Trendaavat aiheet

#

Bonk Eco continues to show strength amid $USELESS rally

#

Pump.fun to raise $1B token sale, traders speculating on airdrop

#

Boop.Fun leading the way with a new launchpad on Solana.

I kinda feel like there is more packed into this single post, than most of FinTwit combined.

Definitely gives you a lot to think about...

21 tuntia sitten

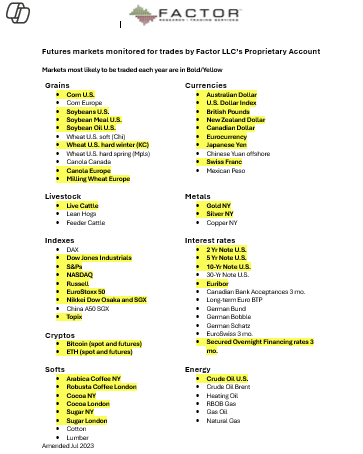

What does a real futures market trading account look like?

I can only explain my own

Real markets with my own real money on real exchanges

Seven figure real money account balance

I collect T-Bill interest on 60% of acct balance

Trade about 40 different global futures contracts ranging from precious metals to grains to softs to interest rates to stock indexes

Avg of 2 to 3 new trades per week -- that's it

Hold trades overnight - sometimes for many weeks

All trades based on chart construction

Losers are liquidated within days

Winners are allowed to run

100% my own trading rules

Hold up to 7 or so individual trades at any one time

No restrictions on how I trade, how often I must trade, how many winning days I must have, etc etc. Those rules are BS optimized so that 95% of retail traders lose money

No restriction on max loss per day or max drawdown, although I seldom have DDs >3-4%

I own all my own losses and gains

I do NOT day trade -- day trading is a losing proposition

I am a swing trader - not interested in tops or bottoms, just chunks in the middle

Hold positions over weekends and into report

All orders entered as GTC between 4PM to 5PM Central

Profits taken at targets

Max risk per trade is 80 basis points (8/10th of 1% of total nominal capital)

26,56K

Johtavat

Rankkaus

Suosikit