chance

DCF GOD23.7. klo 04.05

This aave eth rate is a perfect example why we need to figure out fixed rate lending with liquidations

@InverseFinance miles ahead on this

8,61K

Back then, we owed $12M in DOLA bad debt, went from over $100M to no TVL, no users, no revenue, no hope.

So we did the only thing we knew how to do: Built a better product from scratch. Created the most sophisticated risk mgmt tools in DeFi such as daily borrow limits and pessimistic price oracle among others. Grew loans borrower by borrower, collateral by collateral, feature after feature, over 3 years of slow consistent growth while surviving multiple bank runs due to the bad debt.

Today, the numbers speak for themselves:

Almost $100M actively borrowed, collateralized by nearly $150M TVL, generating $9M/year in revenue. All All-Time-Highs.

By end of week, governance is likely to approve and execute the DOLA bad debt elimination proposal, finally releasing us from this burden.

Post-bad debt, we will continue to build:

- Better risk management tools. We will be the most prepared for the worst to happen. Junior tranche, bad debt socialization, better liquidations.

- Better stablecoins. Monolith will set a new standard for stablecoins: immutable, permissionless, un-censorable and unstoppable. It will also create a more resilient class of collaterals that can replace DOLA’s centralized backing such as USDC, USDe, etc.

- Better collateral types. Monolith is our first move in this direction. Expect new DeFi products built primarily to be used as crypto collateral on FiRM. We will also use FiRM and DOLA to finance the growth of these products vs existing incumbents in their markets.

- DBR derivatives. New financial products for advanced DBR users/speculators/borrowers and to grow the public market capital raise arsenal of the DAO. E.g. a long-term fixed income product for savers, discounted DBR debt instruments for long-term borrowers, etc.

If DeFi ends up replacing TradFi, we are building Decentralized JP Morgan of the new world; the largest, oldest and most prestigious decentralized lender.

To do that, we aim to build the best most diverse collection of lending products, create the best risk mgmt tools, serve the best clients (quality over quantity) and hire the best talent. It will require a lot of trial and error, a lot of capital, a lot of talent and most importantly a lot of patience.

But time is in our favor. In September, Inverse DAO will be 5 years old. This is already 5 years of reputation that cannot be bought with money. We will continue to accumulate this reputation year after year and cycle after cycle, building, growing and serving.

Inverse31.10.2022

Today, we’re excited to unveil a new whitepaper: FiRM. The Fixed Rate Money Market Protocol.

FiRM will unlock new possibilities in DeFi, from fixed-rate loans for any duration to interest rate hedging and speculation and more.

Whitepaper:

Thread 🧵

34,43K

Back then, we owed $12M in DOLA bad debt, went from over $100M to no TVL, no users, no revenue, no hope.

So we did the only thing we knew how to do: Built a better product from scratch. Created the most sophisticated risk mgmt tools in DeFi such as daily borrow limits and pessimistic price oracle among others. Grew loans borrower by borrower, collateral by collateral, feature after feature, over 3 years of slow consistent growth while surviving multiple bank runs due to the bad debt.

Today, the numbers speak for themselves:

Almost $100M actively borrowed, collateralized by nearly $150M TVL, generating $9M/year in revenue. All All-Time-Highs.

By end of week, governance is likely to approve and execute the DOLA bad debt proposal, finally releasing us from this burden.

Post-bad debt, we will continue to build:

- Better risk management tools. We will be the most prepared for the worst to happen. Junior tranche, bad debt socialization, better liquidations.

- Better stablecoins. Monolith will set a new standard for stablecoins: immutable, permissionless, un-censorable and unstoppable. It will also create a more resilient class of collaterals that can replace DOLA’s centralized backing such as USDC, USDe, etc.

- Better collateral types. Monolith is our first move in this direction. Expect new DeFi products built primarily to be used as crypto collateral on FiRM. We will also use FiRM and DOLA to finance the growth of these products vs existing incumbents in their markets.

- DBR derivatives. New financial products for advanced DBR users/speculators/borrowers and to grow the public market capital raise arsenal of the DAO. E.g. a long-term fixed income product for savers, discounted DBR debt instruments for long-term borrowers, etc.

If DeFi ends up replacing TradFi, we are building Decentralized JP Morgan of the new world; the largest, oldest and most prestigious decentralized lender.

