Trendaavat aiheet

#

Bonk Eco continues to show strength amid $USELESS rally

#

Pump.fun to raise $1B token sale, traders speculating on airdrop

#

Boop.Fun leading the way with a new launchpad on Solana.

Duncan

Investing and crypto content. Will never sell a course or charge money.

Duncan kirjasi uudelleen

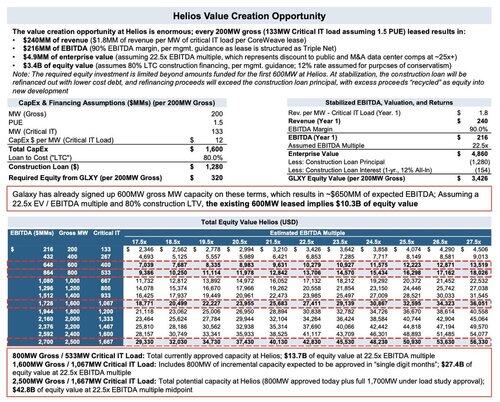

Segment on $GLXY capital raises and coming initialized coverage

$JPM $GS $JEF we're underwriters of the raise at $19, taking their capital position from $1 to $1.5 Billion

Thanks friend "doesn't think there is an unlock"

Given the scope of Galaxy Digital business, this coverage is a big awareness boost to @galaxyhq

Management has said an 80/20 Debt to equity ratio on Helios buildout. Learn more by following @RHouseResearch and @FloodCapital

Galaxy funding vs miners $MARA $RIOT $CORZ

Thanks to the sponsor @DexToroApp $DTR, trade onchain and support the show:

1,08K

Very bullish $SBET and by extension on of their investors, custodians and staking providers $GLXY!

*Walter Bloomberg6 tuntia sitten

BLACKROCK’S HEAD OF DIGITAL ASSETS LEAVES TO JOIN SHARPLINK GAMING, THE SECOND-LARGEST #ETHEREUM TREASURY COMPANY

4,26K

Totally agree! Although $GLXY does have a ton of crypto exposure the market is clearly not giving Galaxy's data center business enough credit.

Although I think this could change on August 5th earnings where we should get some material updates, some things we may get updates on are:

1) Financing announcement for $GLXY's Helios phase 1 and 2 AI data center build out.

--> This would be a huge vote of confidence from the financial institution that is willing to lend Galaxy $4-5B to build out Helios.

2) News if CoreWeave will exercise their remaining 200MW option at Helios (expanding the lease from 600MW to 800MW) this will add an incremental $300M/year in average annual rent, bringing the total to $1.2B/year on average - this will start cash flowing in H12026 and ramp into 2027. (note $CRWV has till September to exercise this option).

3) Updates about the additional 1.7GW of power that Galaxy has under study with ERCOT (comes in the form of an 800MW tranche and 900MW tranche) if they get approved for another 800MW this soon that would be a huge bullish surprise (management has guided to this being "single digit months away / EOY") ^ following this we may start to see news flow about a potential new tenant for the additional capacity, again if they are able to lease out the next tranche + the remaining 200MW option $CRWV has to exercise that will bring the average annual revenue Helios generates from $900M --> $2.4B!

4)Updates on the pipeline of ~40 Bitcoin mining sites Galaxy is evaluating for potential acquisition or partnership. Galaxy has developed relationships with tier 1 data center contractors, CoreWeave, other hyperscalers, and it seems like TSMC/AMD to build out bespoke AI Data Centers for hyperscalers like $CRWV. This $CRWV lease that Galaxy has already secured really sets them ahead of the pack in the Bitcoin mining space proving to other hyperscalers that they have the ability to execute. $AMZN $META $MSFT or others will not want to partner with a small bitcoin mining company that doesn't have the relationships, capital or expertise to execute on bespoke AI data center buildouts.

Mitchell Martan6 tuntia sitten

$GLXY still being treated like a higher levered crypto proxy is a good thing.

Market is telling you they either don’t believe the data centre in Helios or just don’t know about it.

Usually the kind of misunderstood setups that yield the highest return.

