Trendaavat aiheet

#

Bonk Eco continues to show strength amid $USELESS rally

#

Pump.fun to raise $1B token sale, traders speculating on airdrop

#

Boop.Fun leading the way with a new launchpad on Solana.

The thesis is simple:

ETH and NFTs are strategically synced, institutions are pushing ETH, and NFTs remain one of its strongest catalysts for demand.

Companies adopting the ETH reserve strategy are now actively participating in the ecosystem.

Most of these participants are ultra-wealthy, and sooner or later, they'll be battling for the ultimate flex: the rarest JPEG, all while pumping their own bags.

In this new world, ETH at 10K and NFTs back at 100 ETH floor isn’t that crazy anymore.

14 tuntia sitten

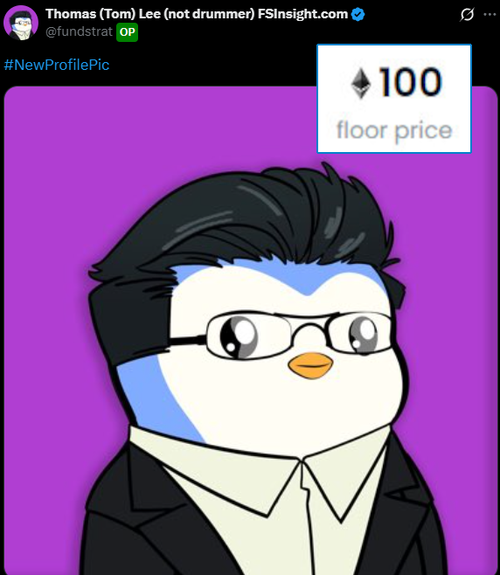

100 ETH floor price again?

Yes, I’m now more bullish than ever.

Tom Lee repping a Pudgy Penguins changed everything!

Why?

The current ETH reserve strategy isn’t just bullish, it’s the exact narrative we needed to kickstart the next crypto bull run.

And the fact that NFTs are positioned as a central piece of that story?

Few saw it coming, but it’s happening.

JPEGs a central piece?

NFTs were one of the biggest catalysts in Ethereum’s last major run.

Ignoring them now would be a critical mistake.

Tom Lee knows this and his endorsement isn’t random.

If ETH wins, NFTs win. And vice versa.

That’s why it’s ETH up, NFT up.

And major credit to the Pudgy team for leading the charge by building a positive, inclusive, normie-friendly perception of NFTs, and laying the foundation for the first NFT ETF.

Everyone used to agree we’d never see another 2021-style NFT cycle, myself included.

But this new ETH narrative, paired with institutional appetite for NFTs, is about to change everything soon.

I now believe there’s a very real chance we’ll see crazy prices again, but only for legacy brands and high-end digital art.

Not degen mints.

And that’s not a bug, it’s a feature.

NFT Renaissance 🎭

5,35K

Johtavat

Rankkaus

Suosikit