To do that, we aim to build the best most diverse collection of lending products, create the best risk mgmt tools, serve the best clients (quality over quantity) and hire the best talent. It will require a lot of trial and error, a lot of capital, a lot of talent and most importantly a lot of patience.

But time is in our favor. In September, Inverse DAO will be 5 years old. This is already 5 years of reputation that cannot be bought with money. We will continue to accumulate this reputation year after year and cycle after cycle, building, growing and serving.

Inverse31.10.2022

Today, we’re excited to unveil a new whitepaper: FiRM. The Fixed Rate Money Market Protocol.

FiRM will unlock new possibilities in DeFi, from fixed-rate loans for any duration to interest rate hedging and speculation and more.

Whitepaper:

Thread 🧵

813

nour kirjasi uudelleen

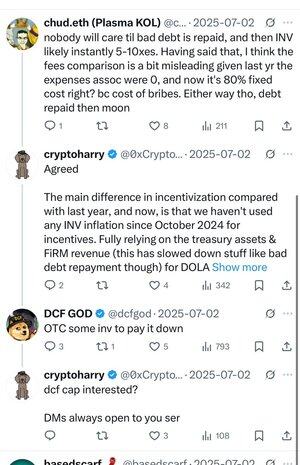

The whole market was waiting for @InverseFinance to cover the bad debt before buying

But instead of happening slowly, it's happening overnight

They've consistently grinded the TVL up to $100M+ and now making over $7M/y in fees

Time to unleash the beast @NourHaridy

note: dcf cap is hoping to soon hold INV

4,73K

nour kirjasi uudelleen

A story in 2 parts

@InverseFinance has been killing it these last few years in terms of shipping new innovative products (ie. DBR), staying relevant on new defi platforms, and earning profits

The team is as OG as it gets and clearly care to deliver all value to the token

The problem is they had some bad debt from an old product and the market ignores them because it seemed too big to overcome in a short time

Now it’s debt out, chads in

Excited to be a major token holder here, it’s time for the on chain stables to win

Note: dcf cap holds INV

11K

Retiring the bad debt will significantly reduce DOLA’s risk premium and therefore the DAO’s cost of capital.

It will bring in new users who were reluctant to hold DOLA due to the implied risk exposure.

It’ll significantly improve the DAO’s margins, competitiveness and growth.

It’ll allow Inverse to finally compete on a level playing field, unburdened by bad debt.

It’ll allow DOLA to fill the void left by MakerDAO, becoming DeFi’s un-censorable, crypto-collateralized, yield-bearing stablecoin of choice.

It’ll allow FiRM to cement its dominance over fixed-rate lending, attracting more borrowers and lending liquidity.

All just in time before Monolith ;)

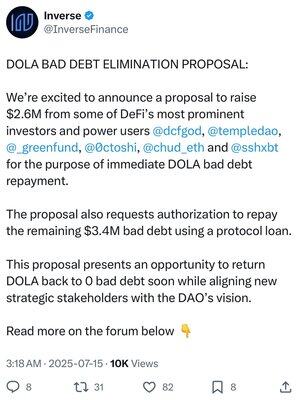

Inverse15.7. klo 18.18

DOLA BAD DEBT ELIMINATION PROPOSAL:

We’re excited to announce a proposal to raise $2.6M from some of DeFi’s most prominent investors and power users @dcfgod, @templedao, @_greenfund, @0ctoshi, @chud_eth and @sshxbt for the purpose of immediate DOLA bad debt repayment.

The proposal also requests authorization to repay the remaining $3.4M bad debt using a protocol loan.

This proposal presents an opportunity to return DOLA back to 0 bad debt soon while aligning new strategic stakeholders with the DAO’s vision.

Read more on the forum below 👇

9,61K

We are going to flood the market with a thousand crypto-backed stablecoins

We will return to what the word ‘stablecoin’ used to mean: censorship-resistant, permissionless, transparent and most importantly IMMUTABLE. Stability in the image of Ethereum.

None of that RWA, custodial, censorable, regulated abomination. Time for a reset.

3,11K

Johtavat

Rankkaus

Suosikit

Ketjussa trendaava

Trendaa X:ssä

Viimeisimmät suosituimmat rahoitukset

Merkittävin