Trendaavat aiheet

#

Bonk Eco continues to show strength amid $USELESS rally

#

Pump.fun to raise $1B token sale, traders speculating on airdrop

#

Boop.Fun leading the way with a new launchpad on Solana.

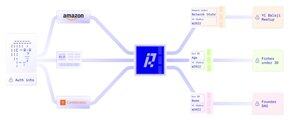

Delphi Digital

A research-driven firm dedicated to making crypto happen sooner and better than it would without us.

Tariff fears have taken a back seat for risk assets.

• Markets priced in tariff de-escalation despite deadlines looming

• Dollar weakness accelerates as deficit spending expectations rise

• Our BTC Top Signal currently sits at 62, well below previous cycle tops (+80)

Summer markets keep climbing among mixed signals.

5,35K

Delphi Digital kirjasi uudelleen

A list of Delphi chads worth following

@KSimback: Amazing eye for opportunities

@simononchain: DeFi & Trench insights

@OnchainLu: Crypto AI

@redphonecrypto: Amazing storyteller

@Shaughnessy119: AI trends

@ZeMariaMacedo: Early stage insights

@anildelphi: Unparalleled energy and optimism

@FloodCapital: Fundamentals king

@3xliquidated: Trading king

@PonderingDurian: AI, tech, and robotics

@0x_Arcana: DeFi deep dives

@YanLiberman: Absolute chad

@yeak__: Early stage innovations & DeFi

@that1618guy: Markets analysis

@lex_feeds: AI technical aspects

@freaz7: Gaming analyst

@0xLTR: On-chain sleuth

@DaftaryNeel: DeFi & Lending

@ceterispar1bus: Head of Research for a reason

@Bitcoin_Sage: Builder insights

@pierskicks: AI, gaming & metaverse

@ashwathbk: Always lifts others up

@Kevin_Kelly_II: Markets perspective

@ccioce: That's my quant

There are many other talented people I didn't have space to highlight, which shows how stacked Delphi is.

Couldn't have asked for a better team.

12,73K

The Internet's proof system is broken. We overshare personal information to verify the smallest claims.

zkTLS allows you to verify everything while exposing nothing. Here are three projects making this happen.

@reclaimprotocol transforms any Web2 data into cryptographic proofs for Web3. Pick a data source and enter credentials in their secure form.

Reclaim's proxy attestor converts the web request into proofs. Your device then runs a zkSNARK to extract just what you need to prove, hiding everything else.

You can prove your social following without sharing your handle or verify income without exposing transactions. Proof generation can be done in under 4 seconds.

@zkPass aims for a similar goal, but bets on adaptability over simplicity.

zkPass specializes in private data verification with its hybrid Three-party TLS system, which combines MPC and proxy-based models, adapting to changing network conditions and server requirements on the fly.

When you want to prove something, ZKPass creates a TLS session either via their decentralized MPC network or a direct proxy, depending on the scenario.

You can prove data from essentially any site, not just specific providers. The MPC portion ensures no single node can forge a session to maintain security.

ZKPass has already been utilized in private credit scoring, financial transactions, and online voting. By not boxing themselves into one model, they've proven you can mix and match proxy/MPC to meet different client needs.

@onflowxyz is a newcomer offering a "ZK on-chain passport" solution.

By creating attestable identities called "Sundial passports," Onflow allows you to KYC once and satisfy future checks with one click.

By running processes locally, verifiers and protocols learn nothing beyond the proof they need to verify the user.

Unlike Reclaim and zkPass which prove any data, Onflow focuses on identity verification.

zkTLS isn’t coming. It’s already here.

23,86K

Delphi Digital kirjasi uudelleen

The @PlasmaFDN Thesis: Everyone is going full stack

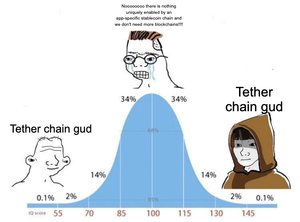

Stablecoins continue to be crypto’s largest use case, with outstanding supply now exceeding $262B. Tether has grown another ~4% within the last month, maintaining ~66% of that overall market share.

