Trendaavat aiheet

#

Bonk Eco continues to show strength amid $USELESS rally

#

Pump.fun to raise $1B token sale, traders speculating on airdrop

#

Boop.Fun leading the way with a new launchpad on Solana.

Molly

Bitcoin Only Cycle # semi-retired #

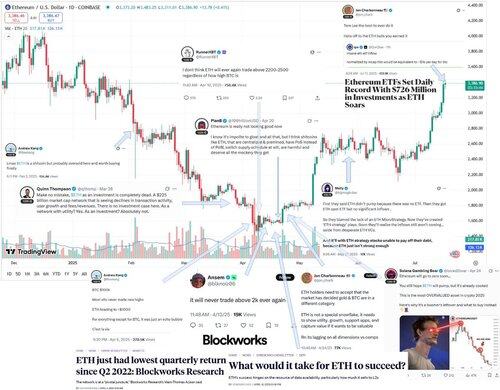

I thought ETH had hit $8K or something for .eth to act like that, turns out it only needed $3.6K. LMAO

stakeyour.eth 🦇🔊18.7. klo 12.58

When people dance on ETH's grave or use mental gymnastics to justify its price action (using metrics that somehow don't apply to other chains) it's probably a good bottom indicator. It's almost as if their opinions are just noise following price.

Some words of wisdom here:

"Make no mistake, ETH as an investment is completely dead" - some guy (IDK who he is)

"it will never trade above 2k ever again" - Memecoin influencer

"soon they'll realize the inflows still aren't coming...aside from desperate ETH VCs" - BTC Maxi (maybe someone can tell them it's primarily BTC mining companies pivoting to ETH strategies)

"Ethereum will go to zero soon...here's why it's a boomer's leftover and what to buy instead" - SOL memecoin trader

One can only hope that as Ethereum continues to gain adoption that people will eventually learn to ignore these VCs/influencers/traders.

12,49K

There should be two types of Bitcoiners:

1. Bitcoin Dominator:

Bitcoin-first, not against betting on high-Bitcoin-beta plays. Measures everything in BTC. Every trade is meant to grow total Bitcoin holdings. (More common in a mysterious country…)

2. Bitcoin Maxi:

Bitcoin-only. Everything else should die. Hates seed oil, loves posting steak pics, workouts, and nicotine patches.( westerns , mostly white… )

4,28K

Bull Cycle Peak Growths Since ETH Existed:

2017 Bull Peak:

• BTC: $19,665

• ETH: $1,432

2021 Bull Peak:

• BTC: $69k → 3.5x from 2017

• ETH: $4,8k→ 3.4x from 2017

Current (2025):

• BTC: $121k → +75% from 2021 peak

• ETH: $3k→ −39% from 2021 peak

Cute that you still believe ETH will outperform BTC. :)

7,32K

The most used product among bitcoiner in Asia every cycle , borrow against bitcoin for daily expenses and other beta investments. CEX offers ~7% APY (flexible), while equity-first platforms give ~4% but with longer lockups. LTVs around 70%.. Surprisingly, not many of us use DeFi. Even I prefer CEXs it’s just much easier without this bridge that bridge this wallet that wallet …but with kyc and some crazy cex internally screening , this demand for defi version of this might increase …

4,78K

Apparently, if you change a $100 bill into 100 $1 bills, you now have 10M according to this old man’s math.

Peter Schiff12.7. klo 21.01

What if Bitcoin’s supply was 21B instead of 21M? Redefining each BTC as 100K satoshis (not 100M) keeps the satoshi supply the same. Would it still feel scarce? 100M is just an arbitrary construct. The supply of Bitcoin is actually meaningless—it’s the satoshi supply that counts.

4,31K

Johtavat

Rankkaus

Suosikit

Ketjussa trendaava

Trendaa X:ssä

Viimeisimmät suosituimmat rahoitukset

Merkittävin