Trendaavat aiheet

#

Bonk Eco continues to show strength amid $USELESS rally

#

Pump.fun to raise $1B token sale, traders speculating on airdrop

#

Boop.Fun leading the way with a new launchpad on Solana.

Since 2020, @MicroStrategy has outperformed Bitcoin itself (27.6x vs 8.5x), inspiring a new wave of micro-cap shell companies to adopt crypto treasuries.

@zkHopium broke down the strategies these companies use to acquire crypto, and whether these ponzi games are sustainable🧵

But when companies adopt crypto treasuries, they become viewed as crypto/tech companies, which typically command a higher trading multiple💰

I.e., when a company converts their cash into crypto, even without much operation changes, they are usually valued higher

How do they operate in practice?

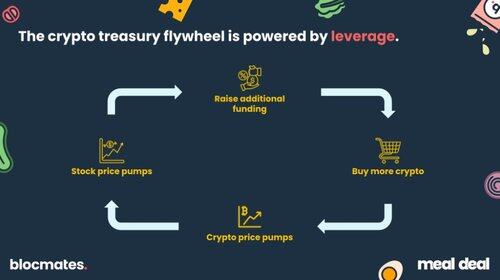

Companies raise initial funding through PIPEs (private investment in public equity) to acquire the first batch of crypto treasuries. Then the flywheel can begin

This involves raising funding via:

Equity: Common stock or warrants

Quasi-debt: Convertible notes

Debt: Term loans

More often than not, companies combine a number of the abovementioned structures to reach the optimal blend in risk and capital.

Crypto treasuries also create optionality in the future.

They can be:

1⃣liquidated to pay for operations

2⃣pledged for loans -> access to immediate liquidity

3⃣used to generate yield -> to finance debt, increase crypto/share, or sold to meet debt covenants.

But the questions remain:

➡️Is this sustainable?

➡️What games are being played?

➡️Who can we blame when this all ends in tears?

Read the full post to find out (free trials available now)

4,16K

Johtavat

Rankkaus

Suosikit