Much of Tether’s success has hinged on the adoption and need for a stable and accessible unit of currency in emerging global markets and economies plagued with hyperinflation.

This is where the disconnect lies. The echo chamber of CT underestimates the actual TAM of stablecoins. Tether has become the most practical form of digital dollar exposure for millions around the world.

Capturing that value by owning the full stack is where most players are moving toward. Codex is now following this playbook as the USDC native chain.

It isn’t necessarily about having another specific chain, but rather about distribution.

In reality, Plasma’s architecture and GTM strategy is optimizing for global payments and remittance services.

Their approach focuses on an already existing demand from corridors outside the US where a majority of the unbanked populations reside.

From a narrative perspective, Plasma is currently the most direct bet towards stablecoin adoption outside of CRCL.

And if you want to know just how deprived the space is for stablecoin exposure, just take a look at Circles recent IPO success.

13,85K

Institutions are warming up to ETH as a capital reserve asset.

• ETH received $1.5B in net inflows this month

• Bitmine currently holds around 163k ETH worth ~$500M

• New ETH accumulators now hold more than all legacy public companies combined

Read the full analysis here.👇

that1618guy17.7. klo 07.29

Ethereum is no longer just gas for DeFi or collateral for stablecoins. It’s becoming a Capital Reserve Asset.

Public companies are now raising hundreds of millions in equity to accumulate ETH, not passively, but through explicit treasury strategies that integrate Ethereum into their capital structures.

This shift mirrors the original playbook pioneered by MicroStrategy with Bitcoin. But now, the model is evolving and Ethereum is leading the next wave.

Ethereum isn’t just being held, it is also being operationalized:

🔹 As a yield-bearing treasury asset

🔹 As a programmable reserve

🔹 As on-chain infrastructure powering validator income

Take SharpLink Gaming ( $SBET ) as an example. In Q2 2025, it raised $435M through equity and warrants to accumulate ETH. This marked the first time a public company positioned Ethereum as its core reserve asset and not just a passive line item.

Why $ETH?

It checks all three pillars of a modern treasury framework:

✅ Institutional-grade custody

✅ Deep liquidity and derivatives access

✅ 4-5% validator yield

✅ Alignment with Web3 infrastructure.

It is not just SharpLink.

📍Bit Digital ( $BTBT ) now holds over 100,000 ETH having fully rotated its treasury into Ethereum and staked a large portion to generate validator income

📍BTCS ( $BTCS) has accumulated 42,000 ETH and is retooling its validator infrastructure to align with an Ethereum-centric staking model.

📍BitMine Immersion Technologies ( $BMNR ) now holds 163,142 ETH (~$500M) and is structuring a full ETH treasury with staking at its core

These are structured, capital-backed strategies designed to build treasury flywheels, enhance equity reflexivity and monetize on-chain participation.

Chart as of June 6 - figures are now higher but the trend holds: Ethereum is becoming a treasury cornerstone for public firms

Ethereum is being reframed.

Not just a Layer 1.

Not just ultrasound money.

But a programmable, yield-bearing corporate reserve that may anchor the next generation of on-chain treasuries.

We break down these capital mechanics, validator strategies, and treasury models in our latest Delphi The Public Crypto Accumulator Era report.

9,88K

Our markets analyst @that1618guy has been covering a potential BTC breakout for weeks.

Read here more insight.

that1618guy12.7. klo 02.01

Over the past month, two forces lined up beneath $BTC:

> Liquidity flipped risk-on

> Bank stocks and TradFi puts in a new ath, with BTC trailing behind

That combo set the stage for this breakout. Let me walk you through it 🧵

5,94K

Johtavat

Rankkaus

Suosikit

Ketjussa trendaava

Trendaa X:ssä

Viimeisimmät suosituimmat rahoitukset

Merkittävin