4,98K

Not only is $GLXY very attractive vs alts at this valuation but it’s very attractive relative to other high quality crypto equities that are all >$100B market cap like $COIN, $HOOD, and $MSTR

Ansem22 tuntia sitten

show me an altcoin chart under $10B that has a better chart + fundamentals setup than $GLXY & ill show you a flying dragon with antlers on top of the entire state building

it doesnt exist

6,44K

Forgot to mention that potentially we will get a financing announcement of $GLXY's Helios phase 1 and 2 AI data center build out on Aug 5th earnings!

This will be a huge vote of confidence from whichever financial institution is willing to lend them $4-5B to build out Helios, I think it will cause the market to start respecting Galaxy's data center business more and should help close the theoretical gap between the value the market is currently ascribing Helios vs this table below by @RHouseResearch below:

Duncan24.7. klo 21.32

$GLXY looks so primed here, breaking out to 4 year highs on the monthly chart + we are setting up for some potentially huge updates and catalyst during the August 5th earnings! A few highlights we could potentially get from Galaxy are:

Balance Sheet Updates:

Revaluation of crypto assets and crypto infrastructure investments on the balance sheet + clarity into the size of investments like $SBET, $BMNR and other treasury companies. This could take $GLXY's balance sheet well beyond the ~$3B number I had in my mind based on the spaces AMA @novogratz @intangiblecoins and others from Galaxy did ~1.5 months ago. I would love if Galaxy disclosed exactly what they hold on their balance sheet so the army of $GLXY researchers on twitter could do a more accurate SOTP model on Galaxy!

Crypto Business Line Updates:

Given the significant ramp up in crypto prices + all the treasury deals Galaxy has been involved with recently we are likely to see a big jump in assets under management, increased trading volumes, and assets staked with $GLXY. We will potentially see some movement on the tokenization front with @GK8_Security, movement on Galaxy's JV EURO stablecoin with @AllUnityStable and maybe even and increase in M&A activity for Galaxy's investment banking arm. Also I would expect Galaxy's loan book to have grown too.

Data Center Business Line Updates:

Okay here is where things could get juicy! Historically Galaxy seems to have done big announcements surrounding their data centers business on earnings day. We have a wide range of potential updates we could get here:

- News if CoreWeave will exercise their remaining 200MW option at Helios (expanding the lease from 600MW to 800MW) this will add an incremental 300M/year in average annual rent, bringing the total to 1.2B/year on average - this will start cash flowing in H12026 and ramp into 2027. (note $CRWV has till September to exercise this option).

- Updates about the additional 1.7GW of power that Galaxy has under study with ERCOT (comes in the form of an 800MW tranche and 900MW tranche) if they get approved for another 800MW this soon that would be a huge bullish surprise (management has guided to this being "single digit months away / EOY")

^ following this we may start to see news flow about a potential new tenant for the additional capacity, again if they are able to lease out the next tranche + the remaining 200MW option $CRWV has to exercise that will bring the average annual revenue Helios generates from $900M --> $2.4B!

- Updates on the pipeline of ~40 Bitcoin mining sites Galaxy is evaluating for potential acquisition or partnership. Galaxy has developed relationships with tier 1 data center contractors, CoreWeave, other hyperscalers, and it seems like TSMC/AMD to build out bespoke AI Data Centers for hyperscalers like $CRWV. This $CRWV lease that Galaxy has already secured really sets them ahead of the pack in the Bitcoin miner space proving to other hyperscalers that they have the ability to execute. $AMZN $META $MSFT or others will not want to partner with a small bitcoin mining company that doesn't have the relationships, capital or expertise to execute on bespoke AI data center buildouts.

BONUS - Research Coverage:

Now that Galaxy is listed on the NASDAQ they are starting to pick up coverage from more US firms. Goldman Sachs, Morgan Stanley and Jefferies lead the $500M raise Galaxy just did and Jefferies just initiated coverage with a $35 PT, I would expect Goldman / Morgan Stanley to follow suit and it would be absolutely epic if they did a deep dive report into $GLXY - this could spark a ton of institutional demand and really help tell the story of Galaxy's 3 pronged business (awesome balance sheet, crypto business lines and data center business).

Excited for August 5th!

5,87K

$GLXY Fastest horse?

Don't follow Shardi B if you hate Money25.7. klo 01.48

The thought clearly here has to be twofold

1. $ETH and $BTC arguably just had their dip and $BTC is moving towards highs

2. $GLXY has just gone blue sky BEFORE $BTC and $ETH and blue skies go higher... and if $BTC and $ETH continue to move up it will continue to give $GLXY the room to continue to fly

19K

$GLXY looks so primed here, breaking out to 4 year highs on the monthly chart + we are setting up for some potentially huge updates and catalyst during the August 5th earnings! A few highlights we could potentially get from Galaxy are:

Balance Sheet Updates:

Revaluation of crypto assets and crypto infrastructure investments on the balance sheet + clarity into the size of investments like $SBET, $BMNR and other treasury companies. This could take $GLXY's balance sheet well beyond the ~$3B number I had in my mind based on the spaces AMA @novogratz @intangiblecoins and others from Galaxy did ~1.5 months ago. I would love if Galaxy disclosed exactly what they hold on their balance sheet so the army of $GLXY researchers on twitter could do a more accurate SOTP model on Galaxy!

Crypto Business Line Updates:

Given the significant ramp up in crypto prices + all the treasury deals Galaxy has been involved with recently we are likely to see a big jump in assets under management, increased trading volumes, and assets staked with $GLXY. We will potentially see some movement on the tokenization front with @GK8_Security, movement on Galaxy's JV EURO stablecoin with @AllUnityStable and maybe even and increase in M&A activity for Galaxy's investment banking arm. Also I would expect Galaxy's loan book to have grown too.

Data Center Business Line Updates:

Okay here is where things could get juicy! Historically Galaxy seems to have done big announcements surrounding their data centers business on earnings day. We have a wide range of potential updates we could get here:

- News if CoreWeave will exercise their remaining 200MW option at Helios (expanding the lease from 600MW to 800MW) this will add an incremental 300M/year in average annual rent, bringing the total to 1.2B/year on average - this will start cash flowing in H12026 and ramp into 2027. (note $CRWV has till September to exercise this option).

- Updates about the additional 1.7GW of power that Galaxy has under study with ERCOT (comes in the form of an 800MW tranche and 900MW tranche) if they get approved for another 800MW this soon that would be a huge bullish surprise (management has guided to this being "single digit months away / EOY")

^ following this we may start to see news flow about a potential new tenant for the additional capacity, again if they are able to lease out the next tranche + the remaining 200MW option $CRWV has to exercise that will bring the average annual revenue Helios generates from $900M --> $2.4B!

- Updates on the pipeline of ~40 Bitcoin mining sites Galaxy is evaluating for potential acquisition or partnership. Galaxy has developed relationships with tier 1 data center contractors, CoreWeave, other hyperscalers, and it seems like TSMC/AMD to build out bespoke AI Data Centers for hyperscalers like $CRWV. This $CRWV lease that Galaxy has already secured really sets them ahead of the pack in the Bitcoin miner space proving to other hyperscalers that they have the ability to execute. $AMZN $META $MSFT or others will not want to partner with a small bitcoin mining company that doesn't have the relationships, capital or expertise to execute on bespoke AI data center buildouts.

BONUS - Research Coverage:

Now that Galaxy is listed on the NASDAQ they are starting to pick up coverage from more US firms. Goldman Sachs, Morgan Stanley and Jefferies lead the $500M raise Galaxy just did and Jefferies just initiated coverage with a $35 PT, I would expect Goldman / Morgan Stanley to follow suit and it would be absolutely epic if they did a deep dive report into $GLXY - this could spark a ton of institutional demand and really help tell the story of Galaxy's 3 pronged business (awesome balance sheet, crypto business lines and data center business).

Excited for August 5th!

43,03K

Johtavat

Rankkaus

Suosikit

Ketjussa trendaava

Trendaa X:ssä

Viimeisimmät suosituimmat rahoitukset

Merkittävin